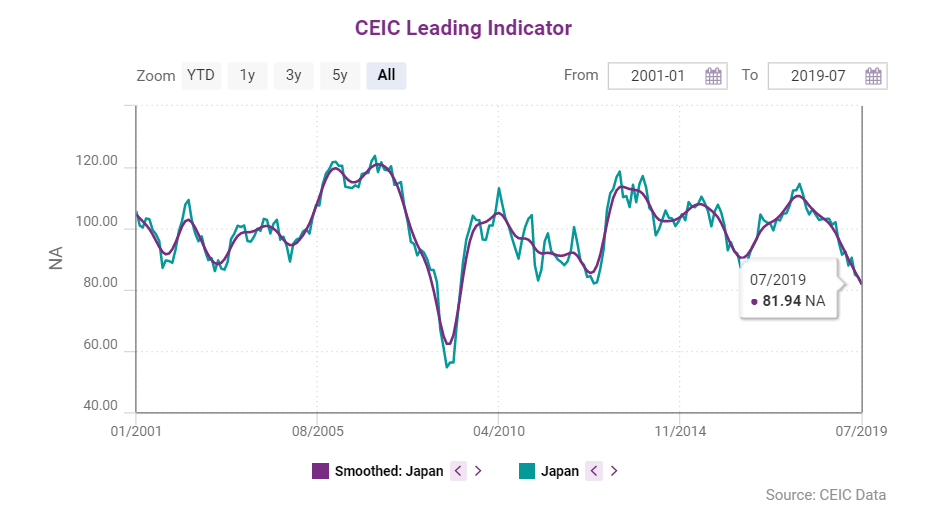

According to the CEIC leading indicator, Japan's steady downward trend in May has continued into Q3.

The major factors that are expected to shape Japan’s growth throughout the rest of the year are seen to be the weaker global growth, coupled with a slowdown in the IT-related goods sector, and the consumption tax hike scheduled for October. Given the lower external demand, exports are expected to remain weak, exerting a negative impact on industrial production.

The risks to the outlook are on the downside. They are related to global growth, primarily to economic developments in China, and to the outcome of the trade protectionism moves of the US, among which Japan’s own trade negotiations with the US.

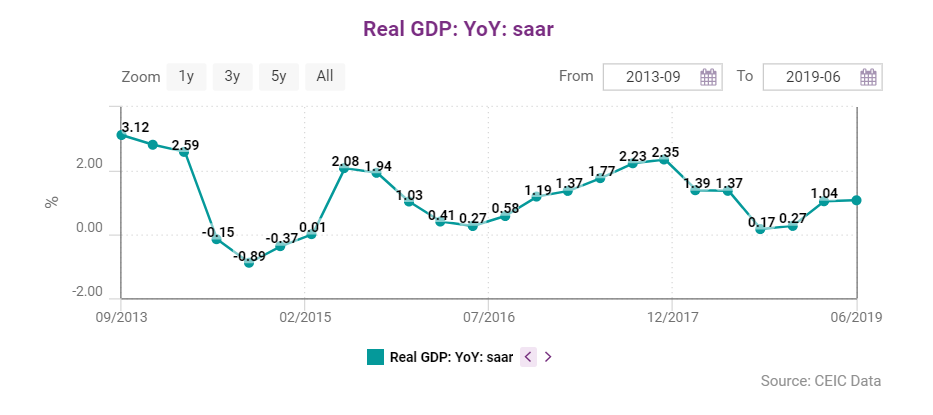

Quarterly GDP growth

Real gross domestic product (GDP)growth accelerated to 0.9% y/y in Q1 2019, up 0.6 pp from Q4 2018, according to the second preliminary estimate of Japan’s Economic and Social Research Institute. On a seasonally adjusted basis the growth came to 0.6% q/q (2.2% annualised rate), compared to 0.5% in the previous quarter (1.8% annualised rate).

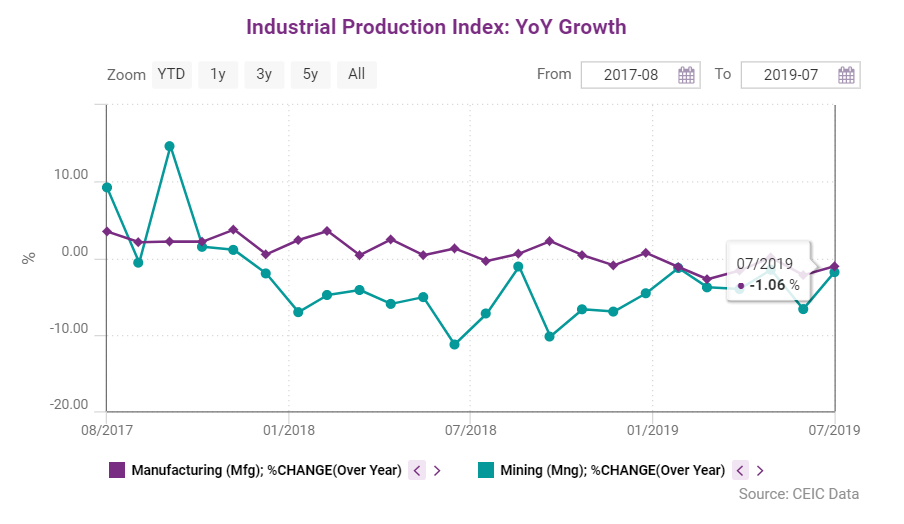

Industrial production

The industrial production index (IPI)in manufacturing dropped by 1.4% y/y in January-April. The most significant declines were registered in the production of machinery, down by 8.2% y/y, and electronic parts and devices, down by 8.1% y/y. The production of transport equipment, chemicals, and food and tobacco increased by 1.5% y/y, 2.5% y/y, and 2.3% y/y respectively.

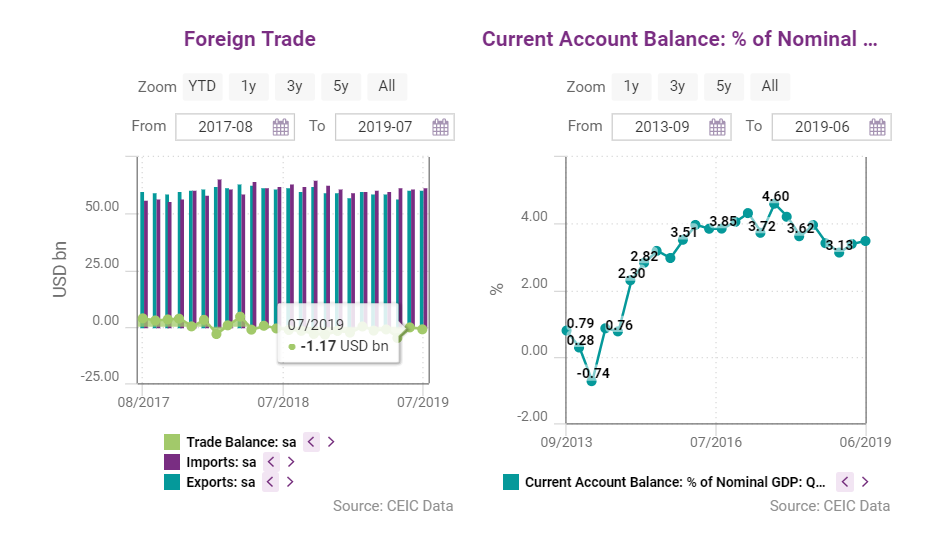

Trade deficit

The trade deficit widened to USD 13.6bn (JPY 1,473.8bn) in January-May, as the 2% y/y decline in imports could not make up for the persistent fall in exports, down by 6.2% for the first five months of the year. Lower demand for IT-related goods and the slowdown of the Chinese economy that had spilled over to other Asian

You can download the full CEIC Japan Economy in a Snapshot Q2 2019 report here.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)

.png)