After India’s nationwide lockdown between March and May 2020, the wholesale and retail prices of fuel remained subdued.

However, the decline in wholesale inflation pertaining to fuel and power started moderating in November 2020, and since then, it has been growing persistently, to a record high of 36.7% in May 2021 thanks to the low base effect.

Although this effect dissipated, fuel inflation remained sticky and above 20%. The consumer price index for fuel and light also witnessed a steady y/y increase starting February 2021 and has now been at record levels for five months. A weighted average of petrol and diesel prices across India reveals that there was a 26% and 30% respective increase between January 1, 2021 and October 26, 2021. If the oil prices continue to remain elevated, it can dent the economic recovery process of India.

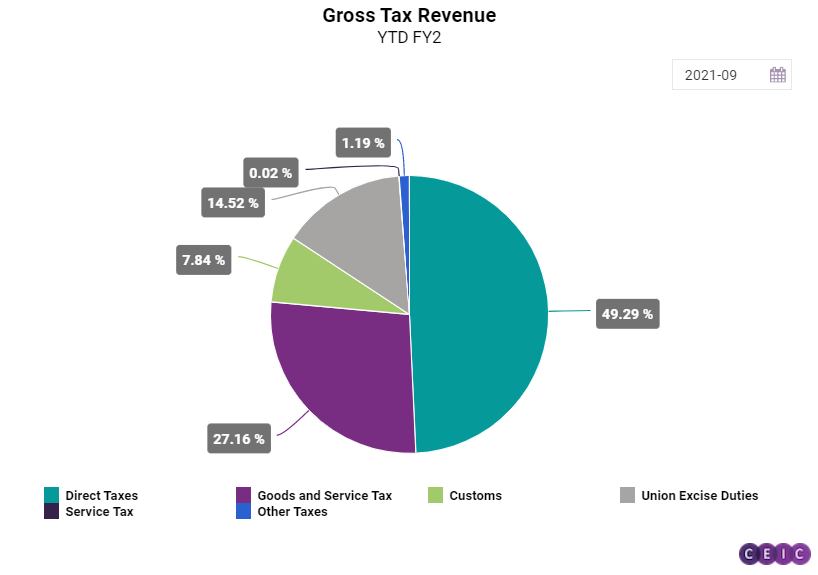

The reason behind the soaring fuel prices in India is two-pronged. First, the global economic recovery has helped the demand for fuel to rebound. In addition, the regulated production by OPEC countries has led to a rise in oil prices. The second, which is more specific to India, is that the taxes on fuel have also increased to an all-time high. This further explains why prices in India have skyrocketed in 2021, even though the international prices of crude oil have been lower than in 2013 and 2014.

The price of petrol and diesel at fuel pumps is a mix of the price set by the oil marketing companies, central government taxes, and state government taxes. Hence, fuel prices vary across the different states of India. Multiple research and journalistic articles (for example, Times of India) show that the share of oil marketing companies’ price, which is determined directly by the international crude oil prices, has dropped to less than 50% in 2021, from above 60% in 2014.

At the same time, the share of central government taxes on fuel increased from 14% to 32%. The increase in the share of state tax was less prominent, from 17% to 23% between 2014 and 2021. For diesel, the increase in taxes has been even more pronounced. Central excise duty on diesel increased from 8% in 2014 to 35% of the retail price in 2021. State taxes, on the other hand, increased more moderately, from 12% to 15%, over the same time frame. It can be concluded that the decline in fuel prices after 2014 had not been fully passed on to Indian consumers.

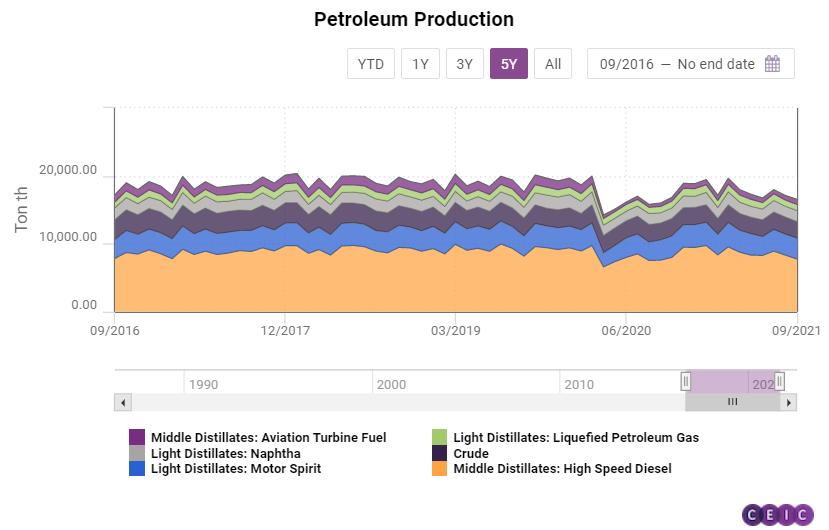

An increase in oil prices can impact the economy through multiple channels. First, it will widen the trade deficit, and hence, worsen the current account balance. However, since a third of these crude imports are re-exported after refinement and other value additions, some impact of the increased oil prices will be absorbed. An RBI paper talks about a thumb rule that every USD 10 per barrel increase in crude prices leads to an additional USD 12.5bn in deficit, which will shoot up the CAD/GDP ratio by 43 bps. The article also claims that a substantial increase in GDP does not mitigate the increase in CAD/GDP ratio. Second, inflation will increase through both direct and indirect channels. The former means a direct increase in fuel inflation, while the latter signifies an increase in the cost of consumer products as the cost of production rises, which would pose upside risks to core and headline inflation.

Sign in to access all datasets for this insight piece here. Alternatively, you can learn more about our Global Database - a source of information for everything you need to know, housing knowledge on developed and developing markets around the world..png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)