While global economic activity is severely restricted by the COVID-19 pandemic, technology companies such as Zoom and Amazon emerged as notable outliers and their business boomed during the pandemic.

The technology sector actually benefitted from the pandemic as demand for digital services rapidly outpaced that for physical services. As social distancing measures came into place, contactless activities were encouraged and the pace of digitalization accelerated. Fintech was one of the segments to reap benefits from this large-scale shift of focus.

Overview of the Fintech landscape in Indonesia

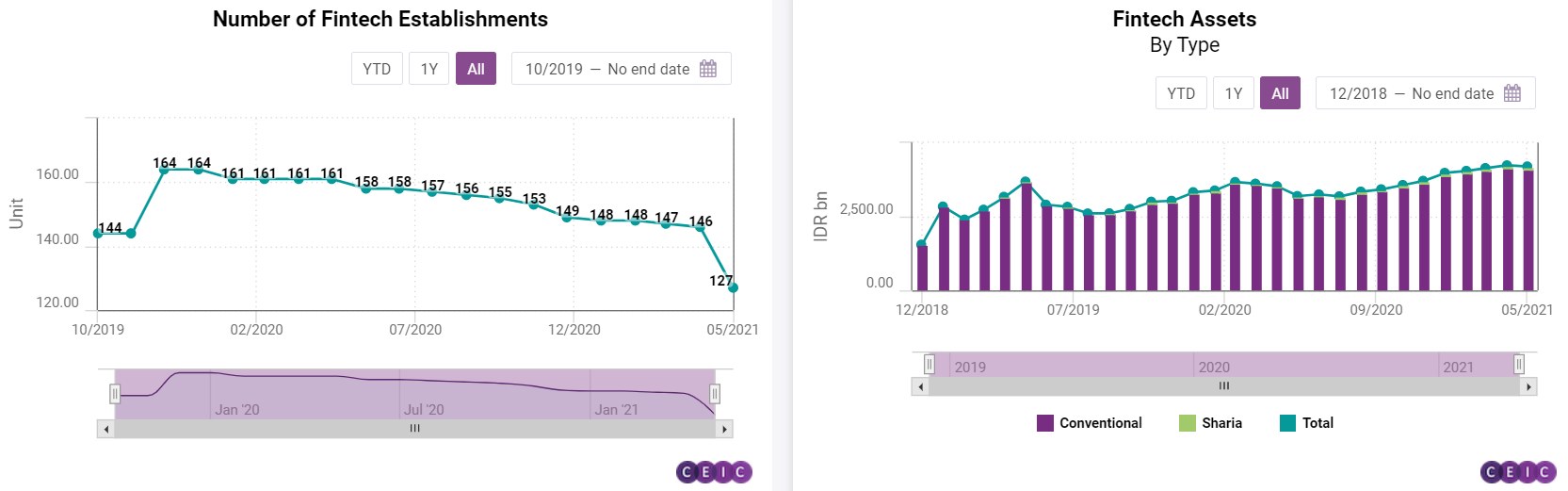

Indonesia has a rather dynamic fintech market. As of April 2021, fintech assets stood at IDR 4,236.4bn, of which conventional fintech assets made up IDR 4,127.4bn and Sharia assets accounted for the remainder. Although the share of Sharia fintech assets is significantly smaller, they have also been increasing.

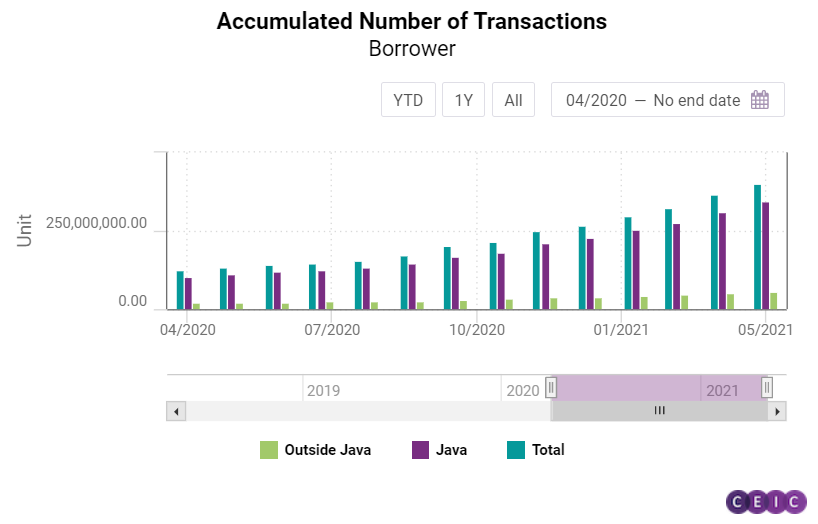

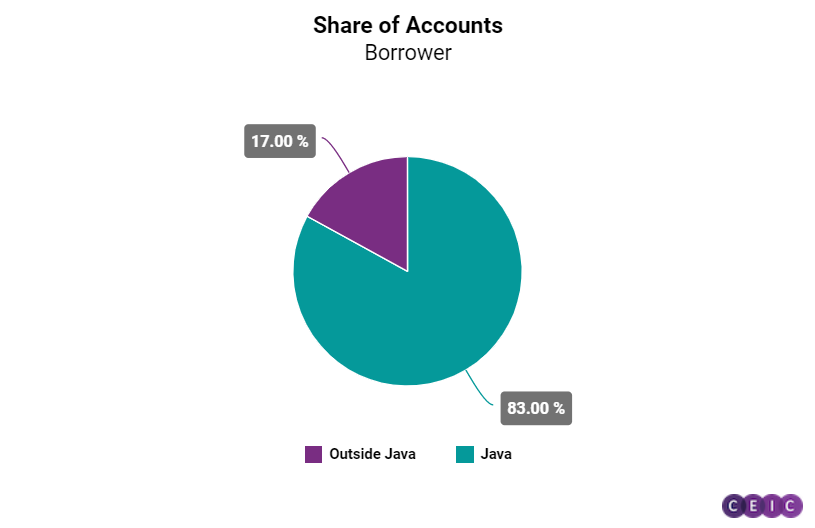

The number of borrower accounts has increased substantially, both inside and outside of Indonesia’s most populous island of Java. Growth rates were staggering, hovering above 100% y/y in each month since data collection began in June 2019. In 2019, the slowest annual growth rate was 325% in December. As of April 2021, there were a total of 60.3mn borrower accounts, of which 86% were Java-based.

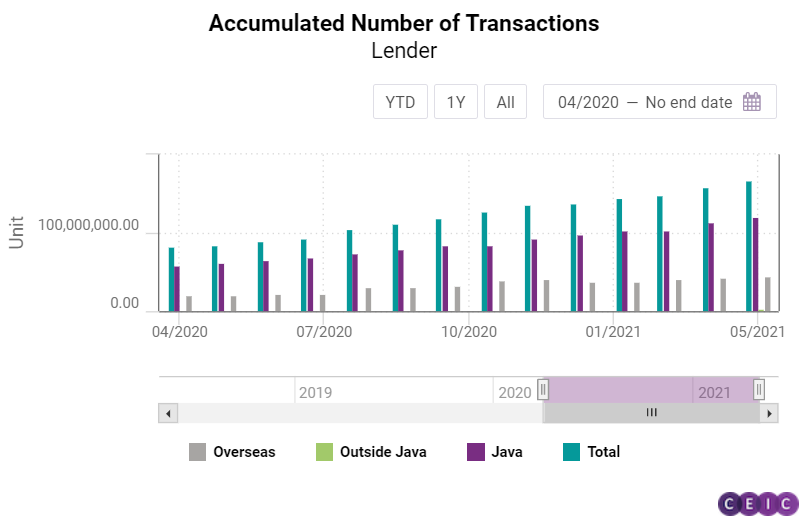

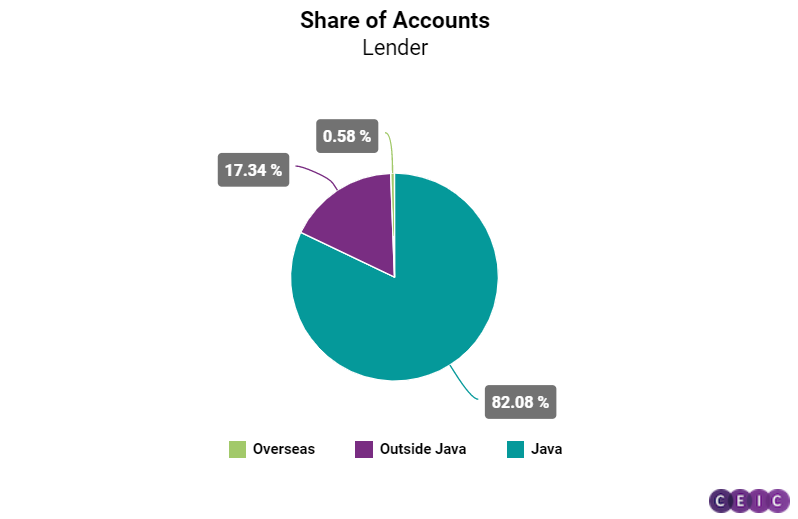

The number of lender accounts also increased but at a more moderate pace. There were a total of 632,404 lender accounts as of April 2021, of which 480,575 in Java, 143,725 outside Java and 8,104 were from overseas.

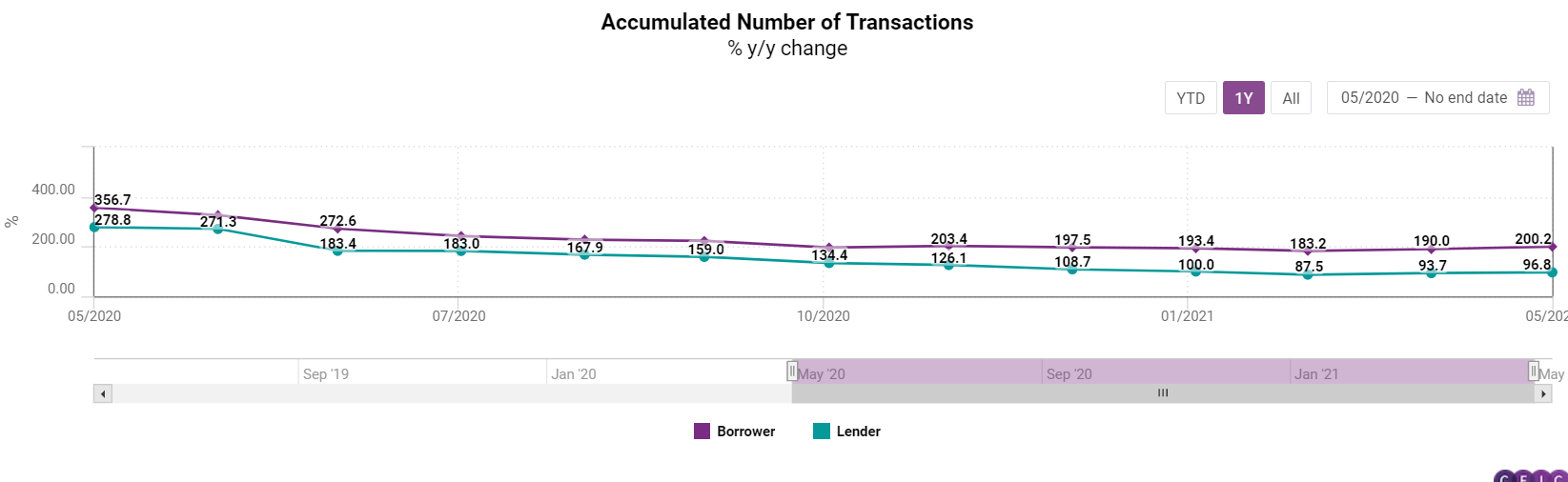

Just like the exponential increase in the number of accounts, the number of borrower transactions also saw impressive growth figures of well above 100% y/y - the slowest pace of y/y growth on record was registered in March 2021, at 183%. The number of accumulated borrower transactions as of April 2021 was 364.8mn, of which 311.5mn transactions were carried out in Java. To put this into perspective, June 2018 only saw 3.2mn transactions.

Lender transactions, while fewer than borrower transactions, also increased by leaps and bounds, with growth rates only falling slightly below 100% in 2021. From just 2.3mn transactions in June 2018, the number ballooned to an accumulated 159.2mn by April 2021. Of these 159.2mn transactions, 114.2mn transactions were in Java and 2.5mn were outside Java. Surprisingly, 42.6mn of these lender transactions were from overseas.

Industry Regulations

The fintech industry in Indonesia is regulated by two government bodies, namely, Bank Indonesia and the Financial Services Authority (OJK). Fintech activities that require licensing or registration related to monetary stability, financial system stability, and payment systems, fall under the jurisdiction of Bank Indonesia. Digital financial innovation from a financial services perspective is under the purview of the OJK.

With the growth of the fintech industry, the government has to strike a balance between imposing more regulations to contain risks and stifling innovation and growth with legislative burdens. In December 2020, the Bank Indonesia issued Regulation No 22/23/PBI/2020 to overhaul the payment licensing framework of the country. Effective as of mid-2021, the new framework aims to shift oversight from an entity-based approach to activity and risk-based approach. Moreover, the new regulation imposes additional requirements regarding share ownership and capital for payment services providers.

The OJK is also revisiting regulations for online lending and draft legislation points to a potential six-fold increase in capital requirements for lenders, regulations on sources of capital, increased transparency, new licensing processes, and requirements for productive loans.

Companies to Watch

Fintech is one of the fastest-growing technology sectors in Indonesia and the COVID-19 pandemic provided it with additional impetus as the new normal now means minimal contact and cashless transactions. There were 146 fintech firms in Indonesia as of April 2021. The largest in terms of valuation is still Gojek, the country’s first unicorn with funding of more than USD 5bn.

The app offers several services that include ride-hailing and transportation, food delivery, logistics, and payment services. In May 2021, it was announced that Indonesia’s largest internet companies, Tokopedia and Gojek, will be merging to form GoTo group. The group is said to plan a listing in Indonesia and the US later in 2021. According to the latest ASEAN briefing of Dezan Associates, the combined ecosystem of GoTo would include more than 100mn active users, 2mn drivers, and 11mn merchants. The combined GoTo ecosystem would approximate 2% of Indonesia’s GDP.

Sign in to access all datasets for this insight piece here. Alternatively, you can learn more about the CEIC Indonesia Premium Database - the premier source for everything you need to know about the Indonesian economy, housing an unprecedented wealth of information revealing the drivers of this market.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)