It is no news that the Indian economy is experiencing troubles as of late.

The GDP growth has been decelerating for six quarters straight to reach a six-year low of 4.6% y/y in Q2 FY2019-20 – a decline of almost 50 bp from the previous quarter. At the same time, petroleum is vital for the Indian economy – oil and gas constitute 36% of India’s ever increasing energy consumption but the country relies heavily on imports of the commodities.

Big appetite

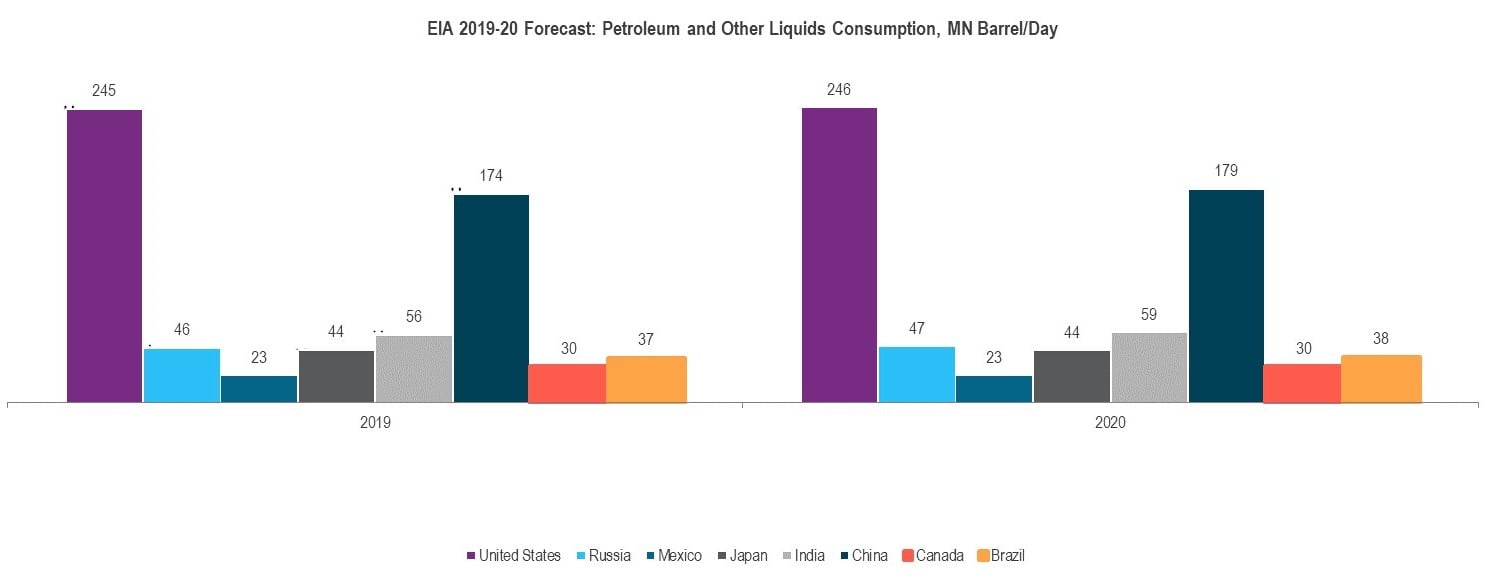

The rapid development of the Indian economy in the past two decades was mirrored by its increasingly rising demand for oil products. Data from BP PLC reveals that as of 2018, India is the third largest consumer of oil products in the world at 5.2mn barrels per day, overtaken only by the two largest economies globally, the US and China. Since 2008, consumption rose almost 1.7 times and surpassed the figures for Japan. India also recorded stronger growth than China post-2010, especially between 2015 and 2016 when consumption increased by 8%-10% annually. According to a report by the International Energy Agency (IEA) quoted by ET EnergyWorld, India is projected to surpass China in terms of oil consumption by mid-2020s.

Source: CEIC Data, U.S. Energy Information Administration

At the same time, domestic oil production can hardly satisfy India’s large appetite for the commodity. In fact, petroleum output has kept to a relatively constant level in the past decade between 35mn and 37mn tonnes annually. There are indications that production could increase – the IEA report revealed that Indian oil output might increase marginally by 2024 to counter the negative effects of geopolitical instability and volatile oil prices.

Recent data, however, suggests otherwise – crude petroleum production has been decreasing constantly since 2012 and in FY2019 it fell to 34.2mn tonnes, the lowest level since 2010. According to the 2018-2022 EMIS India Oil & Gas Sector Report, the country’s ageing oil fields are hampering production of crude oil. In addition, India’s terrain is making oil and gas exploration difficult and the required specialised expertise is beyond the capabilities of local Public-Sector Undertakings.

What Is petroleum consumption telling us?

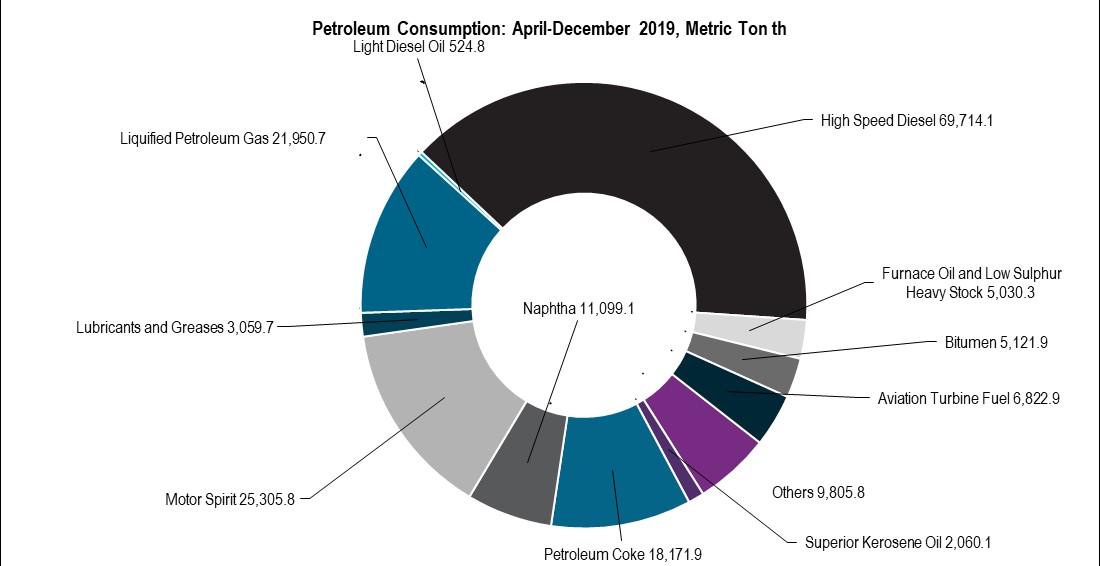

The usual perception when it comes to petroleum usage is as an energy source in electricity production or as a fuel source for automobiles. However, petroleum products have a much wider spectrum of application – for the production of asphalt and road oil, various plastics, chemicals and synthetic materials found in almost all kinds of products in everyday life. India makes no difference in this aspect – along with fuels such as diesel, motor spirit and aviation turbine fuel, widely used petroleum products are bitumen (used for road construction), lubricants and greases and petroleum coke. Nevertheless, fuels continue to represent the bulk of petroleum usage – 39.1% of total petroleum consumption fell to high speed diesel, followed by motor spirit (14.2%) and liquefied petroleum gas (12.2%).

Source: CEIC Data, Petroleum Planning & Analysis Cell

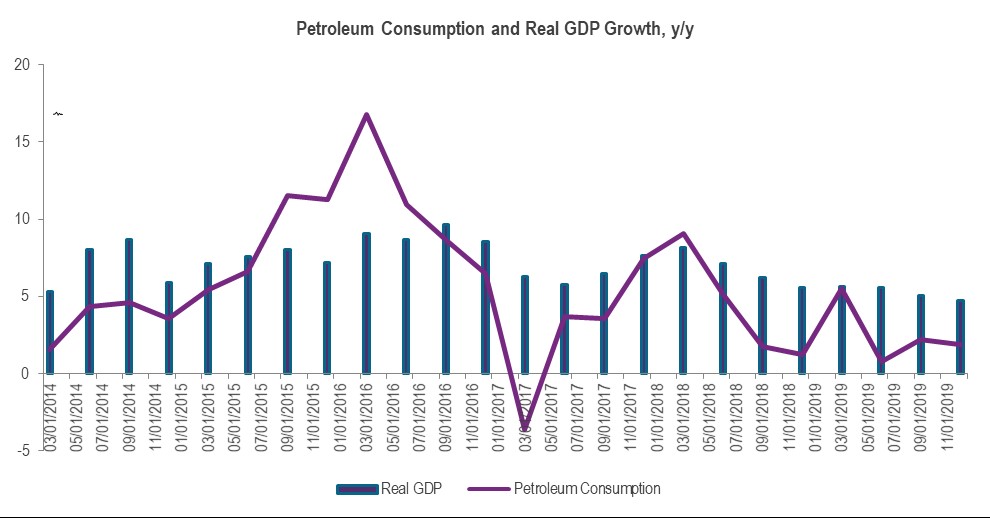

Given the importance of petroleum products in all aspects of life, it is no surprise that economists perceive their consumption as a useful gauge of economic performance. Petroleum consumption is being used as a leading indicator as well as in GDP nowcasting models for both developed and developing economies. Indian data reveals that the start of the GDP growth deceleration in Q1 2018 coincided with a similar onset of a growth downturn in petroleum consumption.

Source: CEIC Data, Petroleum Planning & Analysis Cell, Central Statistics Office

More tough choices

India’s strategy to battle its overreliance of oil imports can be roughly pinned down to two actions – policy initiatives to support domestic output and a focus on renewable energy sources. The Indian government has been more than supportive in its policies towards oil consumption allowing up to 100% FDI in many segments of the petroleum and gas sector. Investor-friendly programmes such as HELP (Hydrocarbon Exploration and Licensing Policy) and OALP (Open Acreage Licensing Programme) have been developed to encourage exploration and production of petroleum and natural gas and thus to decrease the dependency on the imports of the commodities. This has also been a target of India’s Prime Minister Narendra Modi ever since his ascension. In 2015 Modi set out a goal to reduce oil imports (then estimated at 77% of consumption) by 10 pp by 2022. Despite all these efforts, as the data shows, it seems highly unlikely that the situation is going to change anytime soon.

In terms of renewable energy, India is not meeting its (objectively ambitious) targets either. The goal of 175 GW renewable energy capacity by 2022 seems quite unrealistic, given the fact that according to the Centre of Science and Environment (CSE), by December 2019 total capacity has reached only about 86 GW. According to CSE, the slowdown in the growth of renewable energy sources is attributed to a number of factors including sluggish development in auctions, rising costs, and project risks.

The combination of a slowing economy and barriers in diversification is pointing at a continued increase of oil imports dependency. In the current situation India has less tools at its disposal than before. If the choice is between stimulating growth and petroleum independence, it might not be a choice at all.

The CEIC India Premium Database is the definitive go-to resource for analysts, investors, and strategists to assess and run analytical models on the Indian economy. Learn more here

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)

.jpg?width=756&name=shutterstock_428372767%20(1).jpg)