-png.png)

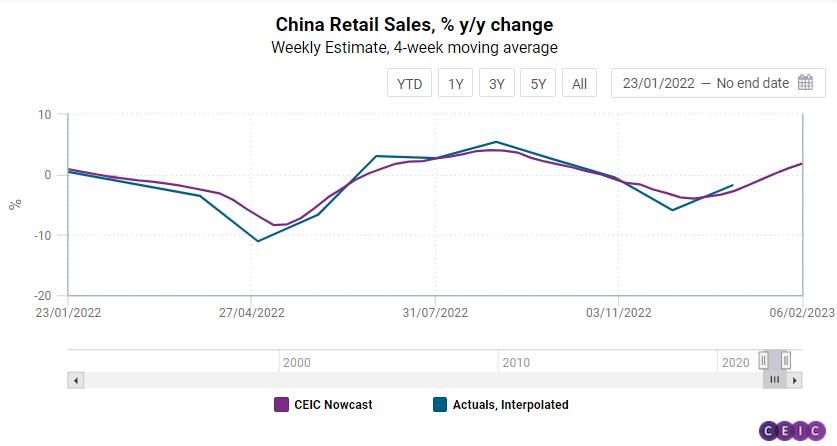

China’s retail sales grew by 0.4 y/y in January 2023, CEIC's weekly nowcast shows. The rebound in China's consumption comes after three consecutive declines between October and December 2022. While the Chinese government eased most of the COVID-19 restrictions at the beginning of December, the consequent boost to retail growth was absent as a result of the severe COVID-19 wave over the same month.

According to the weekly nowcast estimates, retail sales spiked upward in the first week of January, moving from a decline of 2.5% y/y in the week ending January 2 to a growth of 0.8% y/y in the week ending January 9, followed by another acceleration to 1.2% y/y in the week ending January 16, before two spells of moderation. A four-week moving average captures a strong upward trajectory, that augurs well for consumption in China, as well as the overall economy.

Official retail sales data for China is released almost a month after the end of the reference period, which leaves a large gap in information on consumer demand. For example, the November data were released on December 30, while the December data was released on January 30. There are no data released for January and February each year due to the Chinese Lunar New Year. Furthermore, the figures for March will only be available at the end of April, which leaves a 4-month gap in securing official data pertaining to consumption patterns in China. However, by leveraging our proprietary machine-learning framework based on alternative data we estimate retail sales in China on a weekly basis. This cutting-edge approach provides our clients with accurate and up-to-date estimates and insights on China’s retail sales, to aid business decisions and policymaking.

The nowcasting data is constructed using over 200 underlying indicators, and amongst all, the retail price of cord feed has had the largest contribution to retail sales historically. The last available impact of underlying indicators also shows corn feed occupying more than 60% of the total impact, followed by the retail price of tomatoes in supermarkets and marketplaces with about 13%, wholesale price of shallots with 6%, and formula feed price of fattening pig, and wholesale price of tomatoes, both at about 3%.

The CEIC Global Database provides access to a vast database where users can gain insight into the ever-changing dynamics of world economies.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)