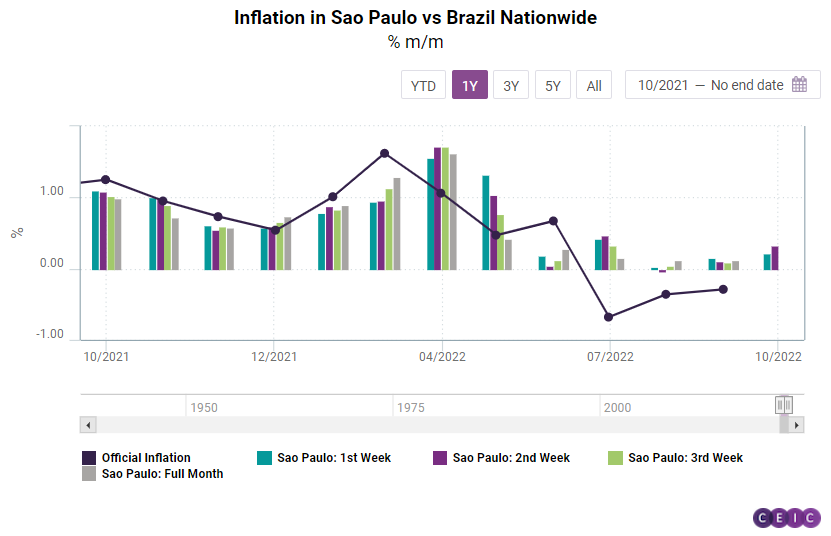

Inflation in Brazil has been cooling off recently following the consistent interest rate hikes by the central bank. The policy rate (Selic rate) stays at 13.75% as of mid-October, a six-year high, while official inflation was 7.2% y/y in September, the fourth consecutive deceleration. However, high-frequency data suggests that the effect of monetary policy tightening was temporary, and inflation is accelerating again in October. In the first and the second weeks of October for instance, the consumer prices accelerated: they increased by 0.2% m/m and 0.3% m/m, respectively, compared to the same weeks in September, according to data for Sao Paulo provided by the Institute of Economic Research Foundation (FIPE).

The weekly inflation data for the biggest Brazilian city could prove a valuable leading indicator in situations when the inflation dynamic is at crossroads, as it provides the change on monthly basis for the first three weeks of each month, as well as for the full month. Moreover, observing the previous weekly dynamic, one could identify a trough in August 2022, as inflation in the second week was negative, albeit very close to zero. Hence, it is possible that the recent slowdown in annual inflation might be as short-lived as the previous one.

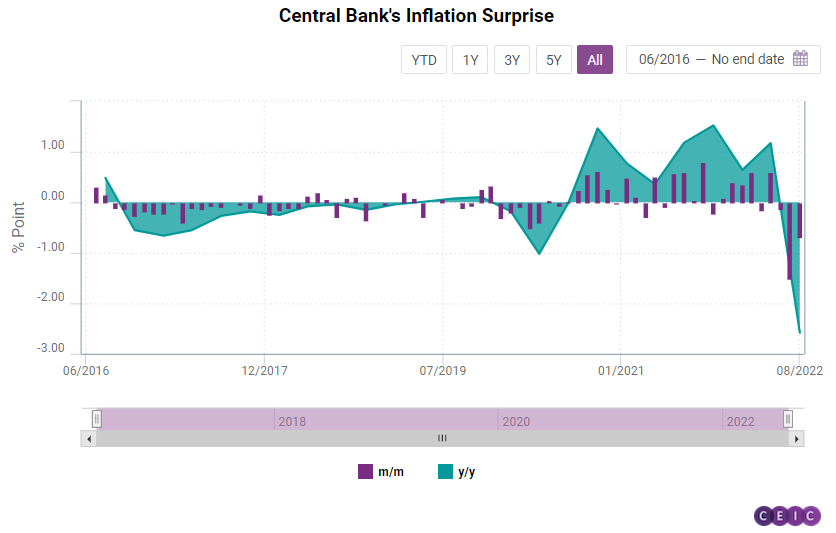

Further, the weekly data, which is provided by the non-profit Institute for Economic Research Foundation (FIPE), is published ahead of the official indicator (IPCA), or four days after the end of the reference week. That way, towards the end of a given month the inflation for its first three weeks is already available, while the IPCA is published as late as 10 days after the reference month has ended. The early availability, the quasi-weekly frequency and the granularity allow the FIPE Sao Paulo dataset to be considered providers of early signals of inflation in Brazil. This is especially valuable, as forecasting price growth has become especially difficult for the authorities since 2020. Brazil's Central Bank's projection underestimated the inflation by the record 2.6pp in the quarter ending in August. This could be partially explained by the federal government's measures to tame inflation like cutting taxes on fuel and energy, which can be difficult to calculate in advance.

The CEIC Global Database provides access to a vast database where users can gain insight into the ever-changing dynamics of world economies.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)