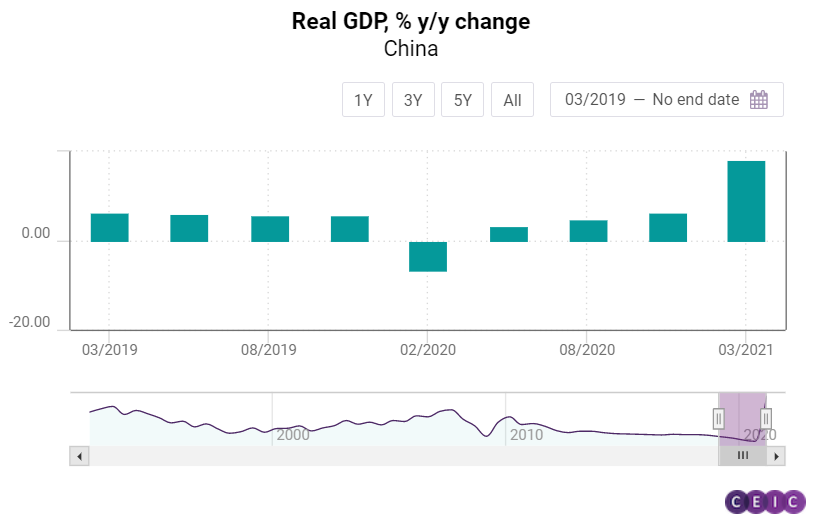

The week commencing July 12 marks the start of major GDP data releases for key economies, which the CEIC Insights team keeps track of, including the Q2 2021 GDP figures for China.

This is expected on Thursday together with a variety of further important indicators, gauging the recovery in the second largest global economy.

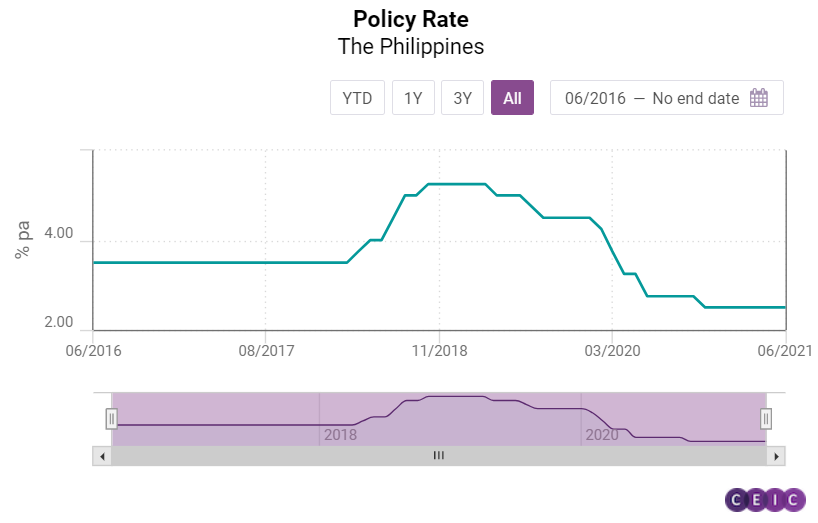

But first, on Monday, the Philippine Central Bank will hold a monetary policy meeting and the expectations are that the authority will keep the overnight lending facility unchanged at 2%.

The Philippine Central Bank started reducing the policy rate back in May 2019 and this trend intensified further during 2020, as most of the central banks across the globe reduced interest rates to support their economies during the COVID-19 crisis. Monday will also see data releases from Turkey on unemployment, as well as from India on industrial production and inflation.

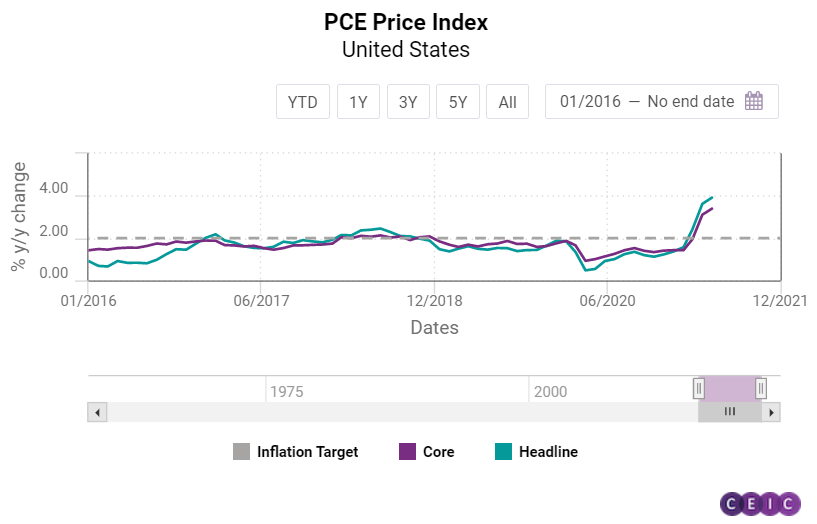

Tuesday will offer further data on inflation in the US, France, and Germany. Inflation has been a cause for alarm recently, as price growth is accelerating against the backdrop of generous government support intended to propel recovery. Headline inflation in the US in May reached a 13-year high at 5% y/y, while the Personal Consumption Expenditure (PCE) Price Index, Fed's preferred inflation gauge, stood at 3.9% in the fifth month of 2021.

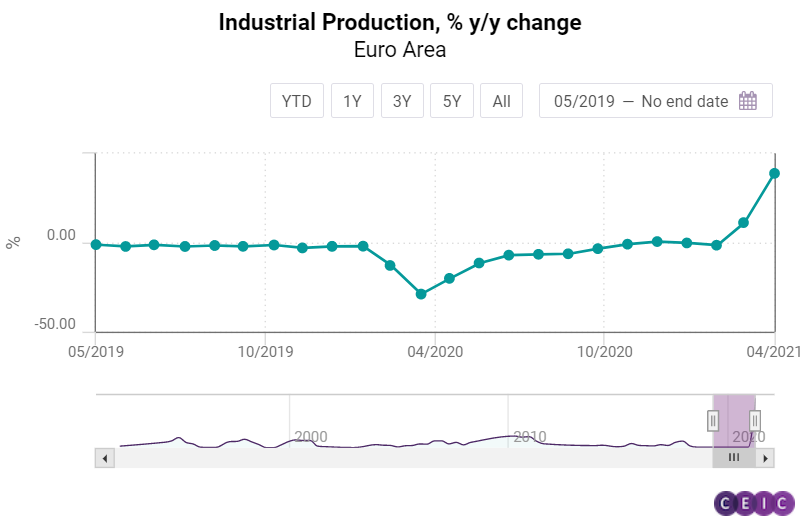

On Wednesday, the expected data releases include inflation figures for the United Kingdom, as well as industrial production in the Euro Area and Japan. Moreover, the middle of the week will see one more monetary policy meeting in a key emerging market: Turkey. The one week repo rate in Turkey stands at 19% and is expected to remain at this level. Nonetheless, the monetary authority with its new governor Sahap Kavcioglu will definitely keep a close eye on inflation, which soared above 17% y/y in June.

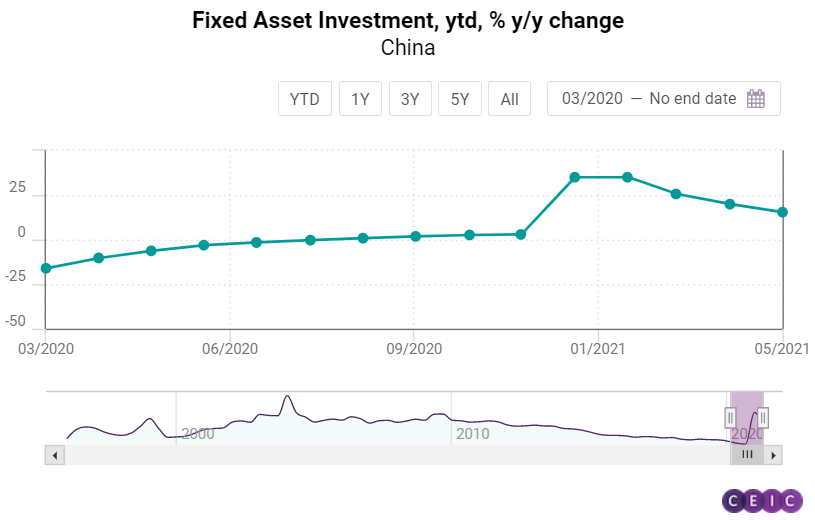

Thursday will definitely provide the highlight of the week, with the GDP data on China expected to dominate in the global macroeconomic coverage. In Q1 2021 the Chinese economy impressed with 18.3% y/y growth, which, however, can be mainly explained with low bases effect. Hence, the figure for Q2, which will be available on Thursday, will probably be below that, but maybe in the double digits again.

Friday will put the final touch of the busy week with further data on China, namely foreign direct investment. In Asia, the Bank of Japan will hold a monetary policy meeting, and in Europe, there will be an update of inflation data in the common currency bloc. In the US, new data on retail sales will shed more light on the consumer sentiment in the biggest world economy.

India GDP Nowcast

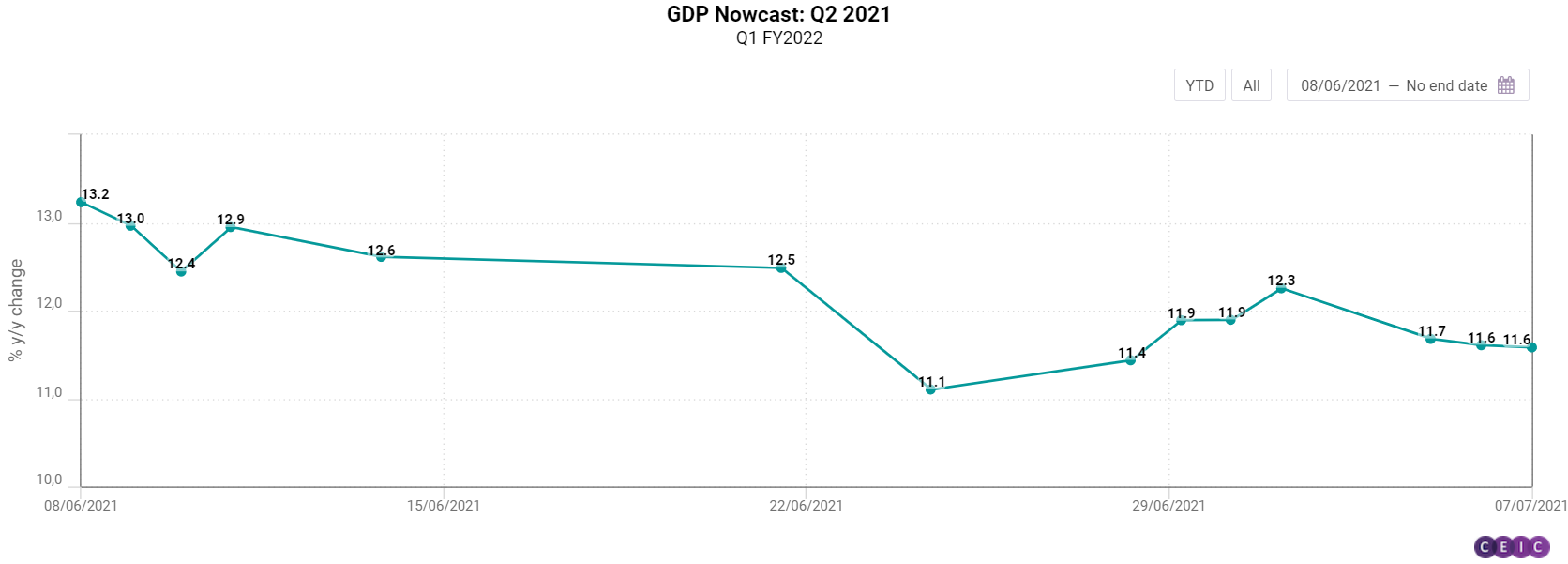

India GDP Nowcast projects an increase of 12.3% y/y for Q2 2021

Our estimates of India's GDP growth for Q2 and Q3 2021 have accelerated as compared to the previous week. As of July 5, the GDP Nowcast projects an increase of 12.3% y/y in Q2 2021, which represents an upward revision of 1.2 pp compared to our estimates a week earlier. Similarly, for Q3 2021, the nowcast has increased to 12.7% y/y, a 4.1 pp movement upward.

Exports, scheduled commercial bank credit, gross tax revenue, and the cash reserve ratio, added positively to the GDP nowcast, while non-oil imports, cement production, rainfall, and the Bombay Stock Exchange Sensex caused the GDP nowcast to decline. Money supply had no impact on the nowcast for either quarter.

Discover the CEIC Global Database and learn how you can gain access to over 6.6 million time-series data, covering over 200 economies, across 18 macroeconomic sectors.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)