While South Korea's retail sales have exhibited a robust post-pandemic recovery, recent high-frequency payment statistics suggest that growth in retail sales has largely tapered off. Retail sales growth moderated at 0.6% y/y in May 2023, its second deceleration in a row, with May’s growth largely supported by resilience in semi-durable goods (i.e.: clothing, footwear, and luggage, sports and entertainment goods, etc.). Prior to May’s results, growth has been largely driven by non-durable goods. However, sluggish, and sometimes negative growth in the retail sale of durable goods since March 2022 points to an absence of a strong demand catalyst during the post‑COVID recovery.

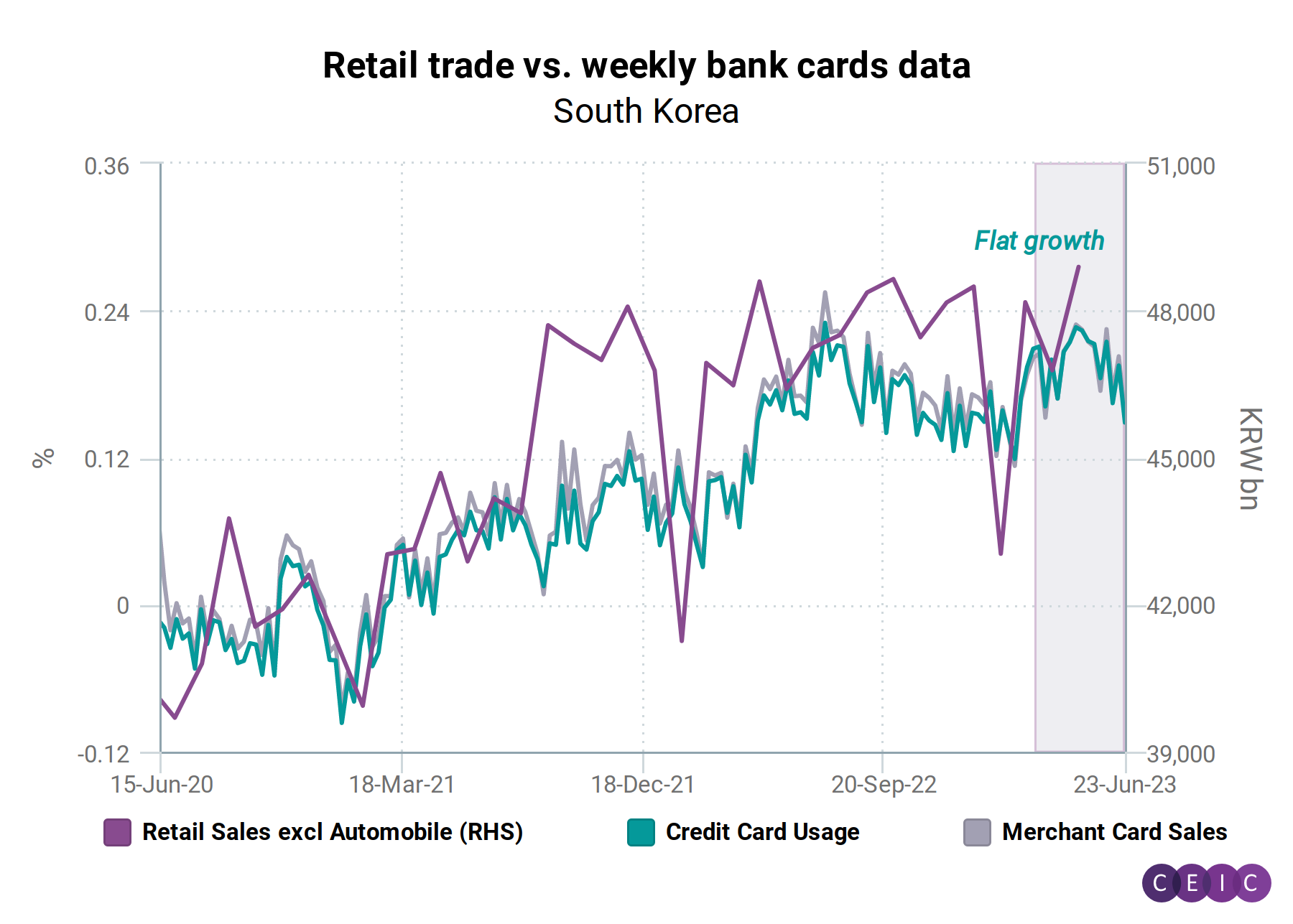

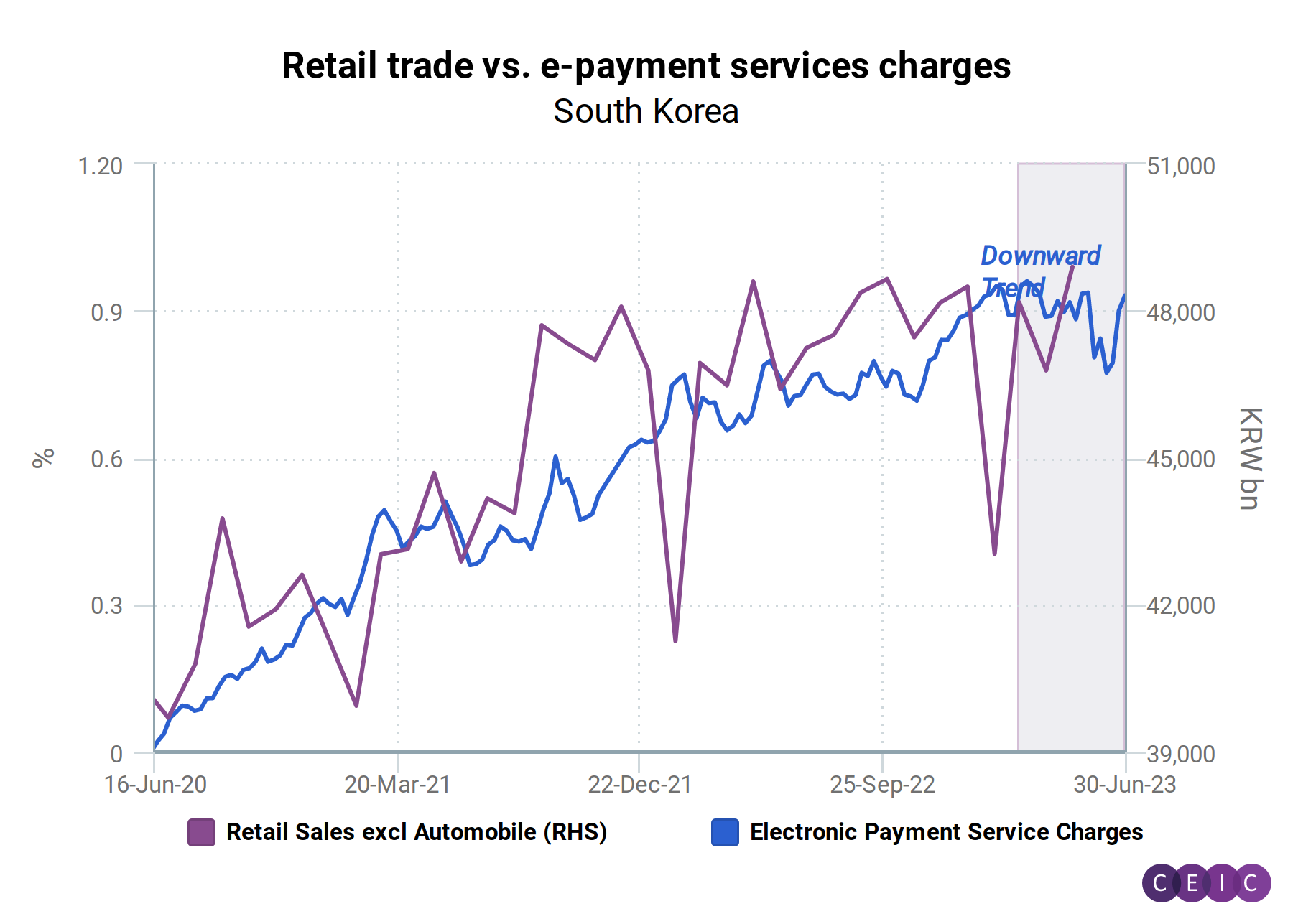

While June’s retail sales numbers are scheduled for release on 28 July, weekly payment and receipt statistics point to a contraction in retail trade for June. Credit card payments and merchant card sales, measured by their growth over January 2020, stood rather flat since mid-March, with average monthly change swinging between 0.15% and 0.23%. Electronic payment services charges likewise appear to have plateaued around 1% since December 2022.

Despite pockets of recovery, the continued moderation in June’s merchant card and credit card sales along with the absence of a convincing recovery in the discretionary retail trade sector will place a damper on retail sales growth prospects in the near term.

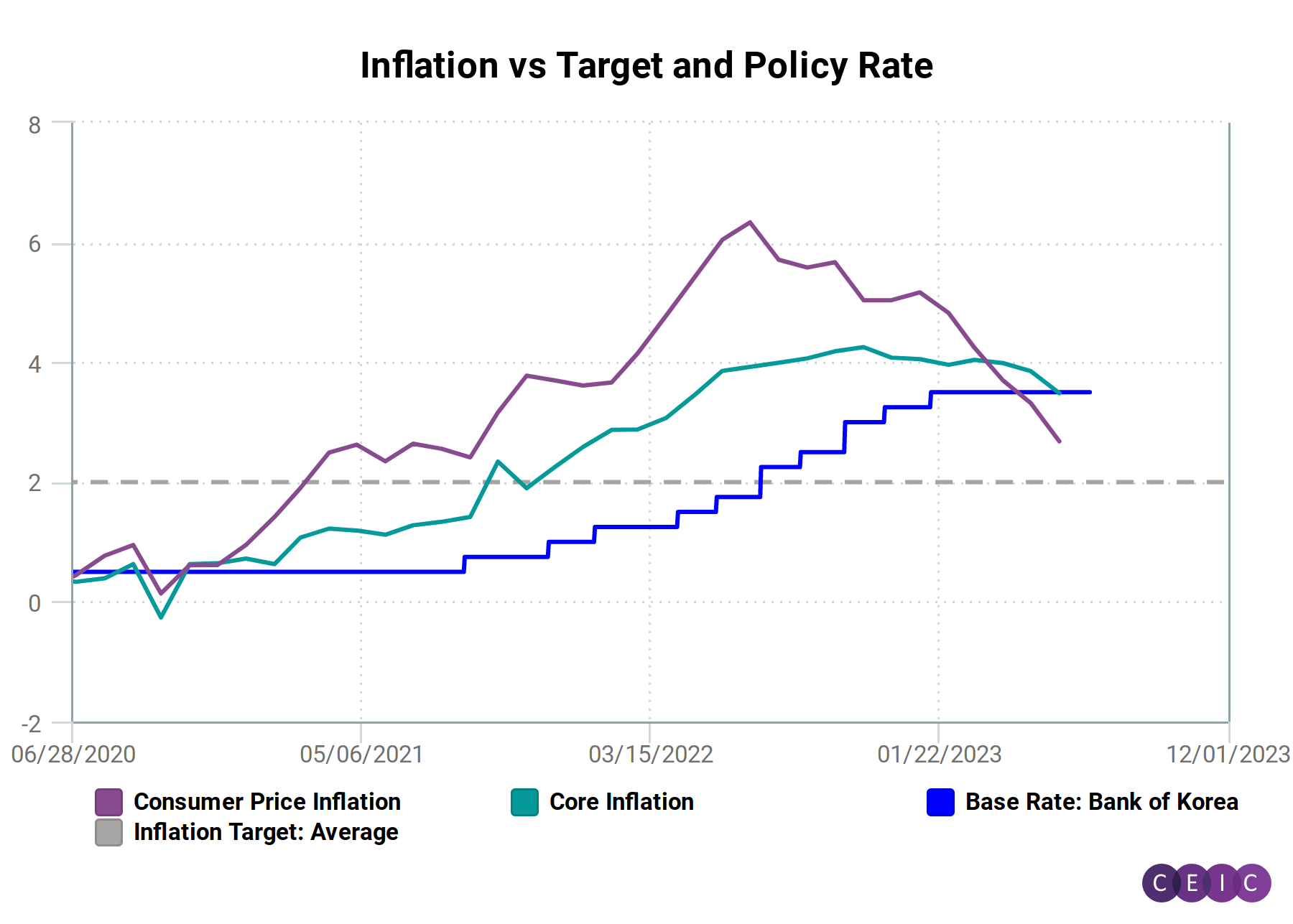

Flattening retail sales will place a further strain on South Korea’s broader economy as South Korea narrowly avoided negative growth during the first quarter of 2023. GDP rose by a seasonally‑adjusted 0.3% q/q during the quarter (-0.3% in Q4 2022) with growth broadly supported by a 0.6% q/q growth in private consumption expenditure (‑0.5% in Q4 2022). Stalled demand‑side recovery is likely to prompt the Bank of Korea to pause or further delay their monetary policy tightening during their next Monetary Policy Board (MPB) meeting on July 13th. The policy rate currently stands at 3.50% after the MPB's last hike in January 2023 – the MPB has raised interest rates 10 times from a low of 0.50% in the third quarter of 2021.

The CEIC Global Database provides access to a vast database where users can gain insight into the ever-changing dynamics of world economies.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)