-png.png)

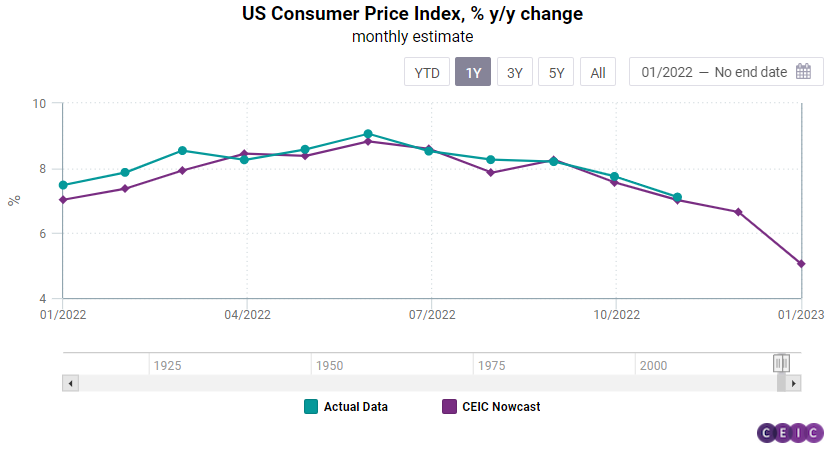

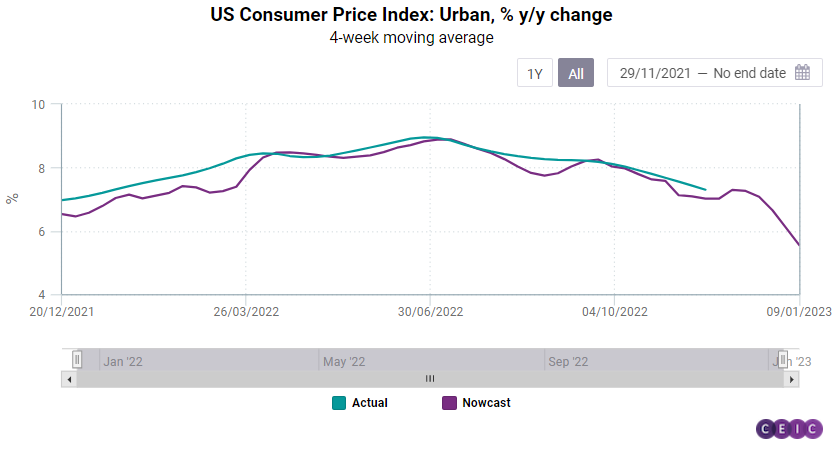

US inflation is expected to slow down to 6.7% in December 2022, its lowest reading in 14 months, and to further decelerate to 5.1% in January 2023, according to CEIC's estimates based on alternative data ahead of the official Thursday release.

The annualised consumer inflation data is released monthly by the US Bureau of Labour Statistics with a lag of more than 10 days after the reference month. The official data for December, for instance, will be released on January 12th, while those for January will be published on February 14th. However, by leveraging our proprietary machine-learning framework based on alternative data we can estimate US inflation weekly. This cutting-edge approach provides our clients with accurate and up-to-date estimates and insights on US inflation to help anticipate US monetary policy and its implications on emerging markets.

The weekly estimates show that the US inflation has sharply decelerated since mid-December, from 7.3% y/y in the second week of December to 5.6% in the last week of December and 5% in the first week of January.

Oil prices, in particular diesel prices, have remained the biggest and most consistent driver of inflation throughout the whole year. This is not a surprise. Although most US consumers do not purchase diesel directly, it is used for the production and transportation of many everyday products. The other main driver of the inflation dynamics as of the end of 2022 and the beginning of 2023 is the labour market, in particular the weekly private sector payroll.

On the other hand, the impact of monetary and financial indicators like currency in circulation, effective Federal Funds rate, and breakeven inflation is fading away relative to oil prices and labour market. The impact of real-economy alternative data like the OECD weekly growth tracker, Johnson Redbook index, and the number of seated diners on inflation remains significant but much lower than a year ago.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)