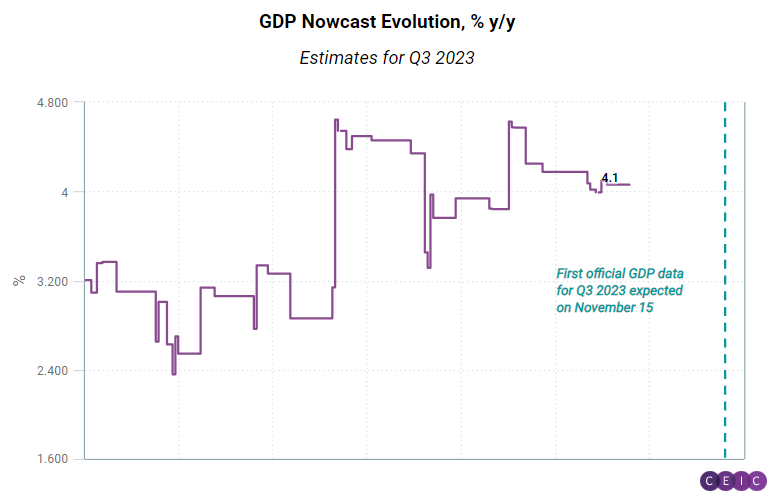

Russia’s economic growth decelerated in Q3 2023, according to the high-frequency data for the period available at the beginning of October. The GDP nowcast for Q3 compiled by Now-Casting Economics estimates real terms growth of 4.1% year-on-year. If realised, this would be a slightly slower pace compared to the 4.9% y/y. The nowcast is also predicting a rather stable growth of 4% y/y for Q4 bolstered by the prospect of additional military and social welfare spending and a higher price for hydrocarbons exports. The GDP nowcast and other high-frequency indicators prove particularly valuable for analysing Russia's economy given that official statistical releases have been compromised since the invasion of Ukraine and the national accounts releases are not always timely. According to the Federal State Statistics Service (Rosstat), the preliminary estimate for GDP in Q3 2023 will not be released until November 15, six weeks after the reference period.

Forecasters are anticipating weak growth in 2024. With the rouble’s value sharply down, the Central Bank of Russia tightening monetary policy, and labour market constraints persisting, the IMF is predicting 1.5% real-terms GDP growth for Russia in 2023, with slower growth of 1.3% for 2024. The FocusEconomics consensus forecast of private sector institutions predicts 1.1% and 1.2%, respectively. The September survey foresees private consumption growth slowing to 2.2% y/y in 2024 from 3.6% in 2023, with fixed investment growth of 1.7% y/y, slightly down from 1.8% y/y over the same period.

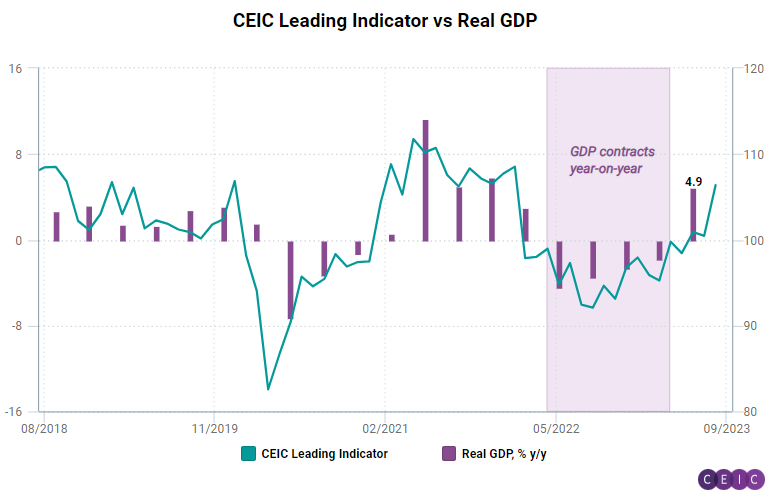

Forward-looking indicators have improved. The CEIC Leading Indicator continued its uneven upward trend in August, when it rose substantially to 106.37 from 100.46 in July, approaching its pre-war levels. Furthermore, this is the largest monthly increase since May 2021. The significant improvement confidently above the 100-mark implies that the Russian economy is performing above its long-term trend and will continue to expand. The CEIC Leading Indicator predicts peaks and troughs in the economy two to three quarters in advance, and its consistent upward movement since October 2022 reaffirms the expectations that Russia's GDP growth will accelerate in Q3 2023.

Purchasing managers’ Indices (PMIs) echo these trends. The manufacturing PMI rose to a seasonally adjusted 54.5 in September from 52.7 in August, while the services PMI was up to 57.6 in August from 54.0 in July. Both are above 50, signalling growth driven by state spending to support the war effort.

The CEIC Global Database provides access to a vast database where users can gain insight into the ever-changing dynamics of world economies.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)