The inflation is back, it's official. The US headline inflation surged to 5% y/y in May and the core inflation reached 3.8%, the highest level since 1992. We are about to see whether and how the Federal Reserve is going to react during its meeting on Wednesday.

So far, there are no indicators that the Fed will change its "transitory-problem" approach, despite the growing concerns and warnings among leading economists and institutions. At least, it is expected that the FOMC is going to revise its 2021 forecasts for the GDP growth and PCE inflation (upward) and the unemployment rate (downward) in their Summary of Economic Projections published four times a year.

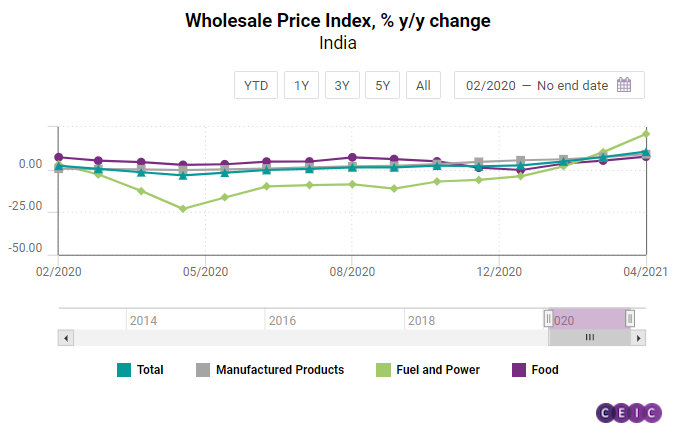

As regards expected data releases, the week starts with May inflation data for India, both wholesale and consumer, and the June economic confidence data for Brazil.

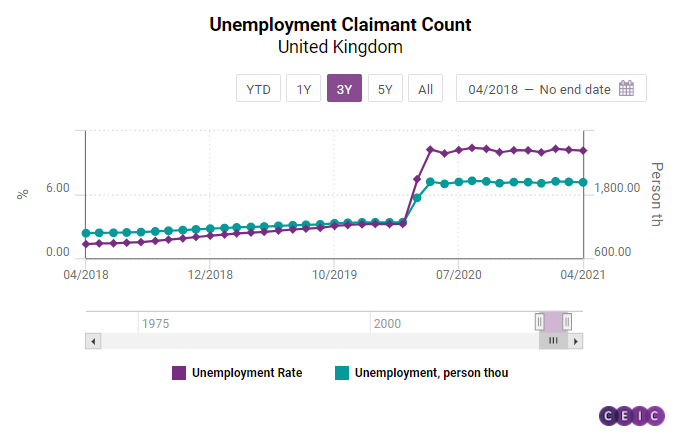

On Tuesday, Indonesia's foreign trade data for May is going to be published, followed by some key data releases in Europe - May inflation for major Euro Area countries like Germany, Italy, and France, as well as the UK claimant count survey. In the US, economic activity data for May will be released, including retail sales, industrial production, and producer price inflation.

Wednesday starts with Japan's foreign trade data, followed by China’s National Bureau of Statistics releasing key economic activity indicators for May, including fixed asset investment, industrial production, retail sales, and unemployment rate. In the US, before the FOMC meeting, the US Census Bureau is going to release the data for private housing units started and permitted. The Fed press conference is scheduled for 9:30 PM (GMT).

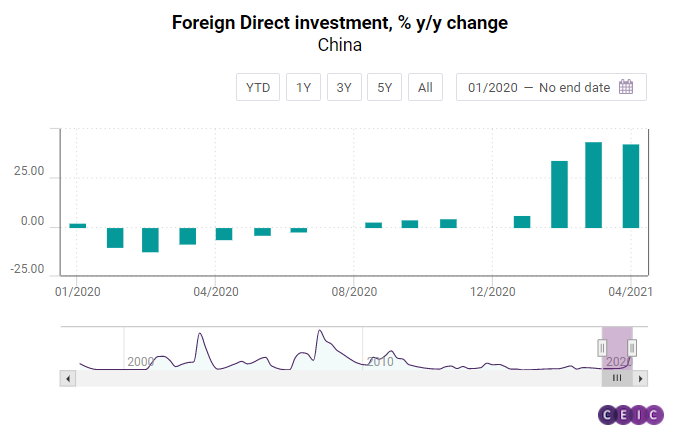

On Thursday, there will be interest rate decisions in two major emerging economies - Indonesia and Turkey. China's housing prices and foreign direct investment for May are also expected on that day, followed by the weekly US jobless claims.

On Friday, the May inflation data will be released, followed by the interest decision of the Bank of Japan and the May retail sales in the UK.

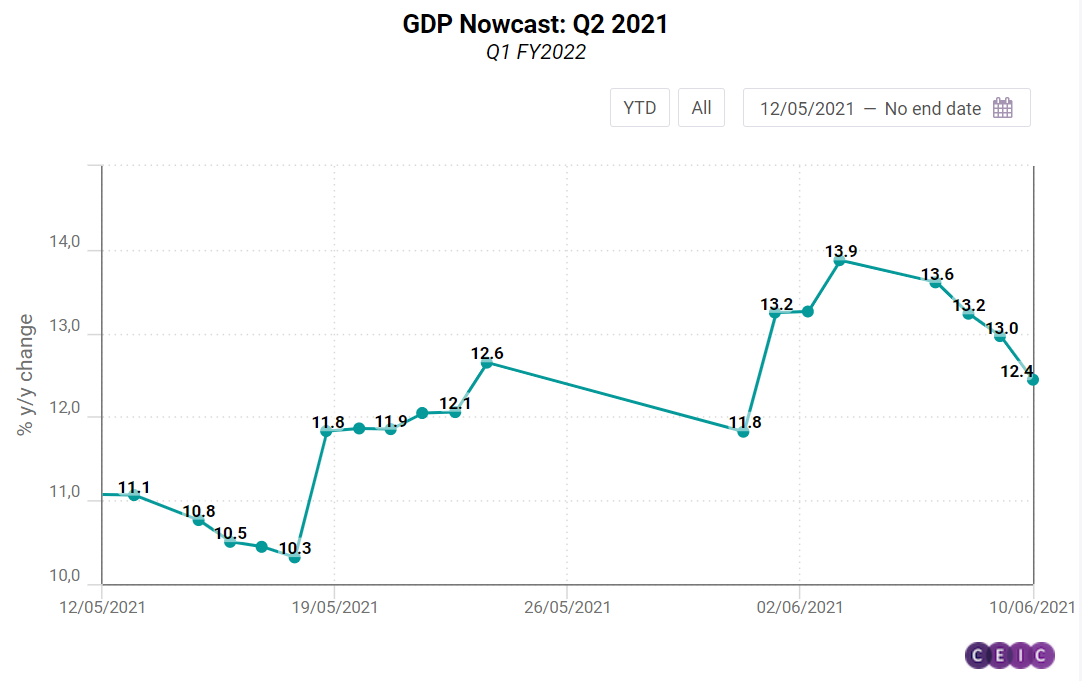

India GDP Nowcast

The real-time GDP Nowcast projects an increase of 12.4% y/y for Q2 2021, and 11.2% y/y for Q3 2021 as of June 11, 2021.

Our estimate of India's GDP growth for Q2 2021 has accelerated compared to the previous week. As of June 9, the GDP Nowcast projects an increase of 13.0% y/y in Q2 2021, which represents a downward revision of 0.2 pp compared to our estimates a week earlier.

A majority of the indicators such as cash reserve ratio, gross tax revenue, air passenger and cargo traffic, bank credit, foreign exchange rate, and non-oil imports, caused the nowcast for both the current and next quarter to decline. On the other hand, exports, railway freight traffic, finished steel production, and the value of the Bombay stock exchange contributed in a positive manner to both the Q2 and Q3 nowcasts.

Register for the CEIC India GDP Nowcast here

Discover the CEIC Global Database and learn how you can gain access to over 6.6 million time-series data, covering over 200 economies, across 18 macroeconomic sectors.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)