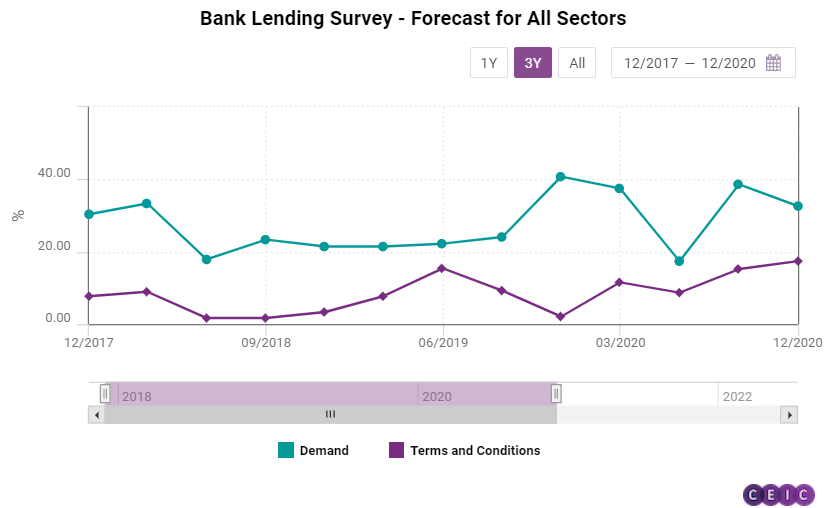

Back in Q3 2018 the Reserve Bank of India (RBI) launched its forward-looking quarterly Bank Lending Survey (BLS) with the aim to gauge expected loan demand, among other parameters, from different sectors.

The survey is also used by banks as a qualitative assessment of the surveyed sectors. For example, expectations for higher loan demand from a given sector would indicate increased activity in the said sector and, in turn, stronger performance going forward.

Survey respondents provide their opinion on a number of parameters including loan demand and loan terms and conditions. The BLS uses a five-point scale, ranging between substantial increase and substantial decrease for loan demand, and between considerable easing and considerable tightening for terms and conditions.

A Net Response score is then calculated by weighing the percentage of responses in a particular scale with a pre-determined weight assigned to it. The value of the Net Response can range from -100% to 100%. A value greater than zero indicates expectations for loan demand growth and for easing loan terms and conditions, while a negative value indicates shrinking loan demand and tightening of terms and conditions.

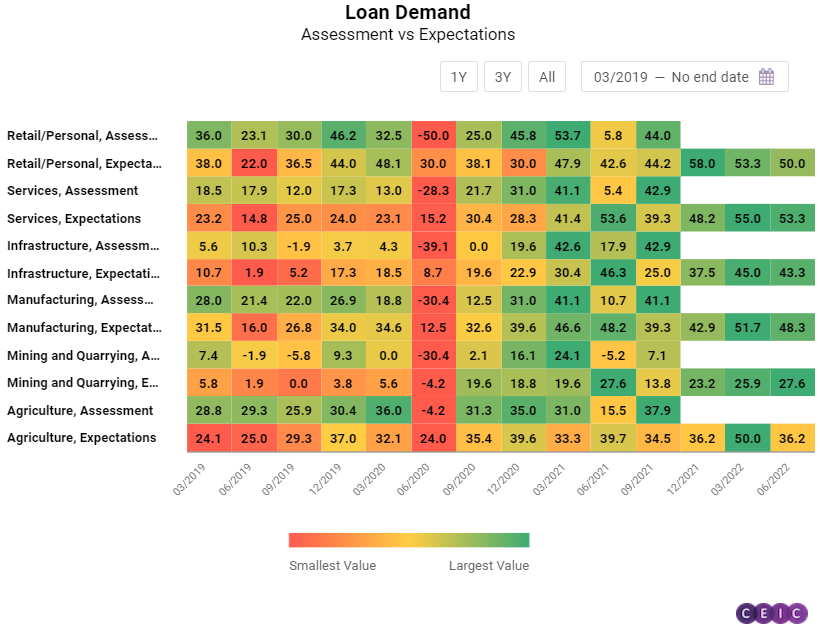

The survey is conducted to understand the loan demand and the loan terms and conditions for each of the following six major sectors as well as on an aggregate basis for all these sectors:

- Agriculture

- Mining and quarrying

- Manufacturing

- Infrastructure

- Services

- Retail/Personal

This insight will explore in greater detail the results of the 16th round of the survey, which included 30 major scheduled commercial banks, accounting for over 90% of the credit by such banks in India.

The COVID-19 pandemic dealt a heavy blow to economic activity across the globe. In emerging economies, such as India, the pandemic slowed industrial growth almost down to a halt and forced fiscal and monetary policies to shift towards resuscitating the economy instead of supporting its growth.

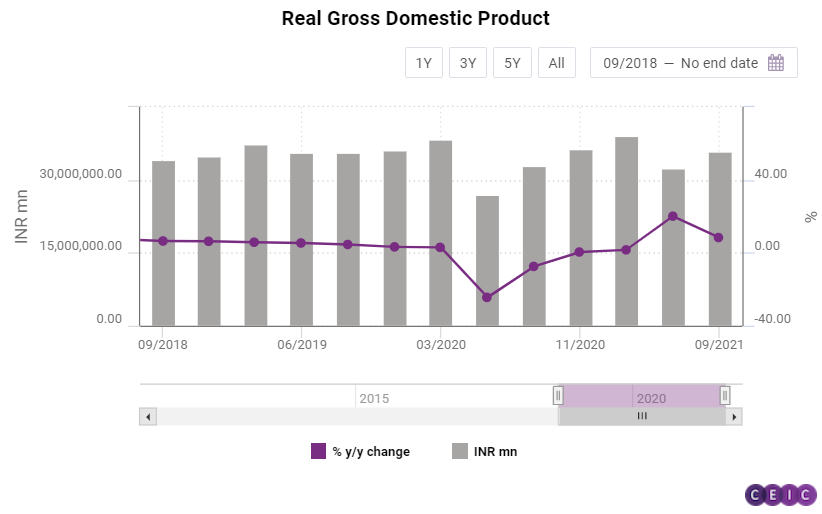

India’s GDP in absolute rupee terms has continued to recover since the devastating results in Q2 2020, but in Q2 2021 the y/y growth was lower than what it could have been in absence of the second wave of COVID-19, which instated partial lockdowns across the country. At the same time, the decline in output was not as severe as compared to that in Q2 2020 because this time around the lockdowns were staggered and were implemented depending on the situation in each state instead of a blanket nationwide lockdown. In terms of quarterly economic growth, the actual GDP value in Q2 2021 decreased from Q1 2021, thanks to the second wave but once again, the decline was mitigated as compared to the first lockdown in Q2 2020, as a result of new measures such as micro containment zones, weekend and night curfews, which allowed economic activity to continue.

India's banks play a key role in the country's economic recovery, as they are the biggest lenders to the developing micro, small and medium enterprise (MSME) sector. The development of the MSME sector is of crucial importance for the country as these enterprises keep the economy vital, ensure competition and create employment. To that end, the central bank has recognized bank loans to MSME as one of the top priorities of the sector and has continued its easy monetary policy to support the revival of the economy.

In the latest round of the BLS, the central bank surveyed senior loan officers at commercial banks on credit parameters for Q2 2020 as well as on their expectations for Q3 2021. There was an additional aspect included in this survey on account of the uncertainty due to COVID-19: the officers were asked to assess the outlook for three forthcoming quarters. Both use the calculated statistic of 'Net Response' as the measure of expectations.

Expectations for loan demand fell to 32.61% in Q4 2020 but rose to 44.64% and then to 50% in Q1 2021 and Q2 2021, respectively. However, following a decline in Q3 2021, officers see loan demand rising for two successive quarters after that. The Net Response for Q4 2021 and Q1 2022 was 50% and 55.4%, respectively. Meanwhile, loan terms and conditions, which had eased for three successive quarters up until Q1 2021, are expected to be somewhat restrictive for two quarters until Q3 2021 and ease quite substantially for two quarters after.

With respect to loan demand, the loan officers surveyed are the most optimistic about the demand for retail/personal loans during Q3 2021 with a net response score of 44.23%. The manufacturing and services sectors follow, with a net response of 39.39% each. Even though demand for retail/personal loans is expected to remain high, that from the agriculture sector is expected to overtake it in the following two quarters up until Q2 2022. While the loan demand from the mining and quarrying sector is expected to rise, it is also likely to remain the lowest among the six sectors for the period surveyed.

Expectations for loan terms and conditions in Q3 2021 follow a similar trend. They are likely to remain the easiest for retail/personal loans with a net response of 25%. Manufacturing and services loans follow with 20.69% and 19.64%, respectively. The terms of agricultural loans are expected to ease substantially in the first two quarters of 2022.

Sign in to access all datasets for this insight piece here. Alternatively, you can learn more about our CEIC India Premium Database -the premier source for everything you need to know about the Indian economy, housing an unprecedented wealth of information revealing the drivers of the market.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)