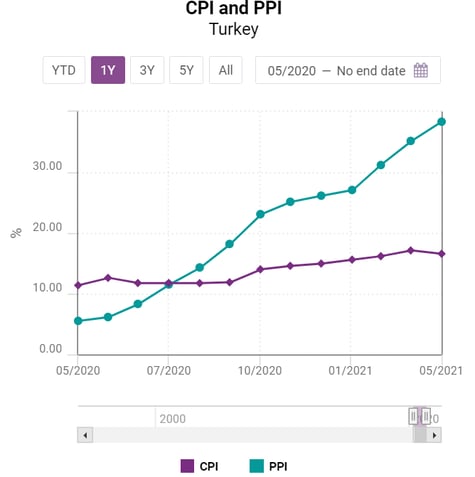

The week starts with the publication of June inflation data for Turkey. Consumer prices have been rising in the double digits almost constantly since the beginning of 2017 and the expectation is for another acceleration at 17%.

An even bigger issue seems to be the boom in producer prices, whose growth has accelerated to 38.3% in May 2021 from 5.5% just 12 months earlier.

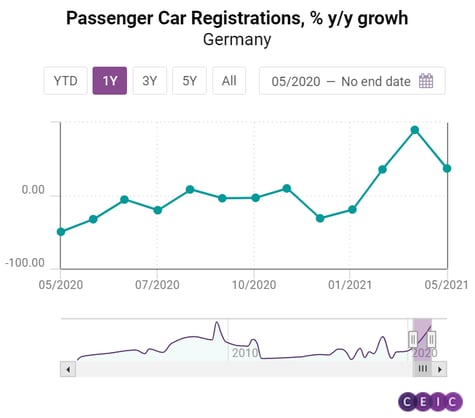

Another important indicator to be released on Monday are the June passenger cars registrations in Germany, one of the biggest automobile markets globally.

Data on retail sales in the Euro Area will be released on Tuesday. Growth of retail trade has been visible since March and in April the volume of retail sales jumped by 24% y/y, although the low base effect from the lockdowns in April 2020 must be taken into account. Growth in May is therefore expected to be more modest, at 4.5% y/y. The latest developments of the industrial production index in Spain are also expected on Tuesday. This indicator has followed a similar pattern, increasing rapidly since March, and April values stood at a record 48.2% annual growth.

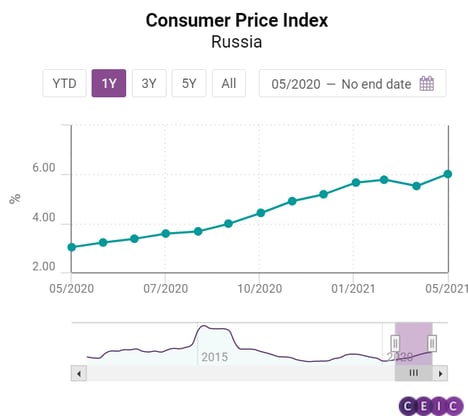

On Wednesday, the Russian Federal Statistics Service will release the June consumer price index data. Inflation in May stood at 6%, the highest since October 2016 amid global inflationary pressures. The Russian Central Bank already raised its refinancing rate three times in 2021 and is expected to do it once more to counter rising inflation.

Also expected on Wednesday is its seasonally adjusted trade balance data for France. The trade deficit has been increasing since November 2020 and amounted to EUR 6.2bn in April.

More trade data, but for Germany, will be released on Thursday. Unlike France, the German trade balance is traditionally positive, and in April the surplus amounted to EUR 15.2bn, with both exports and imports accelerating at a fast pace.

This will be followed by more inflation data, this time for Brazil, where consumer prices have also been rising drastically, with growth reaching 8% in May. The Brazil central bank raised the Selic rate for the third month in a row, to 4.25% in June, bringing it close to the pre-pandemic level.

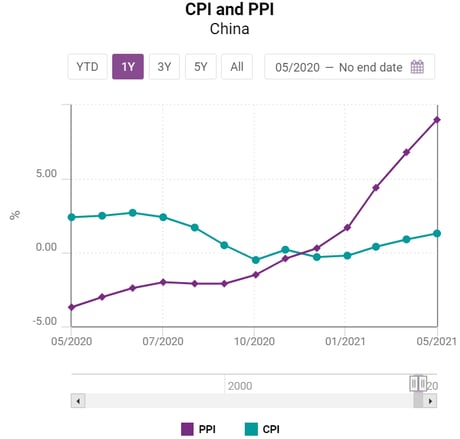

On Friday, June inflation data for China will be released. While the consumer price index is expected to rise only moderately – to 1.6% from 1.3% in May – the producer price index has been booming since the beginning of 2021, increasing to 9% in May, the highest value since September 2008. June expectations are for further acceleration to 9.5%. Given China’s role as a global manufacturing hub, the hike in producer prices might fuel global inflation pressures even more.

The week closes with June unemployment data for Canada. The North American economy managed to cut the unemployment rate to 8.2% in May from a near-record 13.8% at the peak of the pandemic but is yet to reach pre-COVID levels.

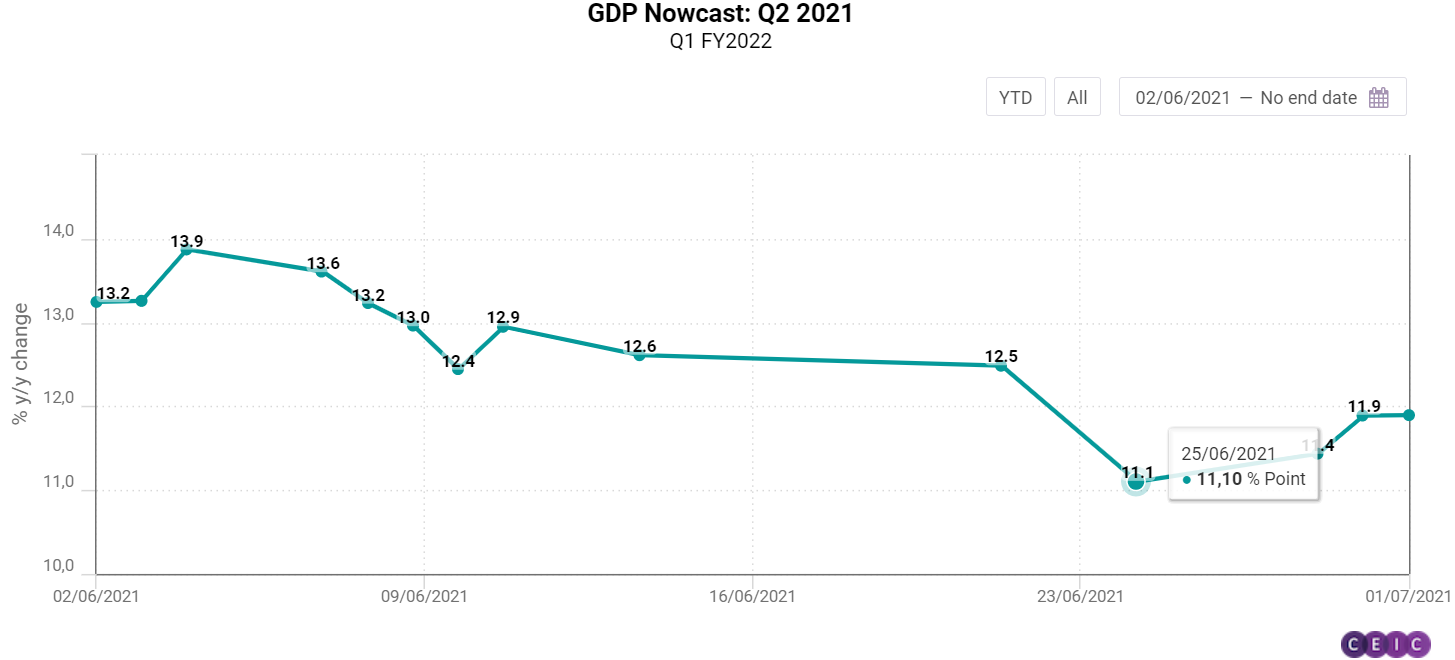

India GDP Nowcast

India GDP Nowcast projects an increase of 11.9% y/y for Q2 2021.

Our estimates of India's GDP growth for Q2 and Q3 2021 have accelerated as compared to the previous week. As of July 1, the GDP Nowcast projects an increase of 11.9% y/y in Q2 2021, which represents an upward revision of 0.9 pp compared to our estimates a week earlier.

Similarly, for Q3 2021, the nowcast has increased to 10.9% y/y, a 2.3 pp upward revision. During this period indicators such as gross tax revenue, exports, crude steel production, and two-wheelers sales caused the nowcast to increase. On the other hand, indicators such as farm tractor sales, passenger cars sales, and electricity generation had a markedly negative effect on the GDP growth nowcast for both Q2 and Q3 2021.

Access the CEIC India GDP Nowcast here

Discover the CEIC Global Database and learn how you can gain access to over 6.6 million time-series data, covering over 200 economies, across 18 macroeconomic sectors.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)