-png.png?width=1000&height=333&name=Shutterstock_1828506668%20(2)-png.png)

After a policy shift by the Bank of Japan, the October inflation numbers coming up will be closely monitored alongside the central bank policy announcements. Last month, the Bank of Japan took a further step towards loosening its monetary policy by discarding its % cap on 10-year bond yields and revising its inflation forecast, projecting that price growth will exceed its 2% target until the end of next year.

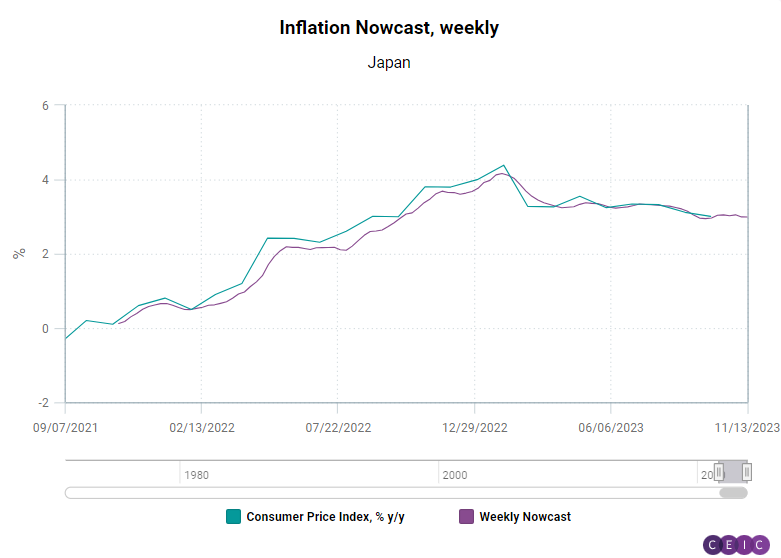

Ahead of the October data release, CEIC's nowcast projects that Japan's inflation has remained steady at 3.1% y/y, up from 3% in September. This further extends the inflation streak in excess of the central bank's 2% target, breached since April 2022.

CEIC's inflation nowcast is based on a machine-learning approach that embeds high-frequency data to provide weekly estimates of inflation in Japan and other major economies. According to recent estimates, Japan's inflation in the first two weeks of November remains moderate at 2.9% y/y, little changed from the previous week's estimate, suggesting an absence of any immediate catalyst for a change in the inflation trajectory.

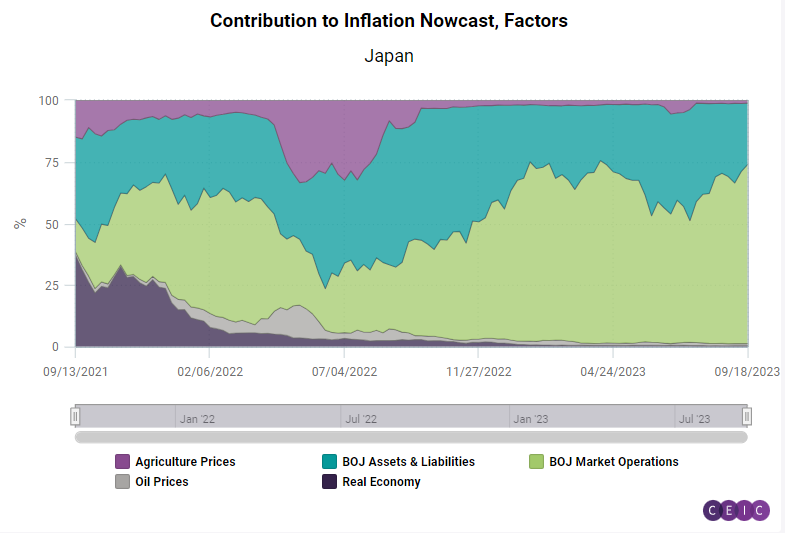

CEIC's machine-learning nowcast model identifies and evaluates major underlying factors influencing inflation dynamics. For Japan, the machine learning model places significant importance on the Bank of Japan's market operations as a major predictor of price growth, followed by the Bank of Japan's Assets and Liabilities, while oil prices and the real economy currently have a negligible impact on inflation dynamics. This represents a significant shift in the driving factors since mid-2022 when almost one-third of Japan's inflation was explained by changes in agricultural prices, while currently, their share is slightly more than 1% of the inflation deviation factors.

The CEIC Global Database provides access to a vast database where users can gain insight into the ever-changing dynamics of world economies.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)