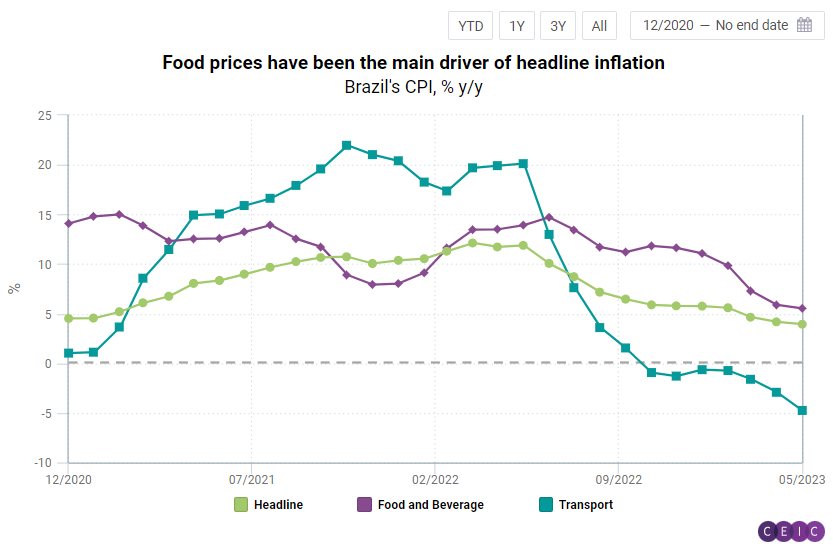

Recently, food inflation has been supporting Brazil's overall price growth, while transportation costs—previously driving inflation up in 2022—have significantly fallen on a yearly basis. Daily agricultural prices indicate that meat, grains, and fruit prices have moderated during the first half of June, suggesting a further slowdown in headline inflation from the 3.9% year-on-year (y/y) rate in May. However, this might not be sufficient for the Brazilian Central Bank to reduce interest rates, as core inflation (7.3% y/y in May) remains well above the upper limit of the inflation target (4.75% y/y).

Contrary to the headline, food inflation has been more persistent. In May, the food and beverages sub-index grew by 5.5% y/y, offsetting the 4.8% y/y drop in the transportation sub-index. Notably, prices of meat and soybean oil fell by 5.3% y/y and 29.5% y/y, respectively, while fruit prices experienced a slower growth rate of 17.5% y/y (1.4 percentage points lower than in April).

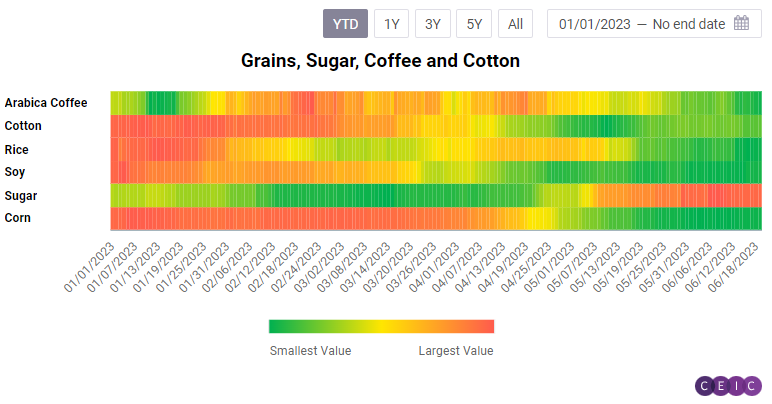

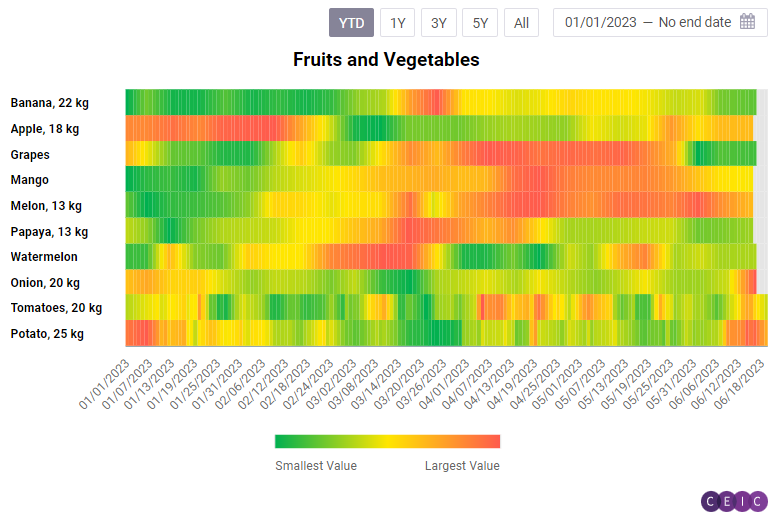

According to daily agricultural prices from the Centre of Advanced Studies in Applied Economics (CEPEA), food prices are expected to continue declining in June. For instance, the average beef price indicator during the first half of June was BRL 245.5, representing a 9.5% decrease compared to the previous month. Chicken and pork prices also fell in the first half of June, by 10.2% month-on-month (m/m) and 13.1% m/m, respectively. Grains are also anticipated to contribute to a decrease in inflation in June (see Dashboard). However, fruits and vegetables, which have more volatile prices, are likely to exert some upward pressure on food inflation. Prices of potatoes and apples, for example, rose by 23% m/m and 10.9% m/m, respectively. The Brazilian Institute for Geography and Statistics will release the official figures for June on July 11, reaffirming that daily agricultural prices serve as a valuable tool for near real-time monitoring of food inflation.

The expected lower inflation in June will likely not be a sufficient factor for the Central Bank to consider reducing interest rates, particularly given the slow decline in core inflation. The monetary policy committee will convene on June 21st and is expected to maintain the current interest rates. However, the committee will likely provide clearer guidance on when interest rates are expected to start declining.

The CEIC Global Database provides access to a vast database where users can gain insight into the ever-changing dynamics of world economies.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)