-png.png)

Colombia's foreign trade is suffering as global prices for its main export products have been declining since the beginning of the year, and weaker economic activity is weighing on imports. In the first half of 2023, the total export value stood at USD 24bn, a 14% drop compared to H1 2022. On the other hand, export volume decreased by only 3.1% in the same period, with the divergence underscoring the impact of lower commodity prices.

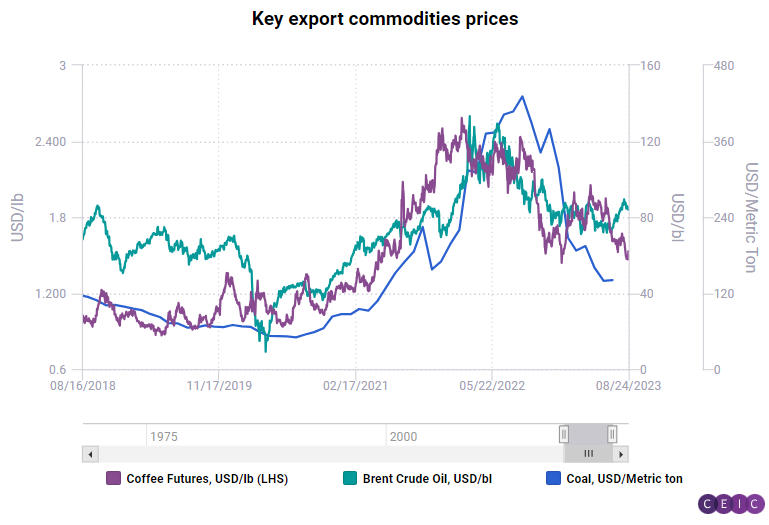

The subdued export performance is due to Colombia’s strong reliance on three commodities: oil, coal, and coffee, which account for 54% of total exports. Their combined export value fell by 24% year on year in the first half of 2023. As the global economy slows down and supply chain disruptions ease, the prices of these commodities have been following a downward trend since the start of 2023, severely affecting the country's export revenue.

The Brent crude oil price averaged USD 74 per barrel in June 2023 compared to USD 122 per barrel in June 2022, marking a 40% y/y drop. The international coffee price reached an average of USD 1.8 per pound in June 2023, down by 21% compared to a year earlier (USD 2.2 per pound). International coal prices (Australian reference) averaged USD 140 per Metric Ton in June 2023, down from USD 374 per Metric Ton in June 2022 (-62%).

We will likely see that export value continues to decrease year over year in July, mainly because, compared to one year ago, oil and coffee prices were considerably higher by 30% and 15%, respectively. In July 2022, Colombia reached USD 5.9bn in export value, the highest value ever recorded. The prices of oil and coffee show early signals of export performance, while official data has a lag of one or two months.

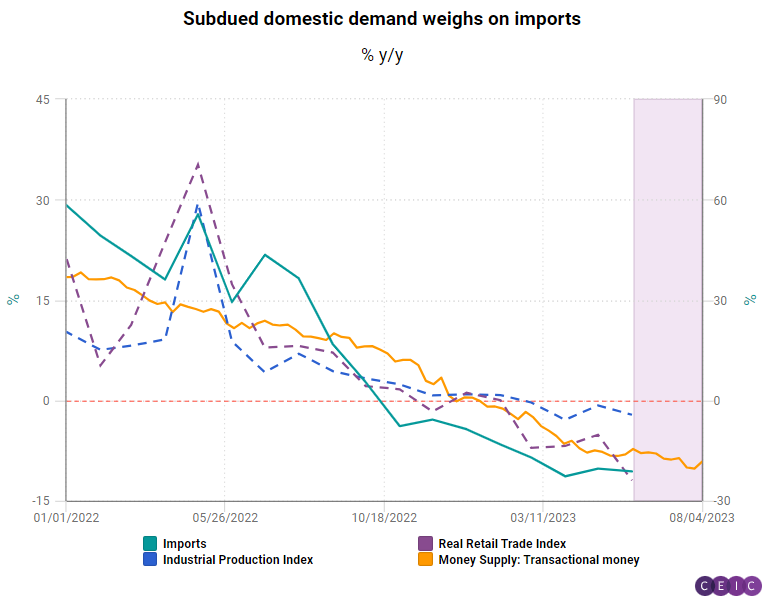

Import value reached USD 31bn in H1 2022, down by 17.4% y/y, with manufactured goods exports dropping the most: by 18% year on year, as local demand cools down and industrial production weakens. Elevated inflation and high financing costs have cooled the economy to an extent that retail sales and industrial production declined in year-on-year growth for four consecutive months as of June 2023, indicating both weak demand and industrial activity.

In July, imports would have decreased again as demand continued to cool during the month. Total transactional money (M1 + savings), a weekly leading indicator of spending, contracted in July by the lowest at 9% y/y, as households and businesses reduced consumption and instead put the money in more secure financial instruments. As spending weakened, lower purchases from abroad are expected to be registered in July.

The CEIC Global Database provides access to a vast database where users can gain insight into the ever-changing dynamics of world economies.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)