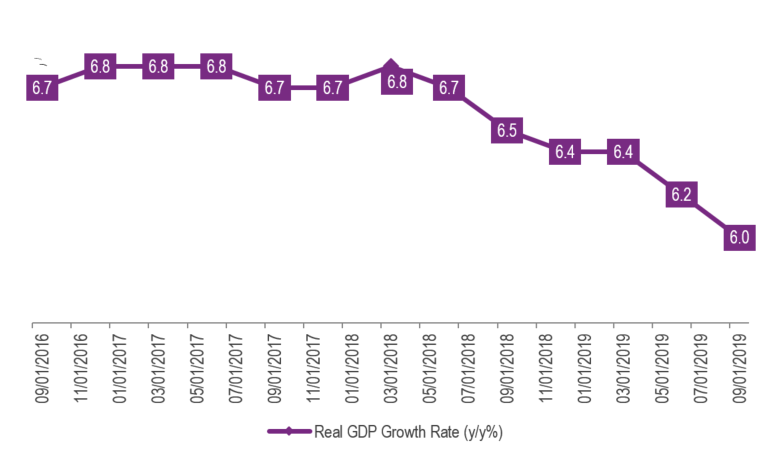

China’s economy had a bumpy ride in 2019 and continued to slow down. Over the past year, China’s economy decelerated to the slowest growth rate in 30 years due to internal and external challenges.

In Q1 2019, the real GDP growth rate remained 6.4% y/y, at the same level as in Q4 2018, owing to supportive policies and subdued trade tensions between China and the US. As the year progressed, the economy slowed down further to 6.2% y/y and 6% y/y in Q2 and Q3, respectively, due to the escalation of the trade war and the weaker domestic demand.

Chart 1: China Real GDP Growth Rate, % Source: National Bureau of Statistics, CEIC

Source: National Bureau of Statistics, CEIC

It is estimated at around 6% y/y in Q4, following the government’s stronger counter-cyclical policies and the easing trade tensions. These counter-cyclical policies included more cuts in lending rates for small and medium sized enterprises (SMEs), fiscal spending on infrastructure projects, and tax cuts to alleviate enterprises’ tax burden. Moreover, the preliminary “phase one” trade deal between China and the US, signed in mid-January 2020, signalled a possible cool-down of the trade tensions at least in the short run.

What is the macro outlook for China in 2020?

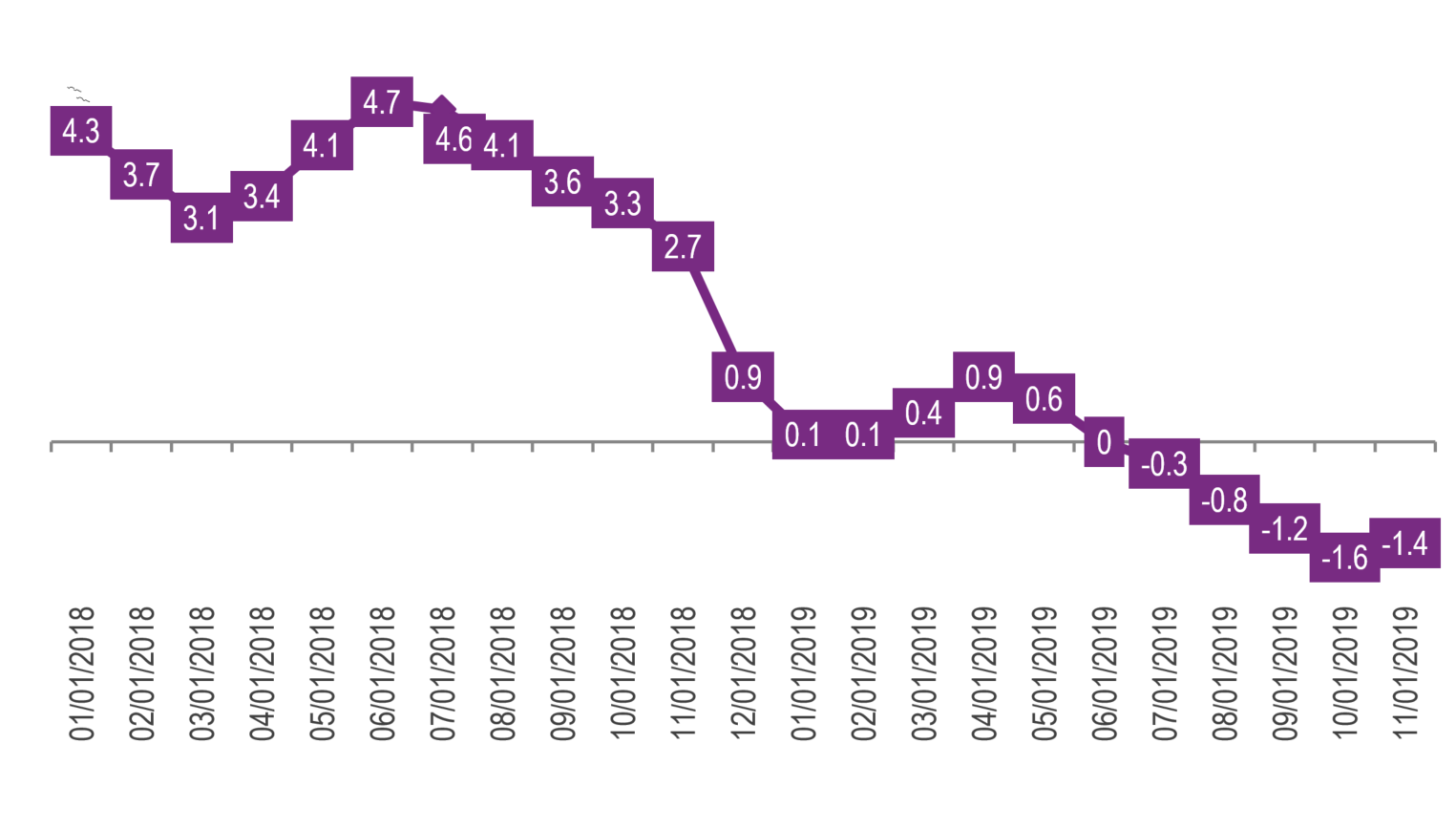

Despite the easing external headwinds, the internal challenges are still present. There are three key short-term internal issues. The first is the deflation pressure in producer prices (PPI). In the second half of 2019, there was a persistent deflation trend and the PPI decreased to -1.4% y/y in November 2019 from 0.0% y/y in June.

China Producer Price Index, % Source: National Bureau of Statistics, CEIC

Source: National Bureau of Statistics, CEIC

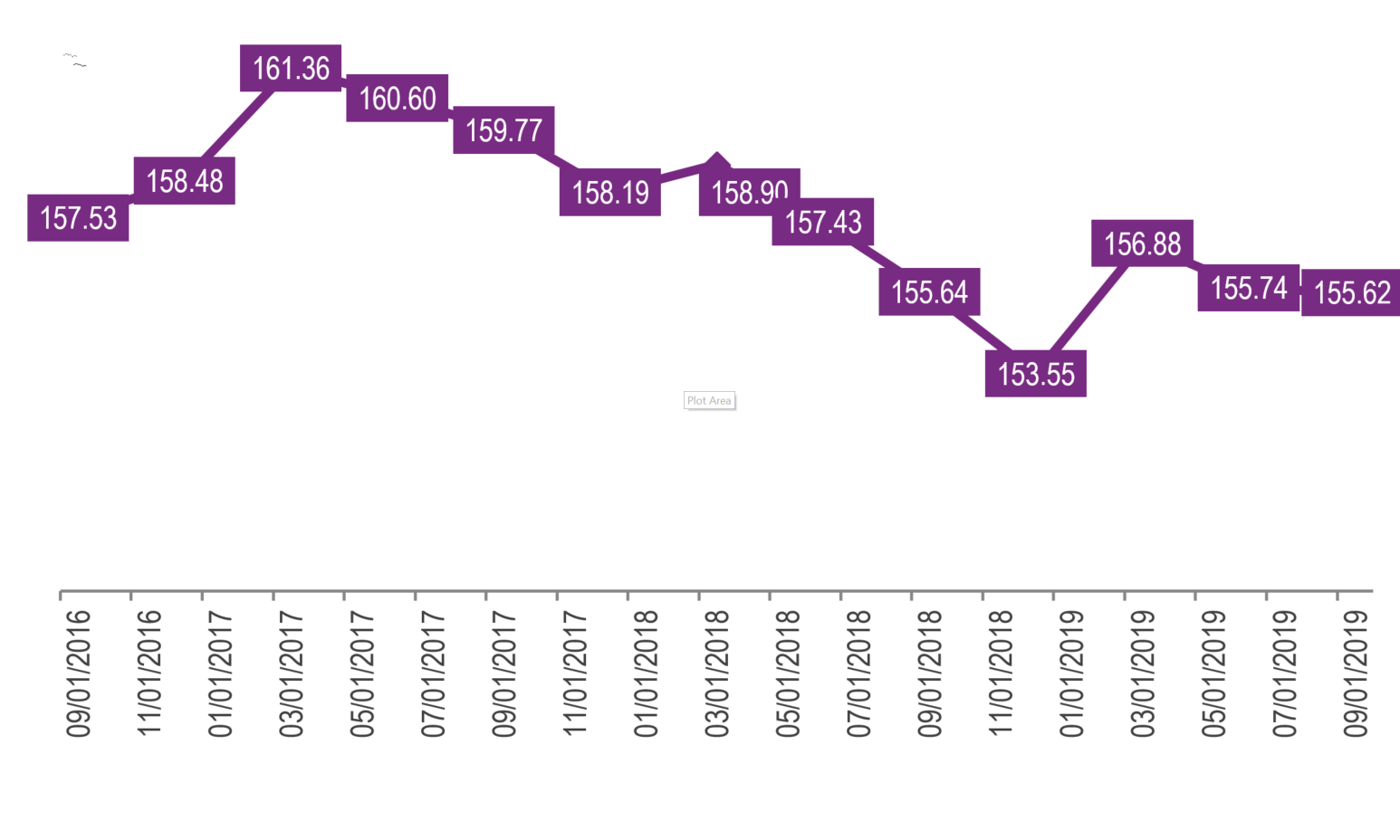

A downward trend like this could hurt the profitability and dampen the business confidence of the real economy. Moreover, the PPI deflation is likely to make debt repayment harder through higher real interest rates. The high indebtedness in the real economy and the difficulties in debt repayment might result in a higher default risk. Specifically, China’s non-financial enterprises’ debt-to-GDP ratio increased to 155.62% in Q3 2019 from 153.55% at the end of 2018, according to the Center for National Balance Sheets.

China Non-Financial Enterprises Debt-to-GDP Ratio, % Source: Center for National Balance Sheets, CEIC

Source: Center for National Balance Sheets, CEIC

The second issue are the negative expectations for the macroeconomic indicators. In 2019, the geopolitical risks and trade policy uncertainties left a deep scar on business and households expectations. Since negative expectations weaken investment and consumption, the persisting gloomy sentiment could further drag the growth rate further down.

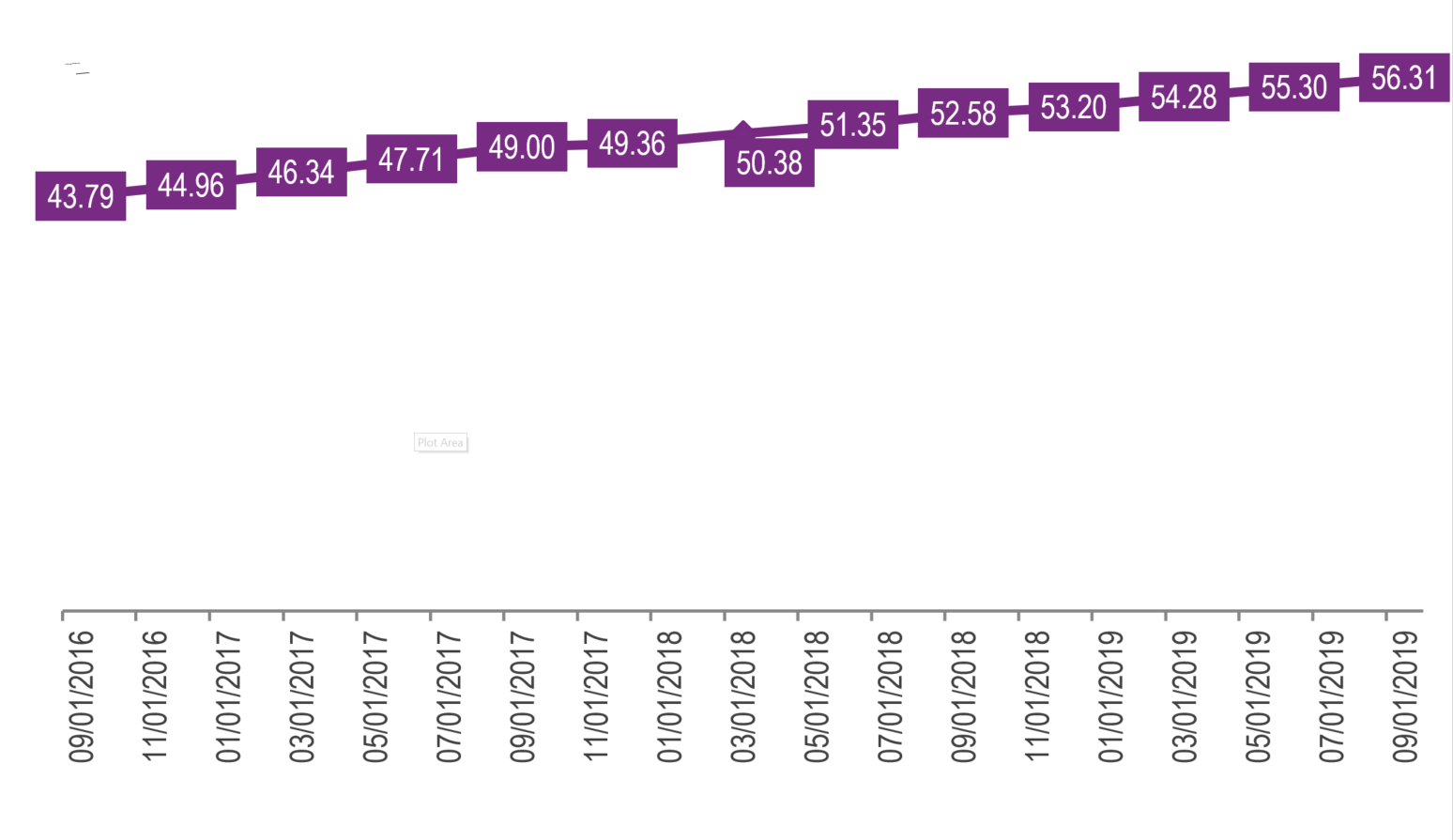

The third issue is the growing household indebtedness. China’s households debt-to-GDP ratio rose to 56.31% in Q3 2019, increasing by 3.1 pp compared to the end of 2018. A 1 pp rise in household debt-to-GDP ratio could cause a deceleration of retail sales growth rate by 0.3 pp, according to a research published in the PBoC’s Regional Financial Operation Report 2019. Hence, the high household indebtedness might reduce the retail sales growth rate by 0.9 pp in the mid-to-long term. Moreover, high household indebtedness could increase the risks to China’s financial stability. The IMF carried out a stress tests, the results of which were published in the working paper Assessing Macro-Financial Risks of Household Debt in China in November 2019. The stress test on household debt repayment capacity showed that low-income households are most vulnerable to adverse income shocks which could lead to defaults.

China Households Debt-to-GDP ratio, %  Source: Center for National Balance Sheets, CEIC

Source: Center for National Balance Sheets, CEIC

Last but not least, the high household indebtedness is likely to constrain the room for policy manoeuvring to support the GDP growth. Mortgage lending, accounting for two-thirds of the household debt, was the main driver of the high household indebtedness. Such high debt level could limit the room for stimulating the real estate industry, which normally contributes 25% of China’s GDP, according to the BBVA Research’s report How resilient is the economy to housing price fall? published in 2018.

Moreover, the outbreak of the 2019 novel coronavirus, a highly contagious virus for which there is no vaccine or specific antiviral treatment yet, poses a significant threat to China’s economy. In an attempt to contain the outbreak, China has imposed a large scale lockdown affecting millions of people, which will undoubtedly have a profound negative effect on economic activity. Although it is too early to assess the full impact of the virus on China, it is clear the outbreak is hurting both consumption and employment. Market expectations are that China’s economic growth might slow down to 4.5%-5% y/y in Q1 2020.

You can access the full article through our CDMNext platform here. In the meantime, find out more about the CEIC China Premium database - the most complete on the country's economy.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)

.jpg)