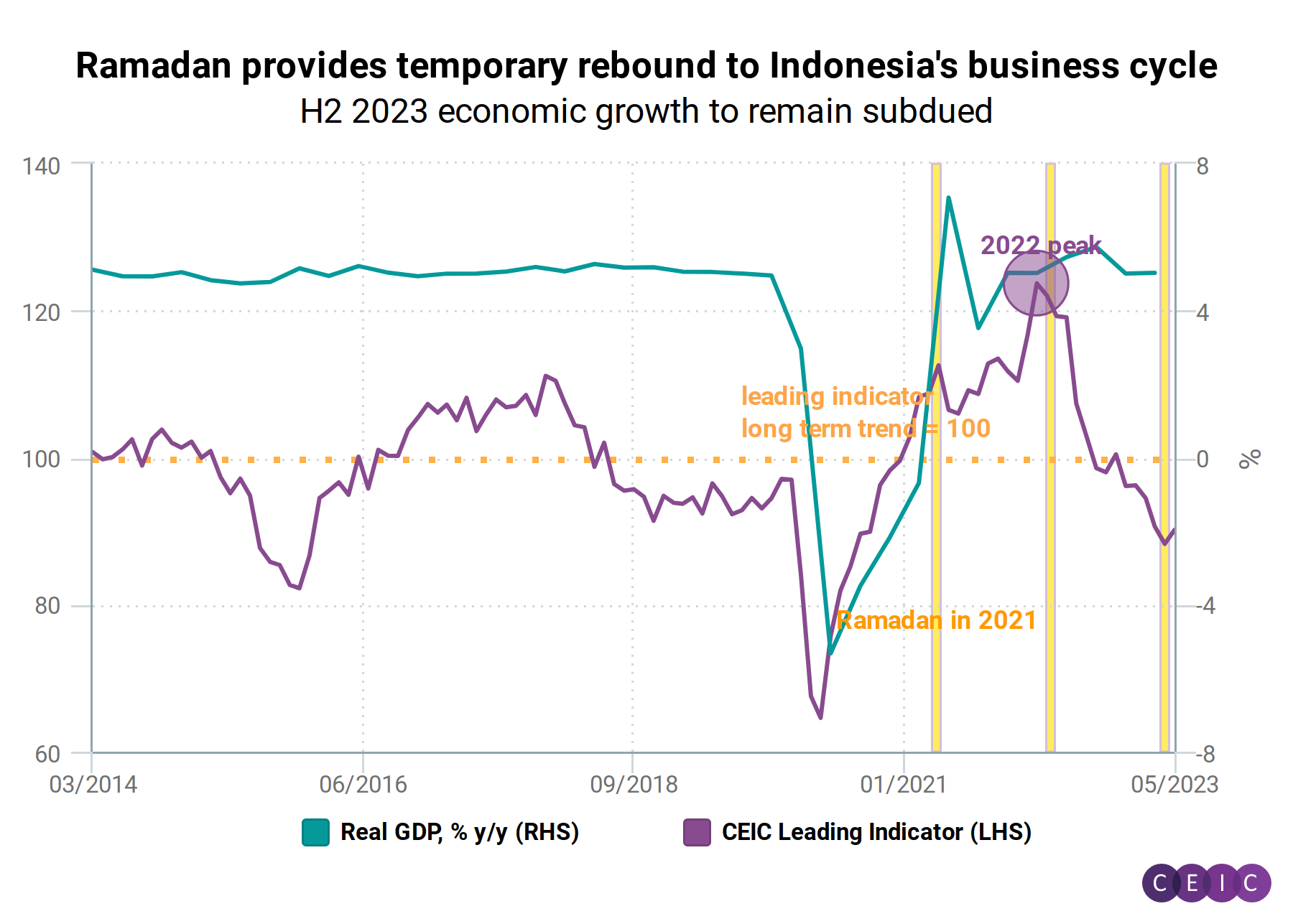

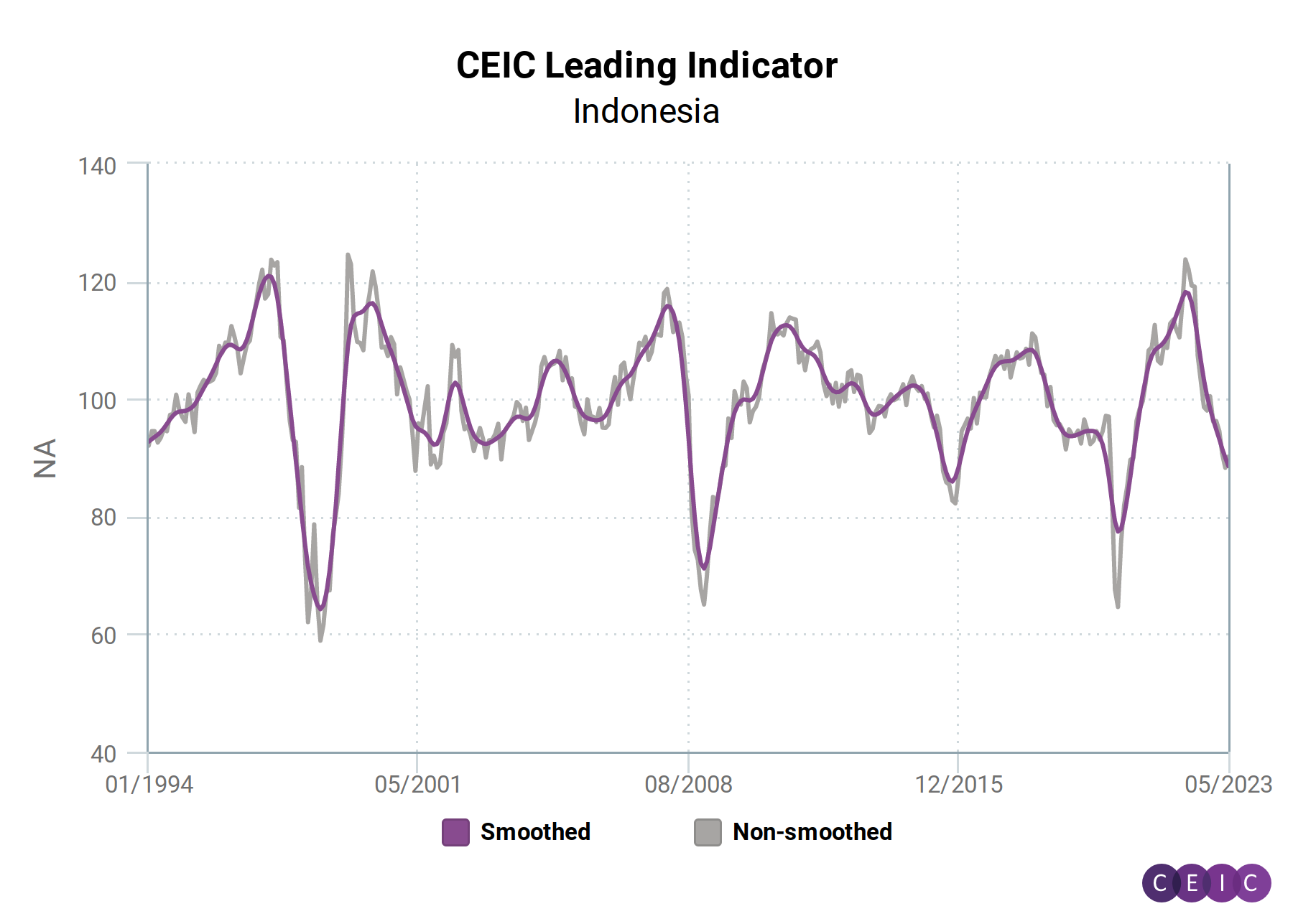

Indonesia's economy is expected to experience a subdued performance in the second half of the year, despite positive signals from May data. The CEIC Leading Indicator increased in May after a downward trend that began in March 2022. However, the indicator's underlying data suggests that this rebound is due to the Ramadan-related revival in consumption.

The proprietary index, which successfully predicts turning points in the economy two to three quarters in advance, sharply decelerated between March 2022 and April 2023, reaching 88.27, almost a three-year low. This is well below the long-term cycle threshold of 100, indicating a deterioration in Indonesia's economy for the remainder of 2023. The increase to 90.17 in May, the first in four months, may be temporary, as it is likely driven by Ramadan when consumption typically increases. Indeed, May 2023 witnessed a strong rebound in vehicle sales and deposits, with vehicle sales growing by 39.4% month-on-month. To further boost domestic sales, the government implemented a zero sales tax on battery electric vehicles (BEVs) in May.

On the other hand, palm oil prices continued to decline, reaching their lowest point since November 2020 at USD 859.84 per tonne in May. Additionally, a weaker rupiah and lower export revenue have acted as a drag on the indicator. Overall, Indonesia's economic performance in the second half of 2023 is expected to remain subdued, influenced by factors such as declining palm oil prices, which are crucial for the local economy, and potential external headwinds.

The CEIC Global Database provides access to a vast database where users can gain insight into the ever-changing dynamics of world economies..png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)