-png.png)

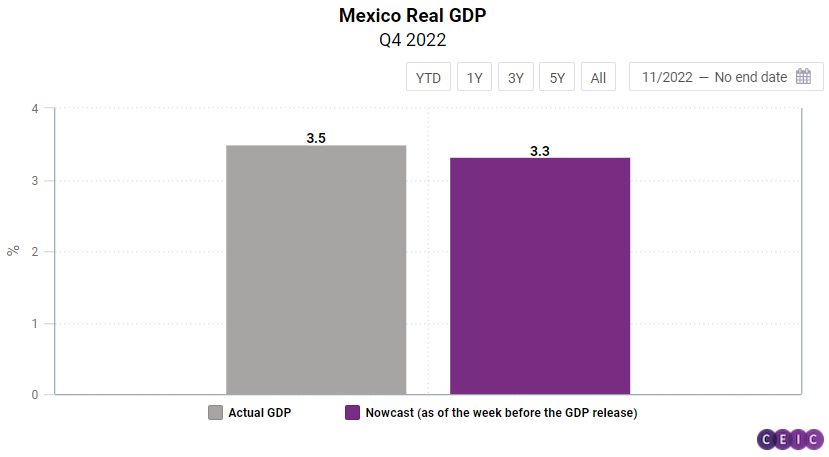

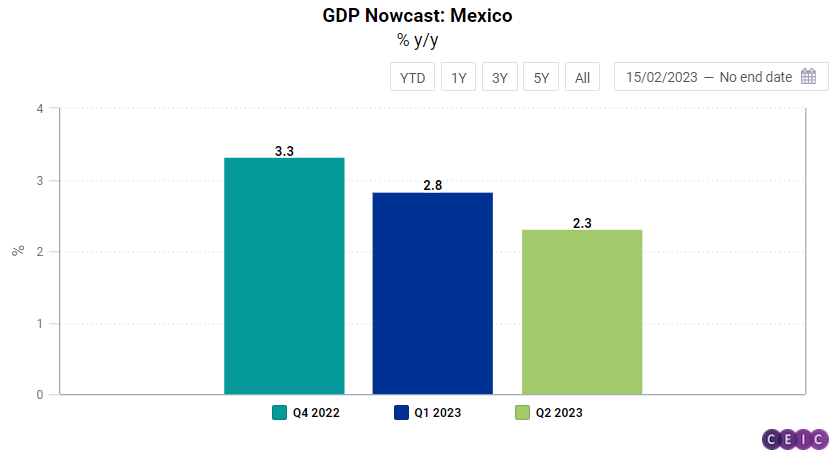

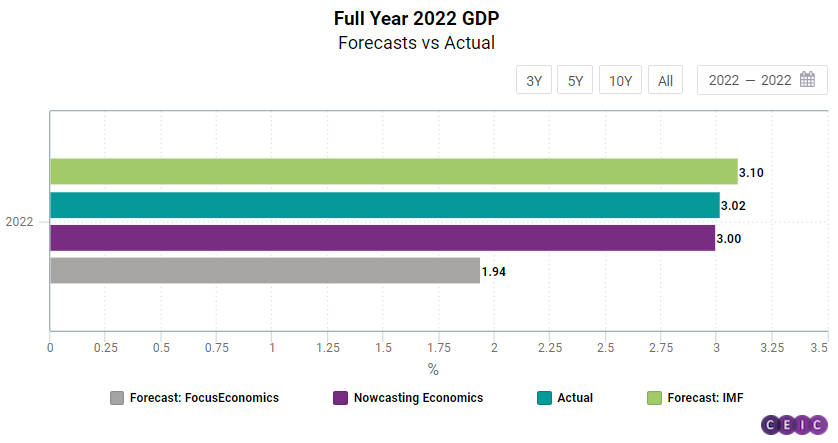

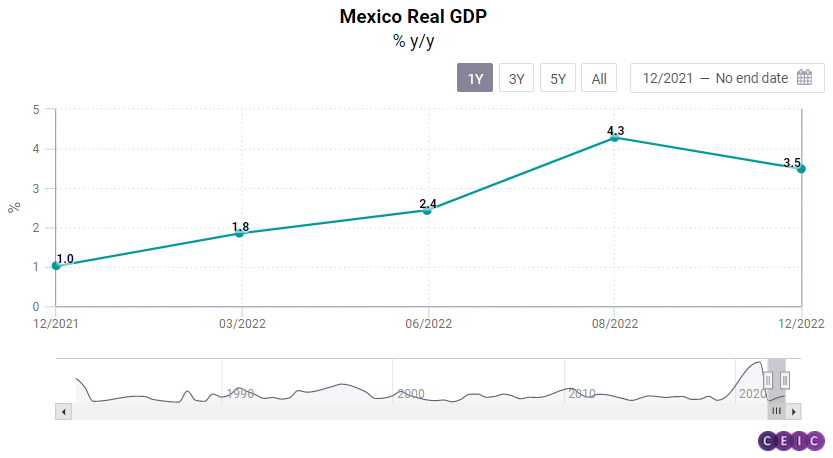

Mexico's economic momentum lost steam in Q4 2022, accurately predicted by the estimations from Now-Casting Economics. It projected a 3.3% y/y growth rate as of mid-January, i.e. one week before the actual GDP release, which was only 0.2 percentage points higher (3.5% y/y). The Q4 2022 deceleration was the first in a year but will definitely not be the last for a while. According to the GDP nowcast for Q1 2023, Mexico's economic growth will slow down to 2.8% y/y, followed by a 2.3% y/y growth in Q2 2023.

A key factor for the upcoming deceleration in Q1 and Q2 2023 is the weakness in the US economy, as 80% of Mexico's exports go to the US. Motor vehicle production in Mexico is the biggest drag on the Q1 2023 GDP increase, stripping 22.9 basis points off the expected growth rate. It is followed by the US manufacturing PMI, which cuts the nowcast by 21.1 basis points. Lower demand from the US could potentially have a significant impact on Mexico's exports revenue.

Since the pandemic, Mexican exports to the US have been following an upward path to all-time highs in September 2022 (USD 43.2bn), according to Bank of Mexico's data. However, this peak was followed by subsequent declines and in December 2022 the export value stood at to USD 40.6bn.

On the upside, Mexico's economy will be supported by strong domestic demand, as consumer confidence in Mexico is the biggest driver of the nowcast in Q1 2023, adding 69.4 basis points to the growth rate, followed by the producer confidence indicator, contributing 39.5 basis points. The non-farm payrolls change in the US is expected to boost Mexico's Q1 growth rate by 35.8 basis points.

The CEIC Global Database provides access to a vast database where users can gain insight into the ever-changing dynamics of world economies.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)