-png.png)

As always, the first week of the month starts with IHS/Markit’s manufacturing PMI data.

Make no mistake, these are the final data, which means revisions for countries for which flash estimates are available like the Unites States, Japan, the Euro Area, Germany, and others, and new data for countries with no flash estimates like China, India, Indonesia, Brazil, and South Korea. Also, China’s official PMI is released on Saturday, July 31, two days prior to the one published by IHS/Markit and Caixin.

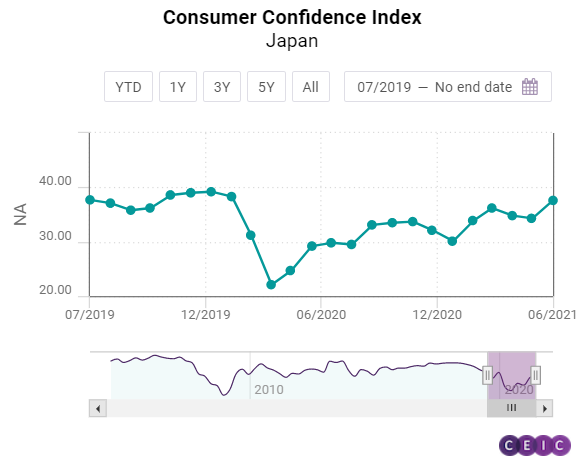

Also on Monday, two key releases for Indonesia – July inflation and June tourist arrivals. The consumer confidence index for Japan will also be published on that day, followed by foreign trade data for India and Brazil.

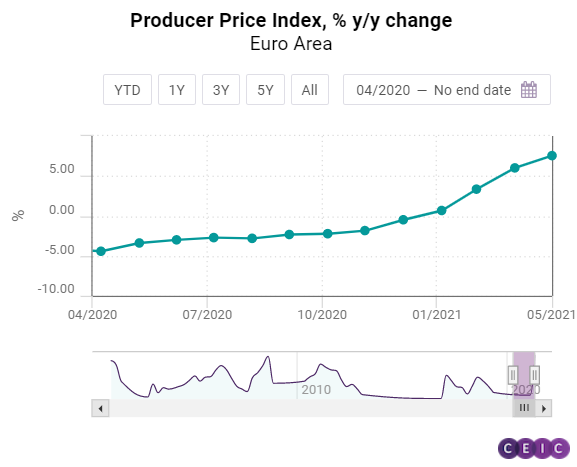

On Tuesday, we will be monitoring the July CPI inflation data for Japan and the PPI inflation for the Euro Area. Also, the CPI inflation data for Turkey will be released on that day, which will be a key signal for the next move of the Turkish central bank amid a stabilizing lira over the past few weeks. In Brazil, the industrial production data is expected to be released.

On Wednesday, the services and composite Markit PMI data will be released, followed by the retail sales data for the Euro Area.

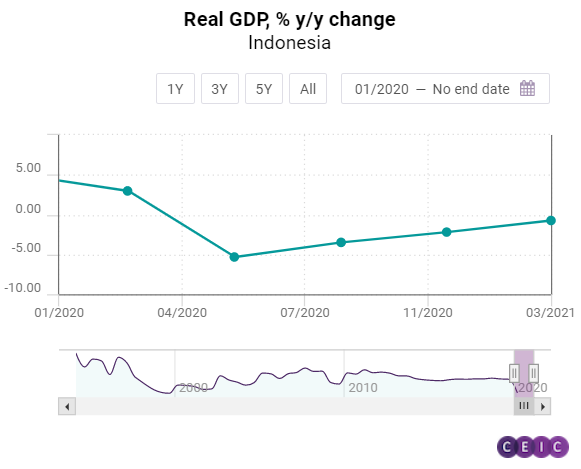

On Thursday, after Indonesia’s Q2 GDP figures, there will be interest rate decisions to monitor on that day in two major economies – the UK and Indonesia. In the United States, the US Census Bureau will release the June trade data on a BoP basis, while the Department of Labour will publish the weekly jobless claims data after a slight improvement last week.

On Friday, Bank of India is going to announce its interest rate decision, while Japan’s Economic and Social Research Institute will publish its leading economic index. Germany’s industrial production, a key indicator for the eurozone’s economic condition, is also expected to be released on that day, followed by the July employment report in the United States.

On Saturday, China’s foreign trade and international reserves data for July.

US Economy in a Snapshot - Q3 2021

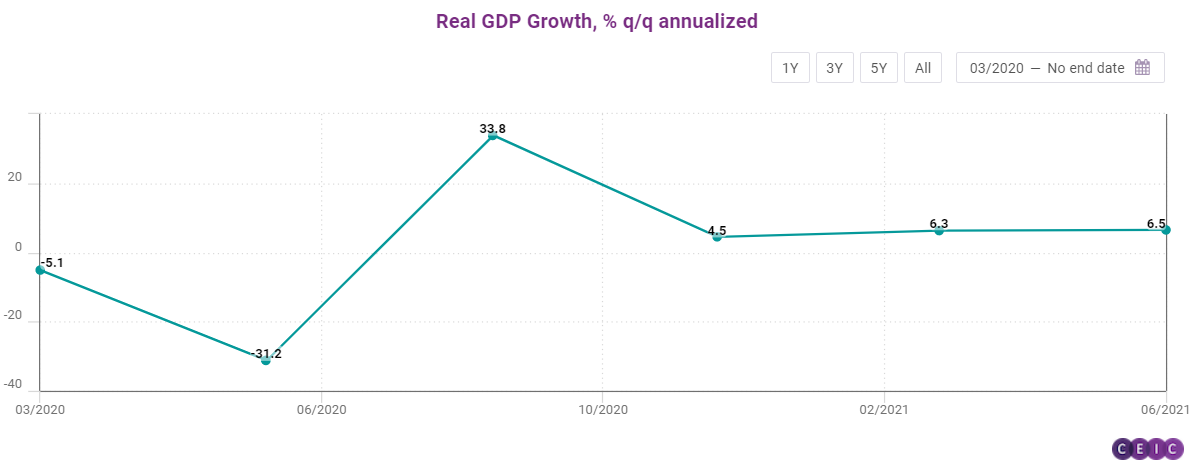

Real GDP increased at an annual rate of 6.5% in Q2 2021, according to the advance estimate released by the Bureau of Economic Analysis, improving slightly from the revised 6.3% outturn for Q1 2021. On an annualised basis, personal consumption expenditures increased by 11.8%, with non-resident investment up by 8% but residential investment contracting by 9.8%.

Government consumption expenditure and gross investment also declined by 1.5%, while exports of goods and services rose by 6% and imports by 7.8%. Due to a rundown of retail trade stocks, inventory growth subtracted 1.1 percentage points (pp) from GDP growth, and net exports of goods and services an additional 0.4pp.

Discover the CEIC Global Database and learn how you can gain access to over 7.3 million time-series data, covering over 200 economies, across 18 macroeconomic sectors.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)