After signing its first economic trade agreement (FTA) post-Brexit with Japan on October 23, 2020, the UK has been making efforts to expand its global trade network away from the EU and shift its focus towards the rest of the world.

In that sense, the UK's decision to move forward with a request to join the USD 12.5tn club of the countries in the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP or TPP11) in February 2021 was a natural strategic move.

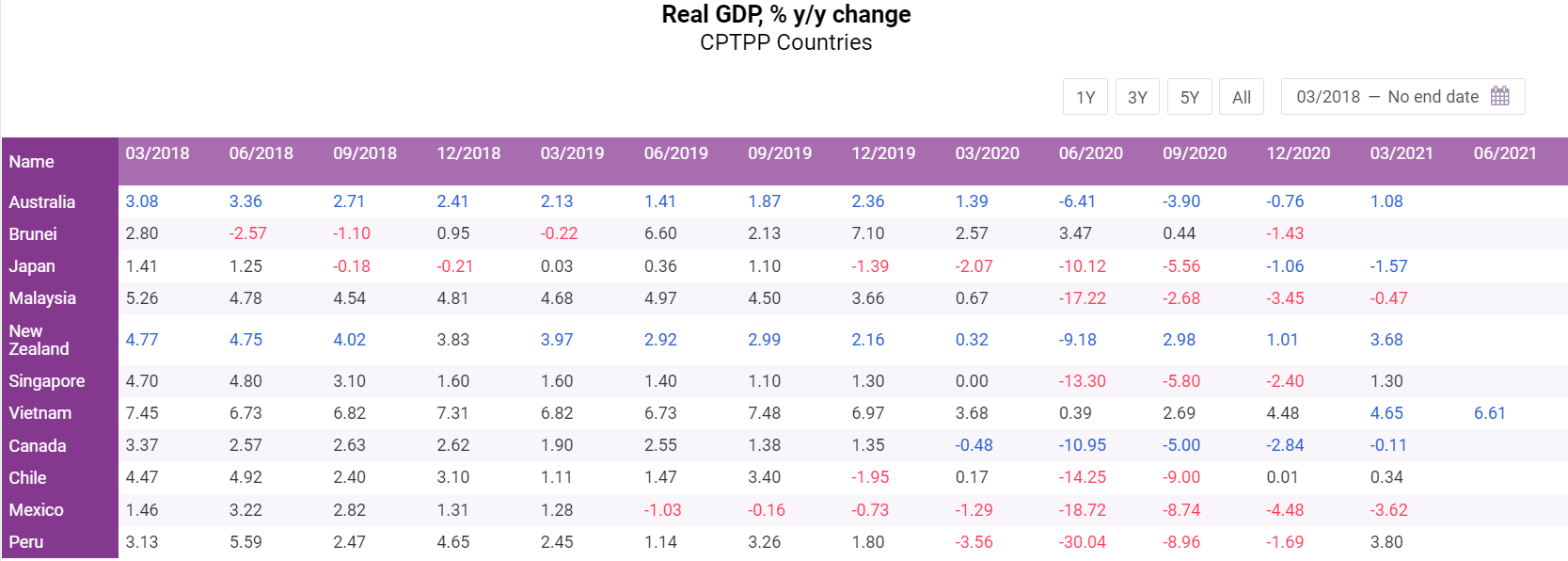

CPTPP is an FTA between Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, and Vietnam. It covers a wide range of economic sectors and allows for a significant decrease in the trade, investment, and government regulatory barriers between the countries, thus encouraging further economic relations, growth, and development. The CPTPP agreement has a strong impact on trade as it abolishes tariffs for 98% of all exports between the member countries. Joining the agreement would give UK exports free access to a 500mn people market. Due to the easy access for business in all of the partnering countries, the CPTPP also actively helps in creating new job opportunities and boosting investments in virtually all economic sectors. More specifically, according to a statement made by the UK's International Trade Secretary Liz Truss, the expectations are that membership in CPTPP will have a positive impact on more traditional industries such as food and drinks, and car manufacturing but will also help in supporting more modern and high-value industries such as technology development and services.

The potential acceptance of the UK in the CPTPP will also strengthen the country's global economic stance, which has been a major priority for London after its separation from the European Union. After months of talks about the UK's request to join the CPTPP, on June 2, 2021, the partners finally gave the green light to the UK's potential membership. The official negotiations are due to start by the end of 2021.

Overview of the UK's Foreign Trade

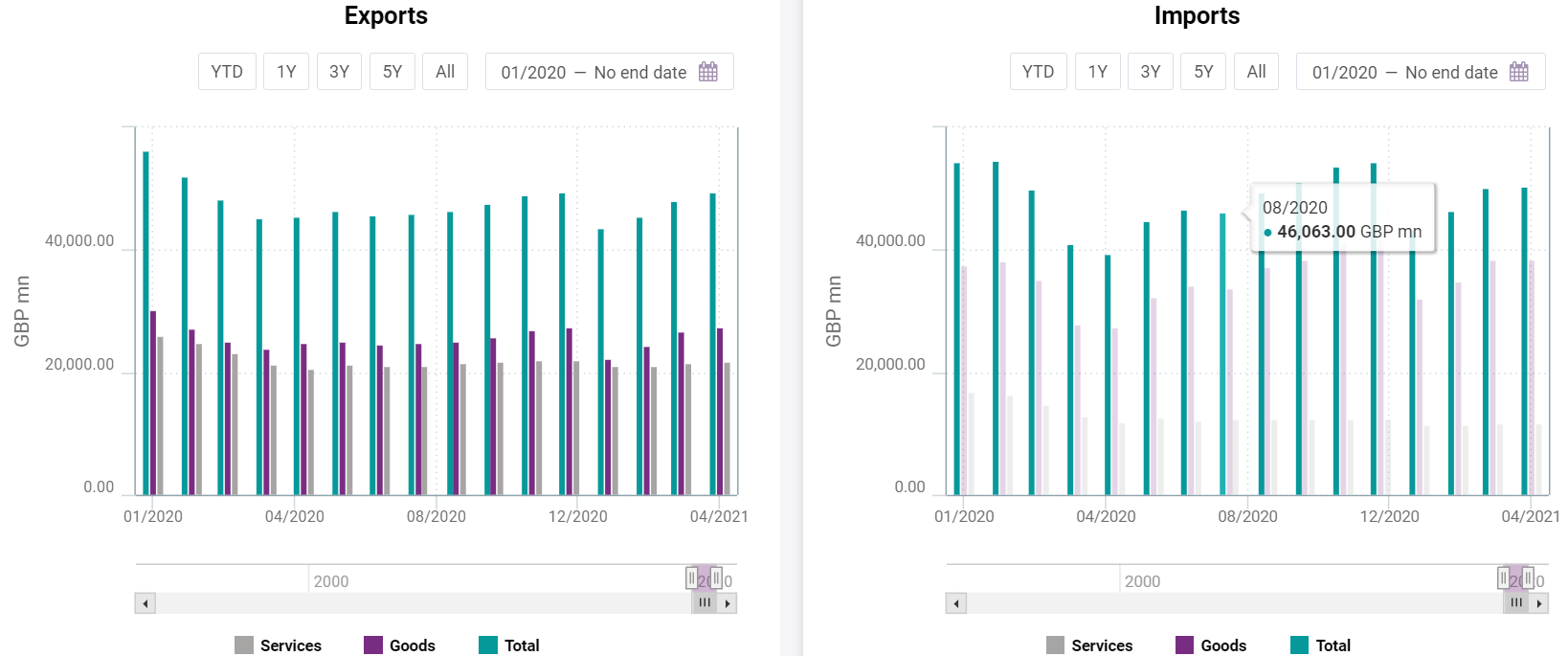

The year 2020 was a tough one for the UK as the country faced a multitude of difficulties and an unfortunate overlap between the post-Brexit transition period and the coronavirus pandemic. As expected by the economists at the UK’s Office for National Statistics (ONS), there were some noticeable fluctuations in the statistical data for trade in the past almost two years which can be explained by the post-Brexit state of the country and the ongoing COVID-19 pandemic.

After a peak of the UK's exports and imports in Q3 and Q4 2019, by the end of the first quarter of 2020 both exports and imports fell drastically – exports went from GBP 189bn in Q4 2019 to GBP 154.7bn in Q1 2020, while imports declined from GBP 172bn in Q4 2019 to GBP 157bn in Q1 2020 and hit a nine-year low in Q2 2020 at GBP 119.3bn. From Q2 until Q4 2020 statistics showed early signs of recovery as exports and imports started to increase but at the beginning of 2021, they fell again. Perhaps due to the ongoing conversation on the UK's potential membership in the CPTPP and the country's efforts to create new trade relations with countries outside the EU, the statistics for Q1 2021 showed that in Q1 2021 non-EU goods imports saw a markedly higher increase than EU ones.

In Q1 2021, the first quarter after the Brexit transition period, the UK's trade balance continued to post a deficit. Nevertheless, it went down by GBP 8.4bn to reach GBP 1.4bn, signifying a decrease in the value of all imports when compared to that of exports. The most recent figures for April 2021 show that imports from non-EU countries reached an all-time high of over GBP 20.1bn, a 4.5% increase compared to March 2021. Exports stood at GBP 13.6bn, down by 2.9% from March 2021.

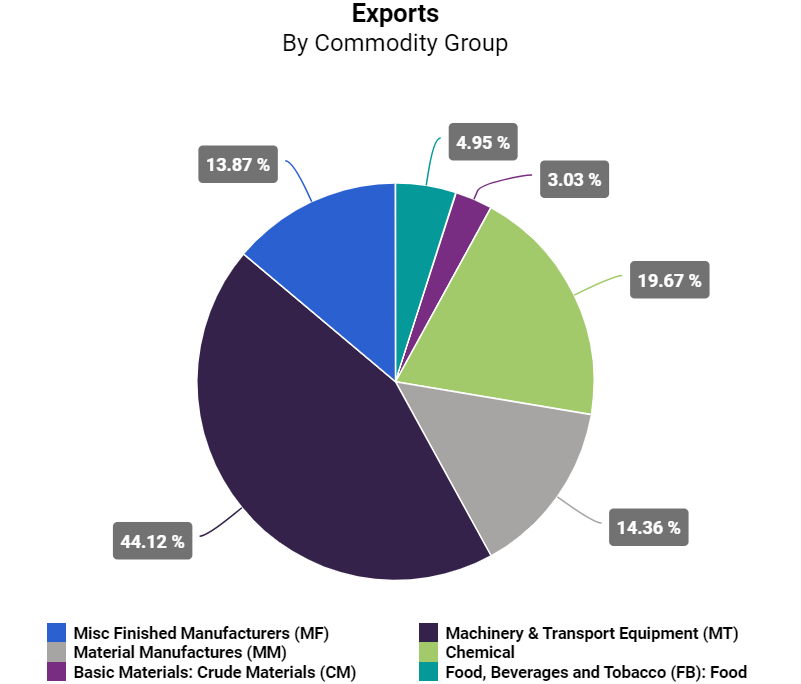

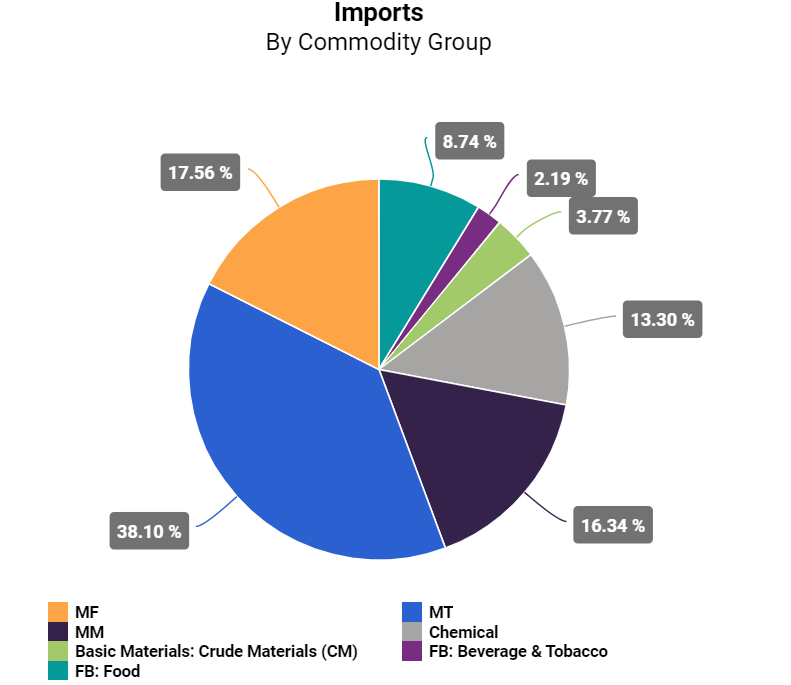

Imports and Exports of Goods and Services

According to data sourced from the HM Revenue and Customs' Overseas Trade Statistics, in January 2021, the UK's largest volumes of exported goods were mainly cars and car parts, precious metals and in particular gold and platinum, aircraft parts, and in particular, gas turbines and turbojets for airplanes, medicine and doses of pre-packaged medication mixes, and crude and refined petroleum. The exports of these commodities accounted for over 25% of the total and made the UK one of the largest exporters of airplane parts and precious metals worldwide. As for the imports for the same period, the largest volumes of imported commodities to the UK came in the form of precious metals and in particular gold, cars and car parts, crude and refined petroleum, telephones and telephone parts, and computers and computer parts.

The beginning of 2021 marked a decrease in the total export value of all goods and services to GBP 43.5bn in January 2021 from GBP 56.3bn in January 2020. Exports of goods declined to GBP 22.3bn in January 2021 from GBP 30.17bn a year earlier while exports of services declined to GBP 21.2bn from GBP 26.1bn There were some signs of recovery in the following months but both imports and exports are still far from the peaks registered at the end of 2019.

Total imports, on the other hand, declined to GBP 43.4bn in January 2021 from GBP 54.4bn in the same month of 2020. The imports of goods fell from GBP 37.5bn in January 2020 to GBP 32.03bn in January 2021 and the imports of services went down from GBP 16.8bn to GBP 11.3bn. This decrease can be attributed both to the UK's separation from the EU and to the weight of the COVID-19 health crisis on the country and on the rest of the world.

Sign in to access all datasets for this insight piece here. Alternatively, you can learn more about our Global Database - a source of information for everything you need to know, housing knowledge on developed and developing markets around the world.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)