-png.png)

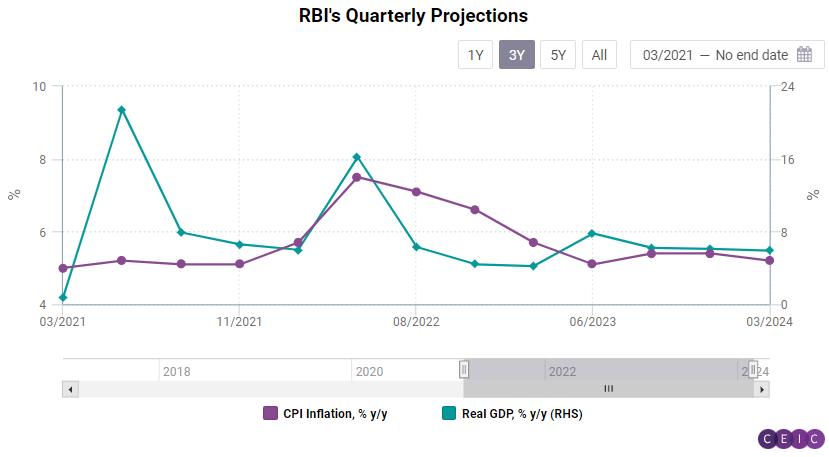

The Reserve Bank of India (RBI) is setting the stage for a gradual withdrawal of the monetary accommodation while supporting economic growth in parallel. The Monetary Policy Committee (MPC) decided to keep interest rates unchanged at 6.5% p.a. at its last meeting on April 6th. This is the first time since May 2022 that the RBI has refrained from any action on the interest rates front.

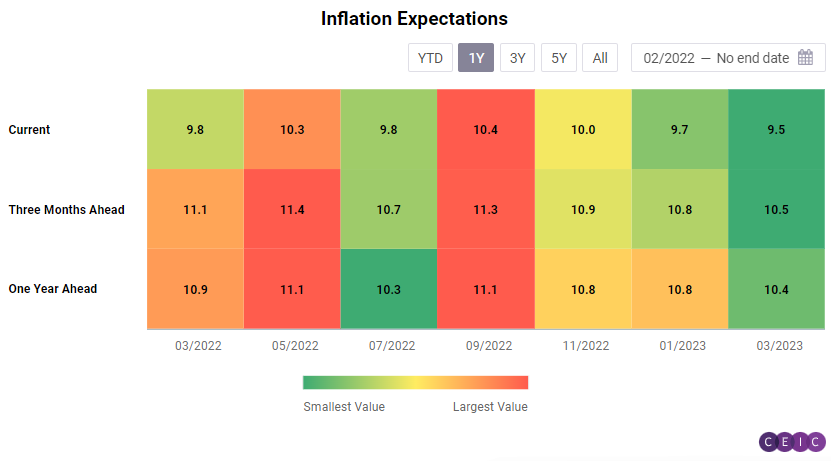

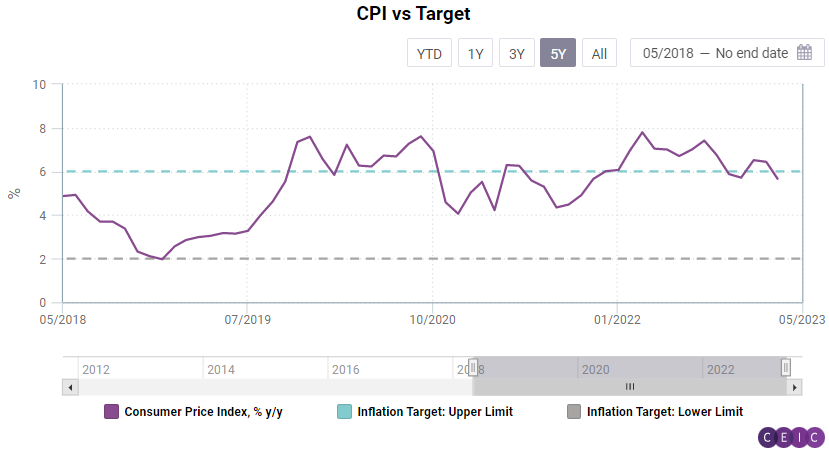

The committee’s decision was rather unexpected, as headline inflation is still overshooting the 6% upper limit of the target range, increasing to 6.4% y/y in February 2023 compared to 5.7% y/y in December 2022. More importantly, growth in the core consumer price index, continues to remain sticky since March 2021, hovering between 5.4% y/y (April 2021), and 7% y/y (April 2022). On the other hand, households expect inflation to cool down both in the short and medium term: all three indicators (current, three months ahead, and one year ahead inflation expectations) declined in March compared to January 2023.

The RBI might be faced with the hard task to strike a balance between withdrawing monetary accommodation without hindering growth. The Indian economy indeed exhibited resilience to the recessionary headwinds from advanced economies but showed signs of moderation in Q1 2023, evident by timelier indicators than the GDP. Urban consumption seems to be decelerating, as light vehicle registrations have moderated after the January 2023 peak. Furthermore, alternative labour market indicators showcase a deceleration in the growth of formal job postings. This puts higher downside risks to growth than upside risks to inflation. On the upside, high-frequency indicators of consumption such as farm tractor sales, and alternative indicators such as two-wheeler registrations suggest strengthening rural demand.

The MPC remains conscious of the inflation environment, which will be shaped by both domestic and global factors, specifically the uncertainty about crude oil prices. Inflation is expected to broadly moderate over the course of FY2024, albeit not drastically. The same goes for the GDP growth rate, supporting RBI’s latest decision to stay put on interest rates. Nonetheless, RBI’s strong stance to battle inflation does not rule out an out-of-cycle rate increase if the need arises.

The CEIC Global Database provides access to a vast database where users can gain insight into the ever-changing dynamics of world economies.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)