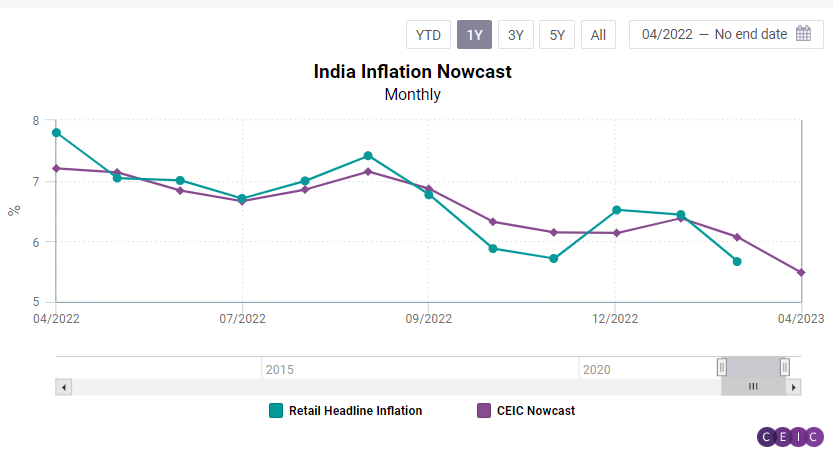

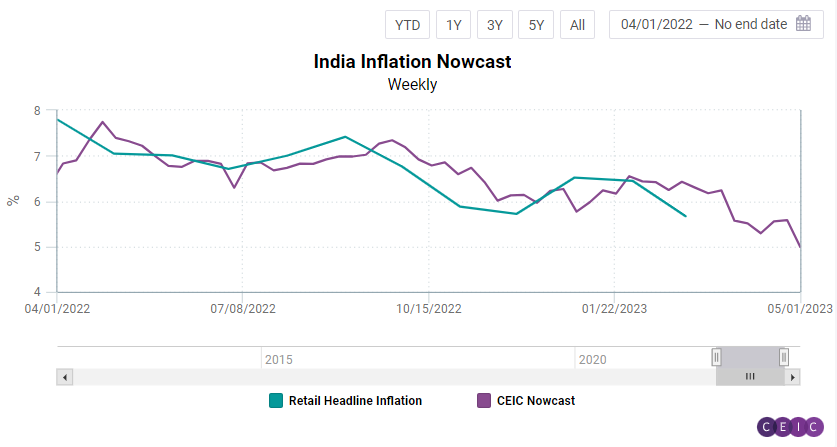

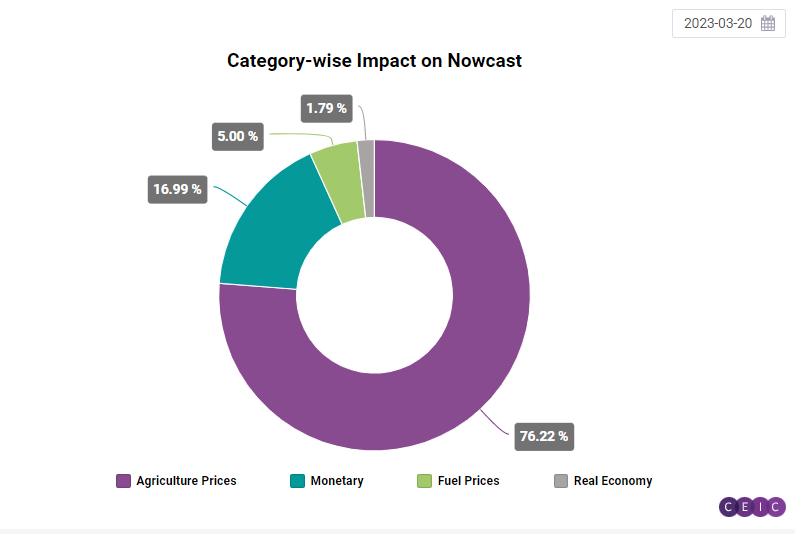

Headline inflation in India dropped further to 5.5% y/y in April 2023, according to CEIC’s weekly inflation nowcast model, from 5.7% y/y in March. Ahead of the official data expected to be released on May 12, 2023, the CEIC's alternative data-driven model estimates the lowest annual inflation rate in India since November 2021. This suggests the Reserve Bank of India’s decision to pause rate hikes in April for the first time since May 2022 came at the right time to boost growth.

The weekly nowcast estimates show that inflation declined even further in the first week of May at 5% y/y.

Since inflation data for India is released around the middle of each month, or two weeks after the end of the reference period, CEIC's nowcast provides accurate and up-to-date estimates and insights on India’s inflation to help anticipate monetary policy and its implications on the economy. Our proprietary machine-learning framework based on both traditional and alternative data estimates India’s inflation rate on a weekly basis.

The CEIC Global Database provides access to a vast database where users can gain insight into the ever-changing dynamics of world economies.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)