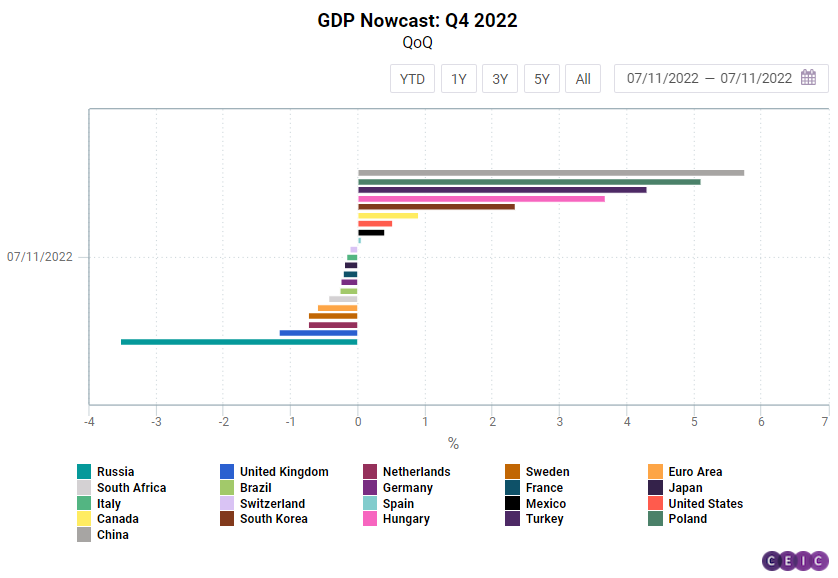

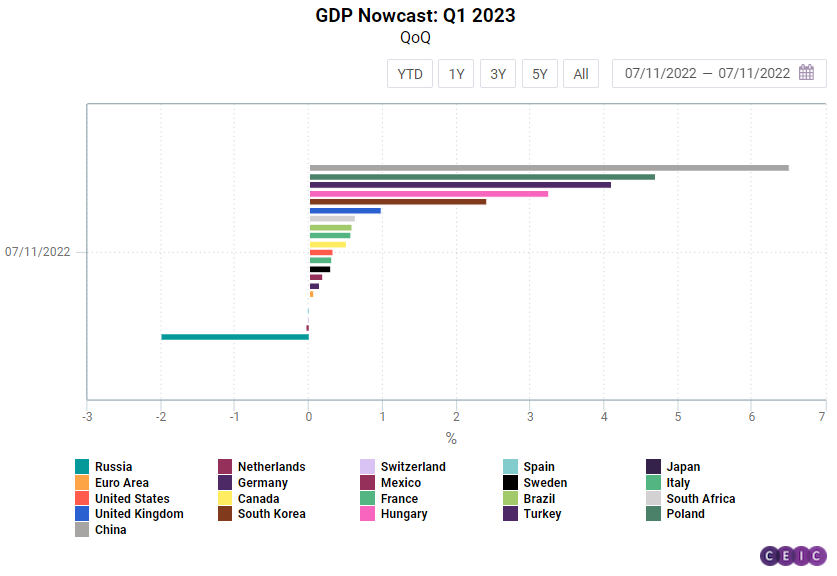

The first quarter of 2023 is going to see a positive turnaround in GDP growth figures across the globe following the current recessionary period, according to the real-time GDP estimates provided by Now-Casting. Amongst the twenty-one countries which have been nowcast, China’s growth for both Q4 2022 and Q1 2023 supersedes the rest, at 5.6% q/q and 6.5% q/q, respectively, followed by Poland and Turkey. On the reverse side, Russia’s growth will likely continue to decline in q/q terms, Q4 2022 by 3.5% and Q1 2023 by 2.0%.

However, the figures point to a diverging performance between advanced economies and emerging markets to the benefit of the latter. The GDP Nowcast employs a dynamic factor model to estimate GDP in real-time and the estimates show a positive q/q growth for all developed economies covered in the dataset, apart from Netherlands, Switzerland, and Spain. The US quarter-on-quarter GDP growth is likely to decelerate from 0.5% q/q in Q4 2022 to 0.3% q/q in Q1 2023, while that for the United Kingdom will turn around from an estimated decline of 1.2% q/q to an expansion of 1% q/q over the same period. China is expected to accelerate its growth to 6.5% q/q in Q1 2023, from 5.7% q/q in Q4 2022. Poland is also slated to continue growing steadily, although the pace of increase is likely to slow. The estimated decline in GDP for Brazil in Q4 2022, at 0.3% q/q, is poised to crossover into a growth phase in Q1 2023, at a nowcast of 0.6% q/q.

The evolution of the current quarter GDP Nowcast shows that the estimates climbed strongly downwards in July and August 2022, before recovering in September. This trend held true for major economies such as the United States, China, Euro Area, and the United Kingdom. The deceleration spell for the United Kingdom extended until mid-September before recovering marginally, albeit remaining in the negative territory, triggered by a substantial change in economic policies after the election of Liz Truss as prime minister. Such instances further bolster the need for a real-time understanding of the economy.

The importance of real-time data has paved the way for alternative data such as nowcasts, which are more accurate than forecasts and tackle the problem of “now”. The data from Now-casting.com shows the GDP backcast, nowcast, and forecast for the following countries. Besides the overall numbers, the impact of the underlying indicators is also presented for each country. Furthermore, the data estimates the GDP for the trailing quarter and the forward quarter. While the nowcast is perfectly understandable as the real GDP of the current quarter, the relevance of the backcast or the previous quarter estimate increases when there is a substantial lag in the release of the GDP, which is the case for most emerging nations such as Brazil, Poland, and Russia.

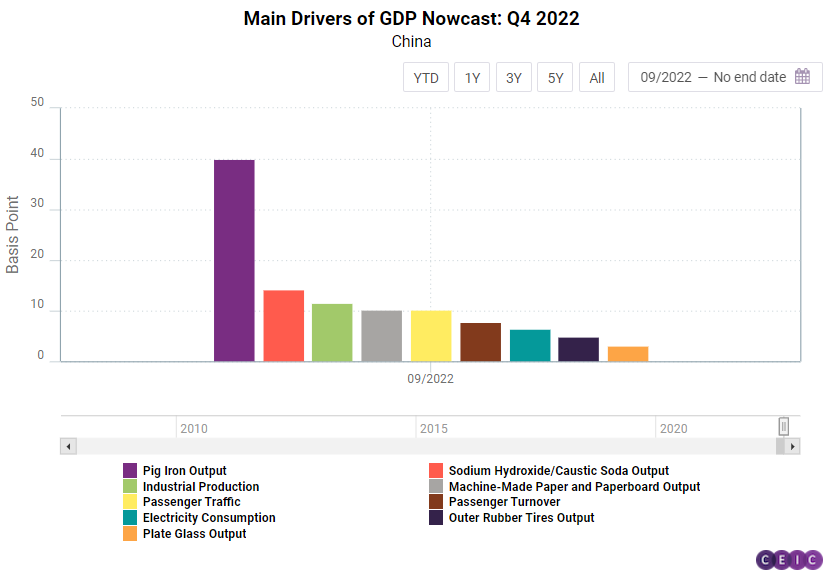

China’s high growth for the current quarter is primarily led by pig iron output, sodium hydroxide output, and overall industrial production, as shown by data for September. While industry-based indicators remain the predominant driver of the nowcast, services indicators such as passenger traffic, and passenger turnover have also made significant contributions to the nowcast for the same month. Consumption, however, has played more deterrent to the growth of the Q4 2022 nowcast.

Russia’s growth prospects, on the other hand, have been weakened by their ongoing war against Ukraine. The GDP of the country is slated to decline in both Q4 2022 and Q1 2023. Russia’s nowcast for Q4 2022 gained on account of PMI manufacturing, new orders and contracts of construction, and business confidence of the manufacturing sector in September, but was dragged down significantly overall industrial production, freight turnover, retail sales, and production of passenger cars.

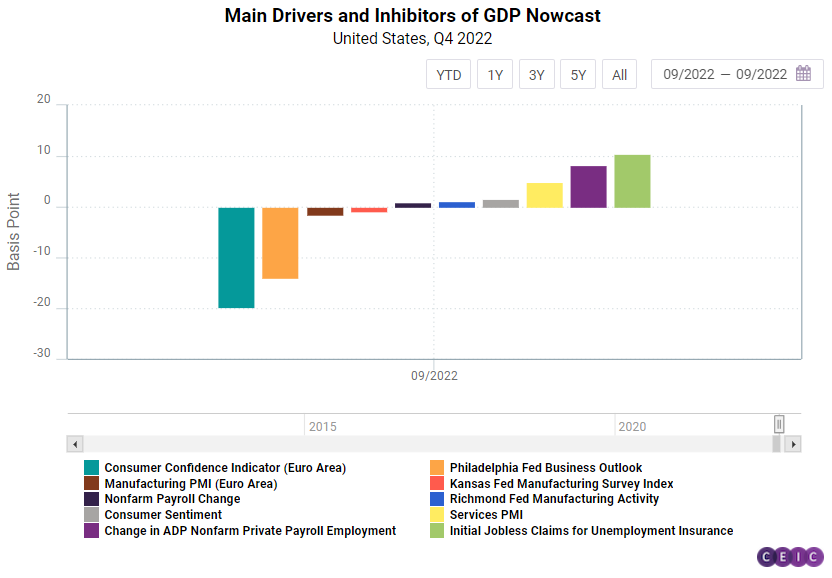

The United States, the largest economy in the world, is expected to see a slowdown in its q/q rate of growth from Q4 2022 to Q1 2023. September data reveals that Q4 2022 nowcast has been largely driven heavily by employment indicators such as initial claims for unemployment insurance and change in ADP Nonfarm Private Payroll Employment. However, the largest driver has been the general business conditions of the Empire State Manufacturing Survey, which was coincidentally the biggest inhibitor of the nowcast in the previous month. The trade and external indicators mostly witnessed a negative impact on the Q4 2022 nowcast in September, but the consumer confidence indicator for Euro Area has turned around significantly, impacting the nowcast positively in October. The Euro Area GDP for Q4 2022 is slated to decline by 0.5% q/q. In terms of the underlying indicators, the manufacturing PMI for Italy was the largest promoter of the nowcast in September. In October, however, the industry business climate indicator for France occupied the spot. Other noteworthy indicators in September were the services PMI for France, the business sentiment indicator of France, which grew the nowcast sharply. The Euro Area consumer confidence turned out to be the greatest inhibitor of the Q4 2022 nowcast, followed by the ZEW economic sentiment and IFO business climate index, both for Germany.

Growth has been impacted across Europe due to the Russia-Ukraine war and high energy inflation. The United Kingdom is the worst hit amongst the group of advanced economies as indicated by the Q4 2022 GDP nowcast, with an estimated 1.2% q/q decline. At the same time, UK’s growth is expected to see a turnaround in Q1 2023, with a 1.0% q/q increase. The PMI for construction contributed most to the growth of the Q4 2022 nowcast in September 2022, followed by new passenger car registrations for the UK, and the new passenger car registrations for the Euro Area. Interestingly, all the primary inhibitors of growth for Q4 2022 turn into the biggest promoters of the nowcast for Q1 2023, in the same order. The October values of manufacturing PMI for the Euro Area have had completely contrasting impacts on the current and the next quarter, going from the biggest detractor to the greatest promoter.

The CEIC Global Database provides access to a vast database where users can gain insight into the ever-changing dynamics of world economies.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)