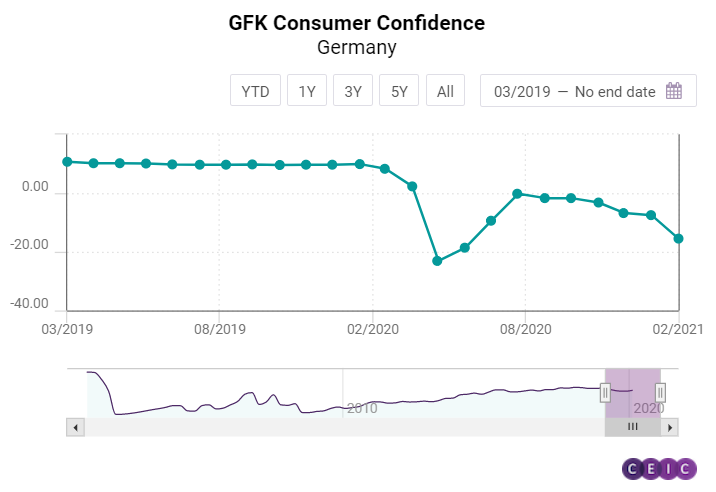

There are always plenty of key data releases in the last week of each month and this one will not be an exception. It starts with April's IFO business climate index for Germany.

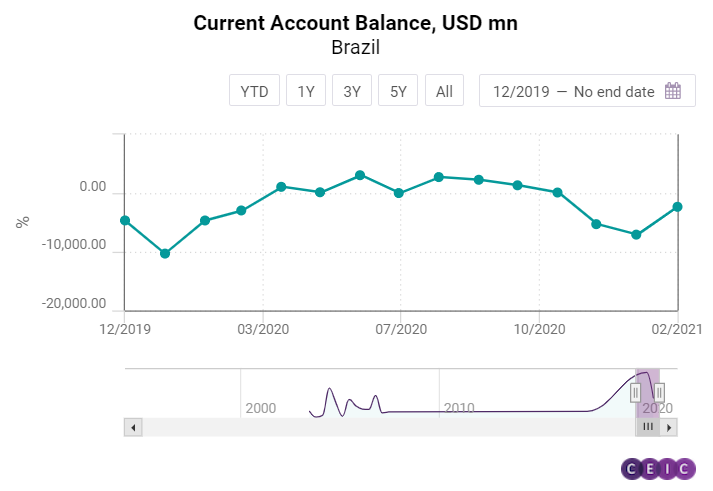

In March the index reached 96.64, which was the highest value since the beginning of the pandemic, showing first signs of recovery for the eurozone's largest economy. Also on Monday, Brazil's central bank is going to release the balance of payments data for March after three consecutive months of current account deficit. On the same day, the US Census Bureau will publish key data for the manufacturing industry.

The new orders growth of the US manufacturing industry has been flattening since the beginning of the year, suggesting that the low base effect of the pandemic is fading away. The Federal Reserve Bank of Dallas is going to release its general business activity index for Texas. The diffusion index surged to 34.9% in March, which was its highest value since 2018.

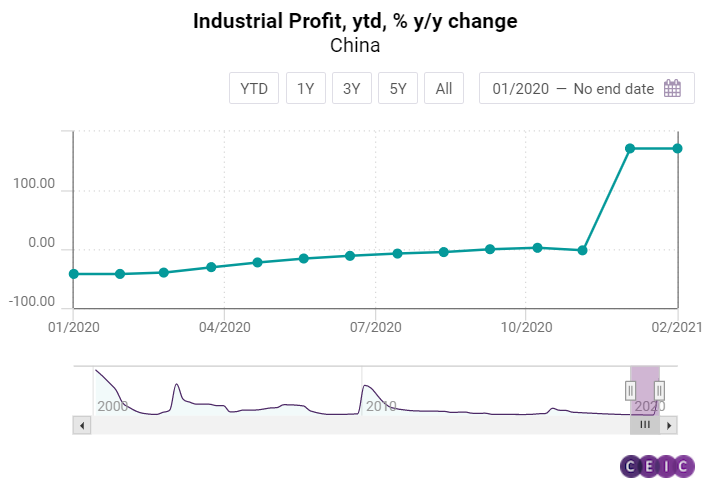

Three major releases will follow in Asia on Tuesday morning. It starts with Korea's Q1 2021 GDP data with hopes for the first positive growth quarter since the 1.37% in Q1 2020. Then, China's National Bureau of Statistics will publish the March data on industrial profits. On a year-to-date basis, the annual growth is expected to remain in the triple digits due to the base-period effect of the lockdown in Wuhan and the rest of the country a year ago. At 6 AM GMT, the Bank of Japan is going to announce its monetary policy decision.

Wednesday starts with more key Asia data - Korea's consumer confidence index for April and Japan's retail sales for March. Two Euro Area countries, Germany and France, are going to release consumer confidence data - the May GFK consumer survey for Germany and the April consumer confidence index for France. In Latin America, there will be another consumer confidence index release, the FGV data for Brazil. At the end of the day, the Federal Reserve Bank is going to hold a press conference on the monetary policy committee interest rate decision amid growing inflation pressure and concerns over policy tightening.

On Thursday, Germany will release its March data on unemployment rate, which registered its first decline since the start of the pandemic in February. Then, the European Commission will publish the economic sentiment and the consumer confidence indicators for April. The CPI inflation for Germany will also be released on that day. The big data release for the US’ Q1 2021 GDP will be published at 3:30 PM GMT, at the same time as the weekly jobless claims report.

On Friday, the last day of the month, Japan's Ministry of Internal Affairs and Communications will publish the March unemployment data, followed by preliminary data on industrial production. Then, the National Bureau of Statistics is going to publish China's purchasing managers' index for April, followed by consumer confidence, housing starts, and construction orders in Japan. In the morning, European time, the Q1 2021 GDP data for the eurozone will be released, including the data for the whole Euro Area, Germany, Italy, and Spain. Data on the Euro Area inflation will be released later on the same day. The week ends with key consumption data for the US, including personal consumption and income as well as the personal consumption expenditure price index, the main inflation gauge for the Federal Reserve.

Oil Demand Revival: What Can OPEC+ Do?

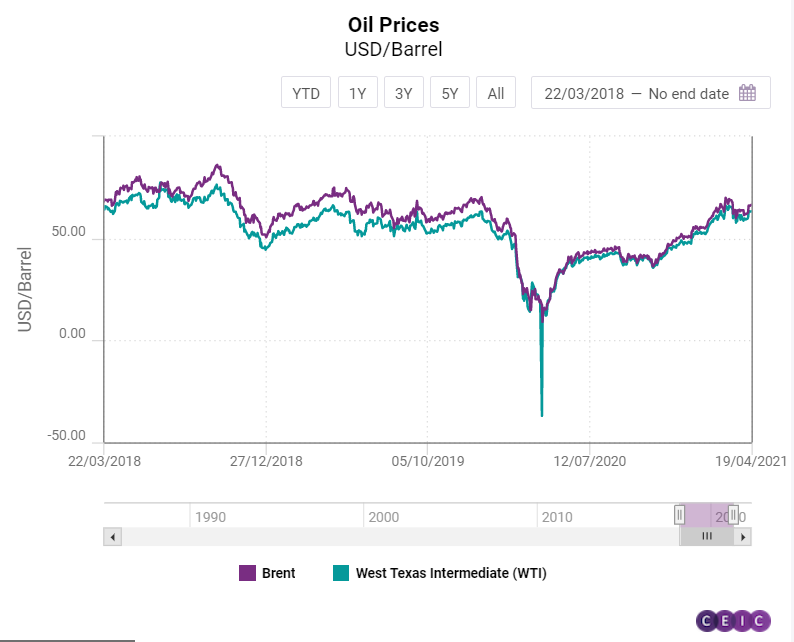

The year 2020 was difficult for the oil industry as the COVID-19 pandemic hit countries all around the world and had a severe negative impact on global oil prices. Most affected countries were quick to impose lockdown measures and restrictions on travelling in an attempt to minimise the spread of the virus. The ensuing decrease in mobility worldwide sent global oil demand and oil and gas prices plummeting. The initial inability of the Organization of Petroleum Exporting Countries (OPEC) to address the growing concerns, followed by the organization’s decision on April 12, 2020 to cut combined production by almost a quarter for the months of May and June left its mark on the prices of oil and gas.

During the first few months of 2020, oil prices became increasingly volatile, dropping to unprecedented lows. The West Texas Intermediate turned negative for the first time in history on April 20, plummeting to a value of -36.98 USD per barrel, followed by the Brent oil price which fell to USD 9.12 per barrel on April 21, marking a 22-year low.

Due to the subdued demand, suppliers preferred to pay the clients to get their oil, otherwise, they would have run out of storage capacity. After April 2020, oil prices started to slowly recover, gradually reaching their pre-pandemic levels. Even with the optimism triggered by the fast development of COVID-19 vaccines, it is still too early to expect a stabilisation of oil prices in the long term. The slow vaccination process, the growing number of infected people worldwide, and the potential new restrictions and lockdowns are all causes for concern and might disrupt both supply chains and global oil demand in the future.

Sign in to read the full insight

CEIC Leading Indicator: Rebound at Full Speed

The development of the CEIC Leading Indicator in Q1 2021 has shown that the majority of the surveyed countries are in a phase of strong rebound from the devastating shock of the COVID-19 pandemic. The March 2021 values were among the highest on record – an outcome that can be explained with rising optimism about the economic resilience one year after the pandemic and the ongoing progress of the vaccination process.

Discover the CEIC Global Database and learn how you can gain access to over 6.6 million time series data, covering over 200 economies, across 18 macroeconomic sectors.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)