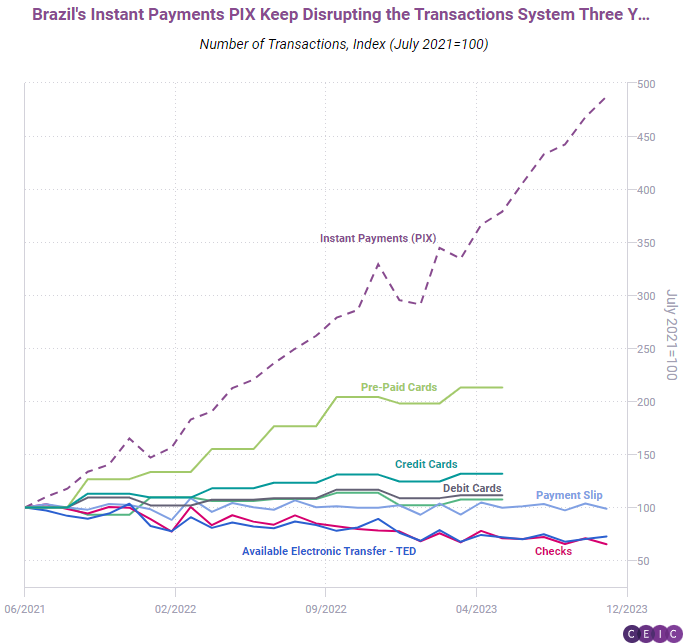

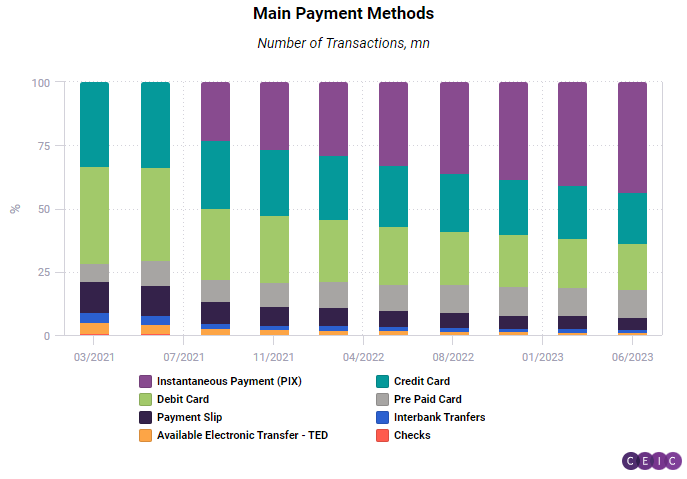

The Brazilian Central Bank introduced the instant payment method PIX back in 2020 with the main goal of reducing barriers to entry into the highly concentrated banking sector. Over three years post-launch, data available in both daily and monthly frequencies confirms PIX’s success story, as it quickly became one of the favorite payment methods in Brazil, for both individuals and businesses. PIX ranked first in terms of the number of transactions, with 9.4tn transactions in Q2 2023—more than twice the 4.4tn transactions by credit cards, which ranks second.

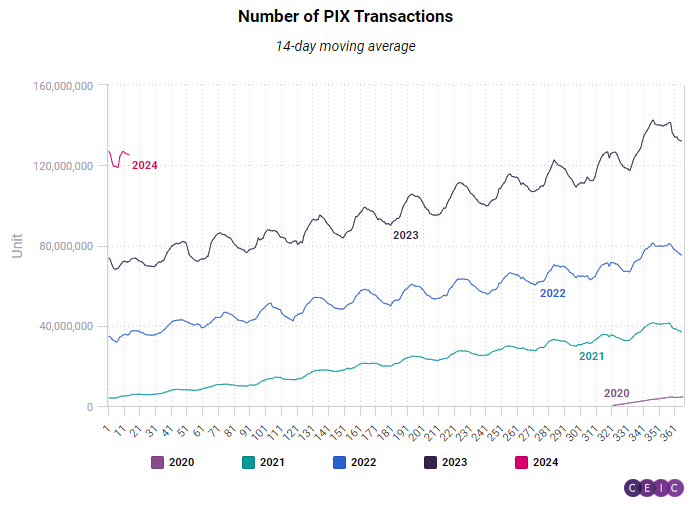

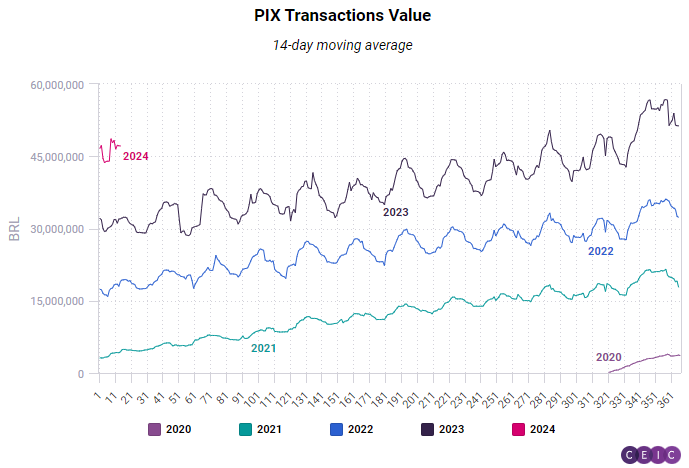

In mid-December, the number of daily PIX transactions hit an all-time high of 142mn, in line with year-end holiday-related shopping. Although daily PIX transactions declined in January 2024, they are still significantly higher compared to the same time in 2023, indicating robust business activity and consumption. The transactions, both in terms of value and volume, peak around the middle of each month as many employees receive their monthly salary around that time. The daily frequency of the data allows for the early identification of any disruption in the spending patterns of Brazilians.

Person-to-person transfers account for the bulk of PIX transactions in Brazil, with a 53% share in November. Person-to-business, on the other hand, posted the highest growth rate, expanding by a 162% YoY rate in November, reflecting the increasing usage of PIX by consumers to pay for goods and services. Business-to-business transfers have the highest share in value terms (41%), indicating that the new technology is changing financial transactions among companies as well.

The CEIC Global Database provides access to a vast database where users can gain insight into the ever-changing dynamics of world economies.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)