The COVID-19 pandemic plunged India’s economic growth in the financial year ending March 2021 to a historic low, thanks to a nationwide lockdown between end-March and early May 2020.

The economic recovery has been marred by sporadic regional lockdowns and local outbreaks of the virus, as well as by the devastating second wave in April 2021. In this rapidly changing pandemic environment, timely high-frequency data can help gauge the movement of the economy.

At present, there is an impending threat of a third wave, especially with the delta plus variant of COVID-19. Such circumstances further strengthen the need for unconventional and more high-frequency data, especially data on infrastructure development and usage of transport infrastructure, that can shed more light on the state of the economy in real-time.

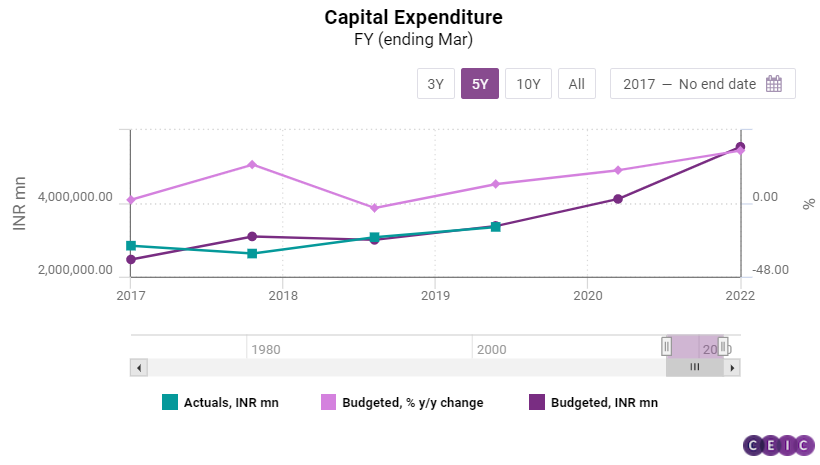

In the wake of the pandemic, capital expenditure became a key instrument to revive the economy due to its high multiplier effect. In the case of India, the infrastructure development announced in the fiscal package post the nationwide lockdown was followed by the launch of the National Infrastructure Pipeline (NIP) in 2020. With an initial outlay of INR 102tn, the NIP is envisaged to attract investments worth INR 111tn over the five-year period ending FY2025. The Union Budget for FY2022 incorporated a 34.5% y/y increase in capital expenditure, the third increase in a row, which also demonstrates the determination of the government to make India a USD 5tn economy.

Another notable development has been the launch of the National Monetisation Pipeline in August 2021, aiming to use institutional and long-term capital by way of a structured contractual partnership with the private sector. This was developed based on the mandate for Asset Monetisation, announced during Budget 2021-2022, and the aggregate monetisation potential is estimated to be INR 6tn through core assets of the central government, between FY2022 and FY2025.

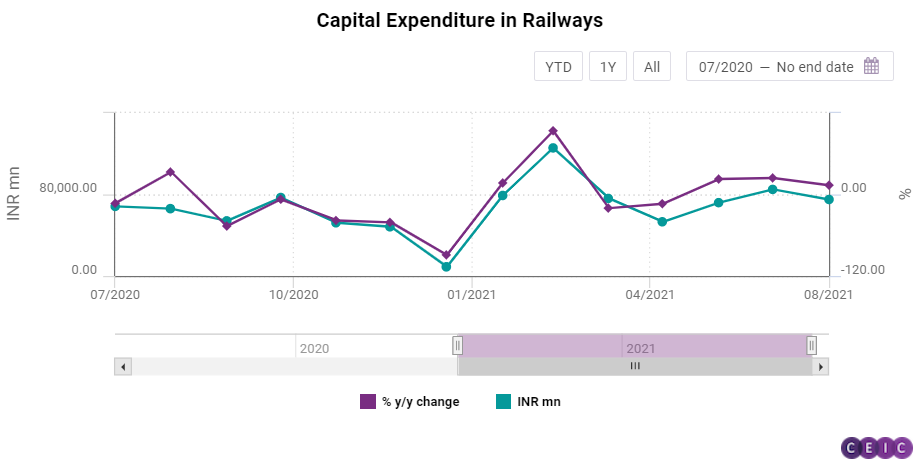

The current capital expenditure is at 20.1% of the budgeted expenditure in the first quarter of FY2022, which is lower in comparison to Q1 expenditures in previous years. This can be attributed to the large increase in budgeted capital spending, as well as to the slow pace of economic activity due to the second wave of infections. Capital expenditure in railways shows a y/y decline for the first two months of FY2022.

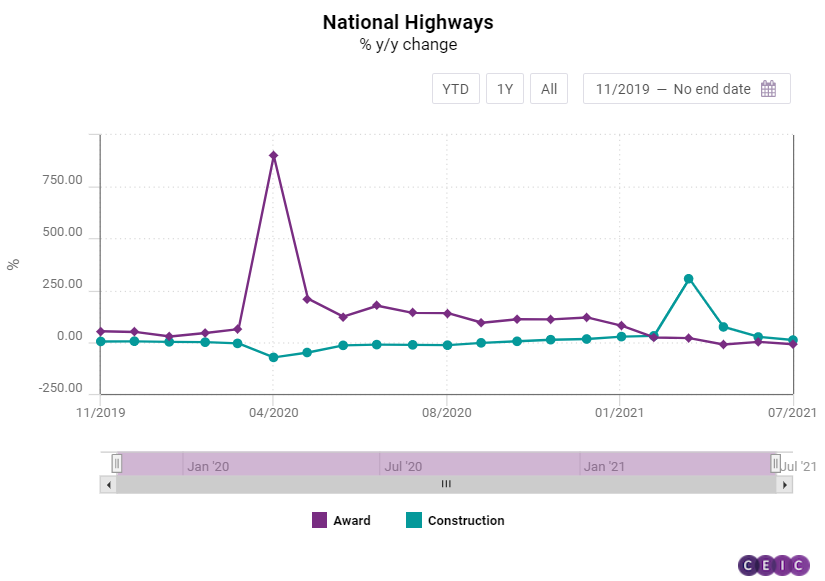

On the other hand, national highway construction rose by a whopping 306.2% y/y in April 2021, thanks to the low base from the previous year. The total length of the highway constructed was 2,927 km in July 2021, against 2,657 km a year earlier. In terms of projects awarded, however, the total length declined by 9.9%, from 2,702 km in July FY2021 to 2,434 km in July FY2022. Prior to the availability of this high-frequency highway construction data, the length of roads was the main source of information regarding roadway infrastructure construction, which is released annually, and with a lag.

Sign in to access all datasets for this insight piece here. Alternatively, you can learn more about our Global Database - a source of information for everything you need to know, housing knowledge on developed and developing markets around the world.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)