After a two-month complete lockdown to combat Omicron, Shanghai finally reopened on June 1. Mobility of people and goods between Shanghai and other Chinese cities is key to not only Shanghai’s economic recovery but to the nation’s GDP growth this year. Our analysis found that despite the reopening, Shanghai’s reconnecting with the rest of the country has been quite hard. In fact, it seems that reconnecting is even harder than reopening as COVID related travel policies continue to limit intercity mobility. Utilizing the AutoNavi highway traffic data and the VariFlight passenger flights data, we’ve tracked the recovery of connections between Shanghai and 20 selected cities in the first month of Shanghai’s reopening. Here are the key findings:

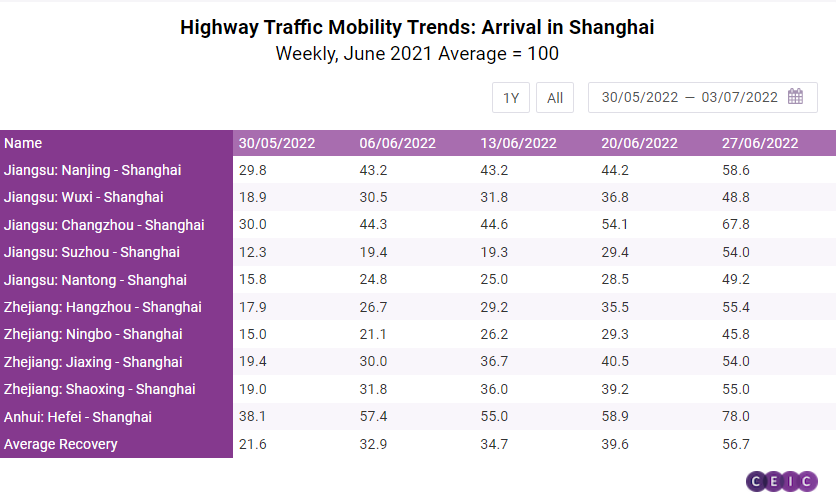

- Highway traffic to Shanghai recovered faster than traffic from Shanghai.

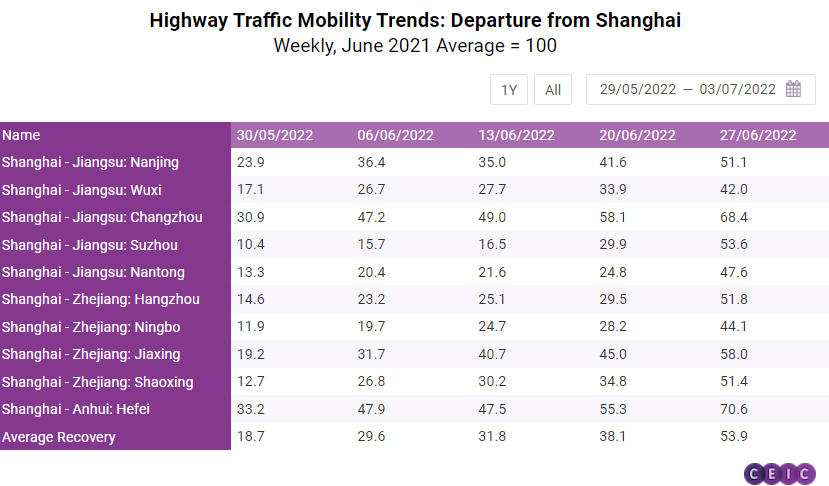

- 10 cities on average, departure from Shanghai recovered to 19%, 30%, 32%, 38%, and 54% in the 1st, 2nd, 3rd, 4th, and 5th week, respectively. 10 cities on average, arrival at Shanghai recovered to 22%, 33%, 35%, 40%, 57% in the 1st, 2nd, 3rd, 4th, 5th week respectively.

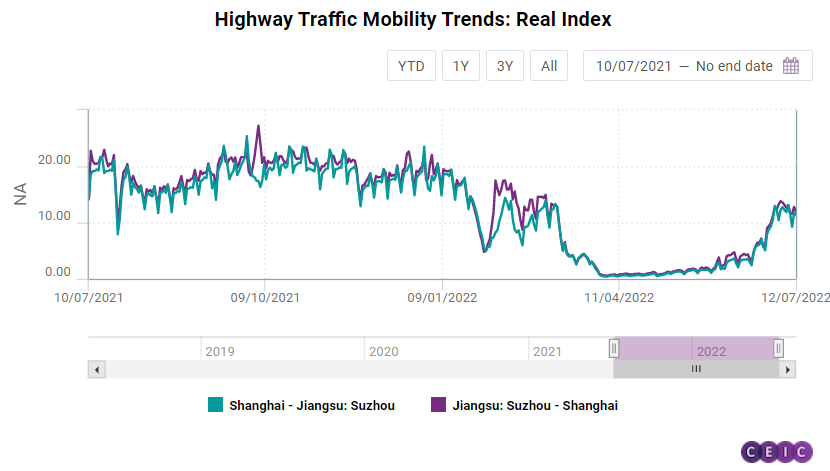

- Shanghai-Suzhou and Suzhou-Shanghai routes were the most active ones in the Yangtze River Delta (YRD) before this outbreak, thus the recovery level of traffic between Shanghai and Suzhou can serve as an important reference to gauge the whole region’s economic resumption. Traffic from Shanghai to Suzhou in the 2nd and 3rd week only reached to around 16% of the level in June 2021. In the 4th week, it increased to 30%. It quickly climbed to above 50% in the 5th week.

- In the week of June 27-July 3, only 272 flights flew from Shanghai to the 10 cities, accounting for only 14.2% of the weekly average of June 2021. Only 297 flights flew from the 10 cities to Shanghai, accounting for only 15.5% of June 2021’s level.

- The resumption of air connectivity between Shanghai, on the one hand, and Chengdu and Chongqing, on the other hand, has outpaced the other 8 cities by far, exhibiting the strong economic ties between Shanghai and Southwest China.

- The resumption of flights between Beijing and Shanghai, China’s two most important economic centers, did not pick up until the end of June.

- COVID-related travel policies are the defining factor for the pace of the recovery.

The economic damages from the lockdown in Shanghai have ripple effects not only on the megapolis itself but also on the whole YRD economic zone, which centers around Shanghai. The YRD, an economic powerhouse for China, accounted for nearly a quarter of China’s nominal GDP and around 36% of China’s international trade in 2021. The region plays an important role in the global industry chains of automobiles, semiconductors, and photovoltaics.

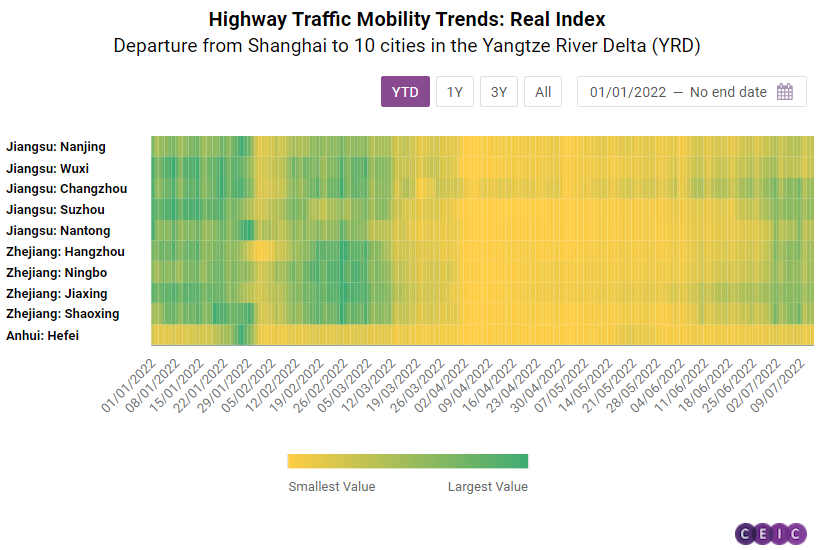

According to a 2021 report published by Shanghai local government, the top 10 cities in the YRD in terms of economic ties and connectedness with Shanghai are Suzhou, Hangzhou, Ningbo, Nanjing, Wuxi, Nantong, Jiaxing, Changzhou, Hefei, and Shaoxing. AutoNavi’s real highway traffic mobility index can help us monitor the recovery of highway trips between Shanghai and those 10 cities. The source, AutoNavi (also known as Gaode), is a popular Chinese GPS mapping and navigation service with around 100mn daily users. The index reflects the clustering of users who travel from city A to city B based on AutoNavi route navigation data. The higher the user numbers, the stronger the popularity of the highway traffic route from city A to city B, and the higher the index value. We use the daily average of June 2021’s value as the benchmark, and then compare the daily average of the 1st, 2nd, 3rd, 4th, and 5th week of the reopening to the benchmark to gauge the level of recovery for each route.

Prior to this outbreak, in June 2021, highway traffic from the 10 cities to Shanghai all exceeded Shanghai’s traffic to the 10 cities, revealing that Shanghai is truly the core city in the area. The routes between Shanghai and 3 neighboring cities, Suzhou, Jiaxing, and Nantong are the top three most popular ones. The movement of people and goods between Shanghai and Suzhou is especially active. In June 2021, Shanghai to Suzhou route averaged 19.3, or 3.8 times that of Shanghai to Jiaxing. Suzhou to Shanghai route averaged at 20.6, or 3.2 times that of Jiaxing to Shanghai. In fact, Shanghai-Suzhou and Suzhou-Shanghai routes are the most active ones in the YRD, thus the recovery level of traffic between Shanghai and Suzhou can serve as an important reference to gauge the whole region’s economic resumption.

Among the 10 cities, highway traffic to Shanghai recovered faster than traffic from Shanghai mainly due to two reasons: First, travel restrictions and quarantine rules continue to limit departure from Shanghai; Second, work resumption brings people back to Shanghai. Data revealed that for both to Shanghai and from Shanghai routes, COVID-related travel policies are the defining factor for the pace of the recovery. Two-way traffic between Shanghai and 10 cities picked up very slowly in the first three weeks of the reopening. The daily average of the 3rd week simply did not improve from that of the 2nd week at all. As Zhejiang, Jiangsu, and Anhui eased quarantine rules for most travelers from Shanghai at the beginning of the 4th week, two-way traffic recovery began to gain momentum. In the 5th week as nationwide COVID curbs showed signs of relaxation, Shanghai’s reconnecting with the 10 YRD cities further accelerated. For example, traffic from Shanghai to Suzhou in the 2nd and 3rd week only reached around 16% of the level in June 2021. In the 4th week, it increased to 30%. It quickly climbed to above 50% in the 5th week.

10 cities on average, departure from Shanghai recovered to 19%, 30%, 32%, 38%, 54% in the 1st, 2nd, 3rd, 4th, 5th week respectively. In the 5th week, 7 out of the 10 routes recovered to above 50% of June 2021’s level, the highest being 71% (Shanghai to Hefei), the lowest being 42% (Shanghai to Wuxi). The 54% recovery level in the 5th week suggests that Omicron’s damage on the YRD has yet to go away and the repair of supply chains needs more time. 10 cities on average, arrival at Shanghai recovered to 22%, 33%, 35%, 40%, 57% in the 1st, 2nd, 3rd, 4th, 5th week respectively. Routes from three neighboring cities Suzhou, Jiaxing, and Nantong to Shanghai recovered to 54%, 54%, and 49% respectively.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)