-png.png)

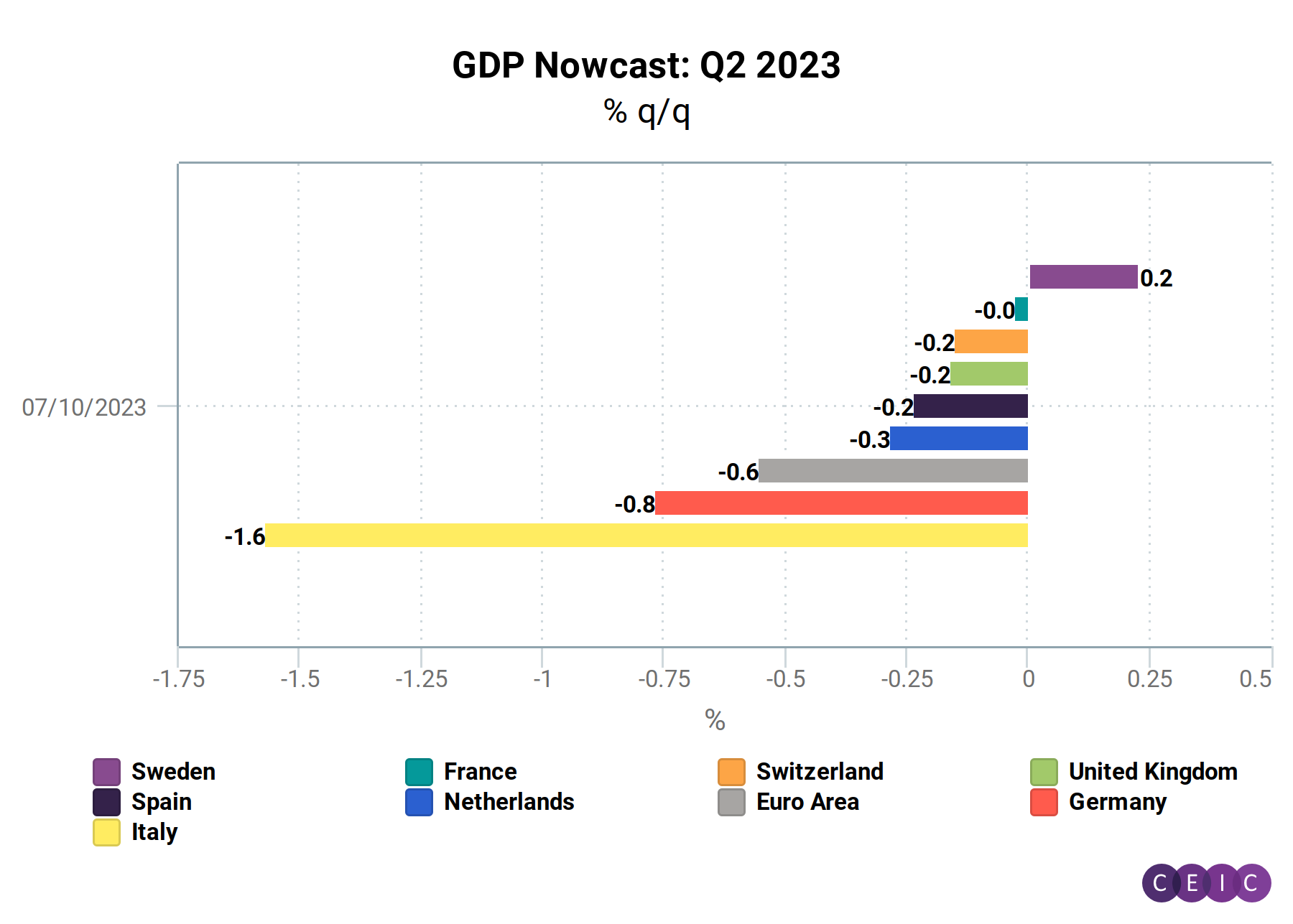

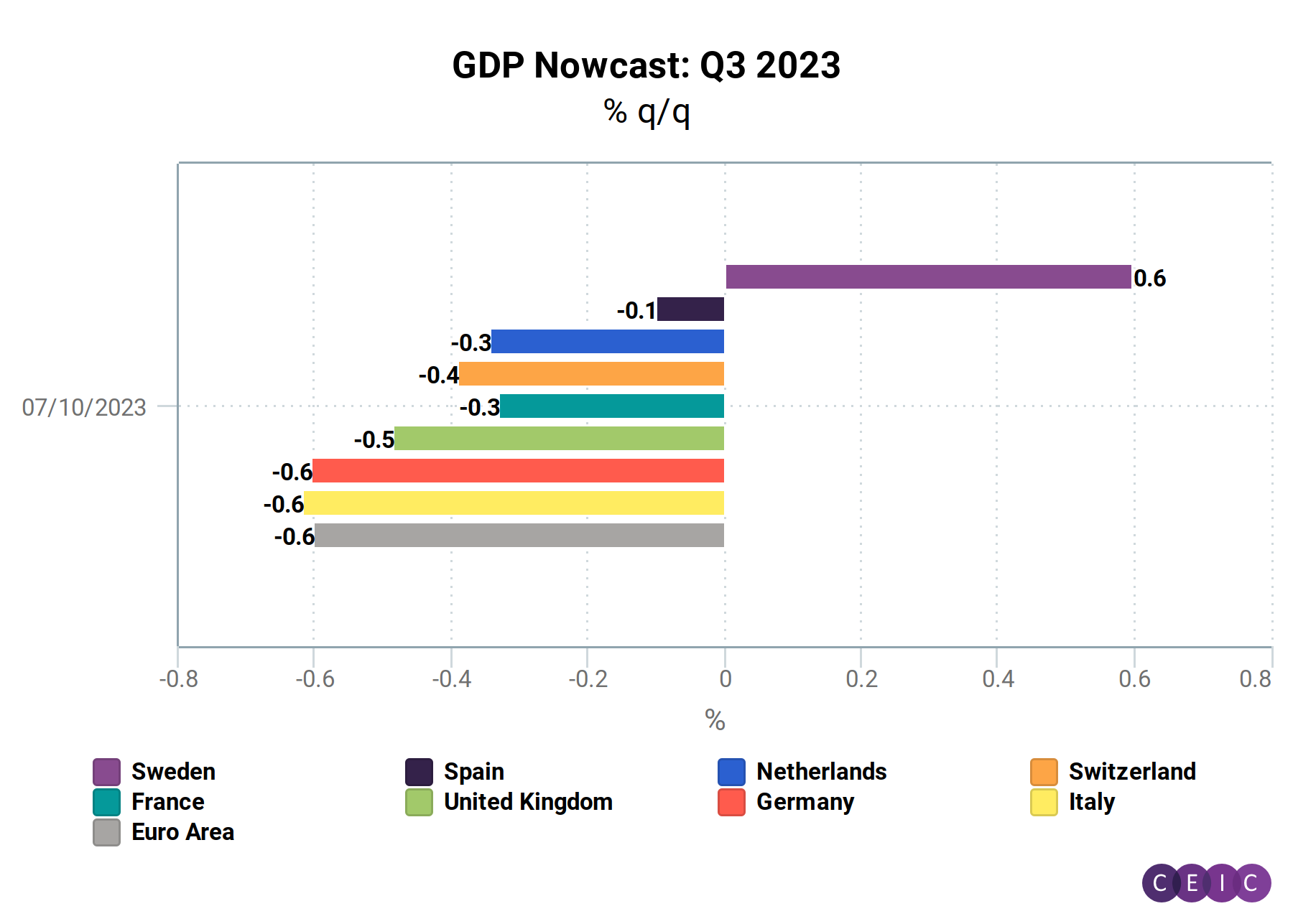

Key developed economies in Europe are headed for contraction on a quarterly basis in Q2 and Q3, before they rebound in the last quarter of the year, according to the GDP nowcast, available within CEIC. The actual preliminary GDP data for Q2 will be available as late as end-July for most markets, underscoring the importance of higher frequency data for monitoring the economic performance in Europe.

The nowcast for the Euro Area for example points to a 0.6% q/q contraction in Q2, which would be the third negative figure in a row after drops by 0.1% q/q in Q1 2023 and Q4 2022 each. All eurozone member states, covered by the nowcast, are expected to experience contraction in Q2, with the largest one observed in Italy (-1.6% q/q). Sweden, which is not part of the common currency union, is set to post a positive GDP growth, albeit close to zero, at 0.2% q/q. Sweden's economy will be the only exception in Q3 as well, set to expand by 0.6% q/q. Non-EU countries Switzerland and the United Kingdom, are projected to contract in both Q2 and Q3.

Developed markets in Europe are experiencing economic slowdown as a result of the monetary policy tightening, carried out by the central banks in order to combat elevated inflation. Among the covered economies, the Bank of England has set the highest policy rate as of mid-July (5%), followed by the European Central Bank (ECB) and Riksbank, Sweden's central bank, which have increased interest rates to 4% and 3.75%, respectively. The Swiss National Bank has a policy rate of 1.75%. The Alpine economy is projected to contract both in Q2 and Q3.

The CEIC Global Database provides access to a vast database where users can gain insight into the ever-changing dynamics of world economies..png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)