-png.png)

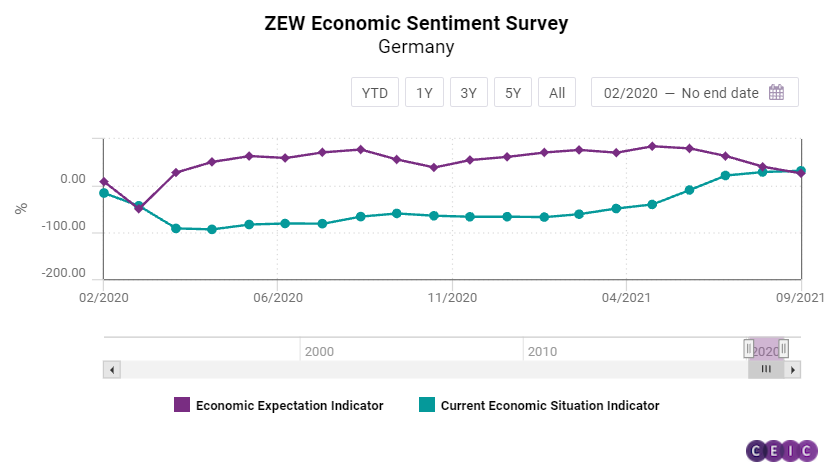

The ZEW index for Germany has shown a rather interesting development over the past few months with the current situation sentiment improving substantially in the third quarter of the year, while the economic expectations are worsening in the same period. The energy crisis and surging inflation in the Euro Area will likely result in even worse sentiment results in October.

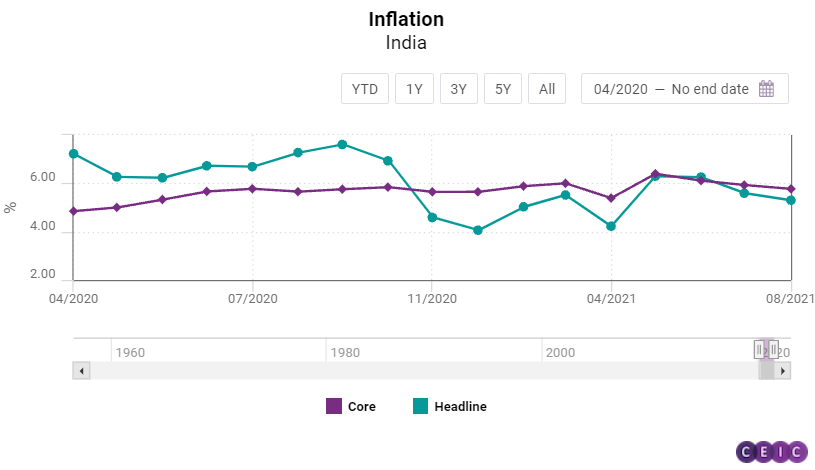

Also on Tuesday, two major releases for India are expected - the August industrial production index and the CPI inflation for September. As of August, the inflation in India remained within the RBI's target range after two months of decline, which made the central bank keep its benchmark rate unchanged on October 8. For the US, JOLTs job openings for August will be published on Tuesday, amid a steadily increasing trend since the beginning of the year.

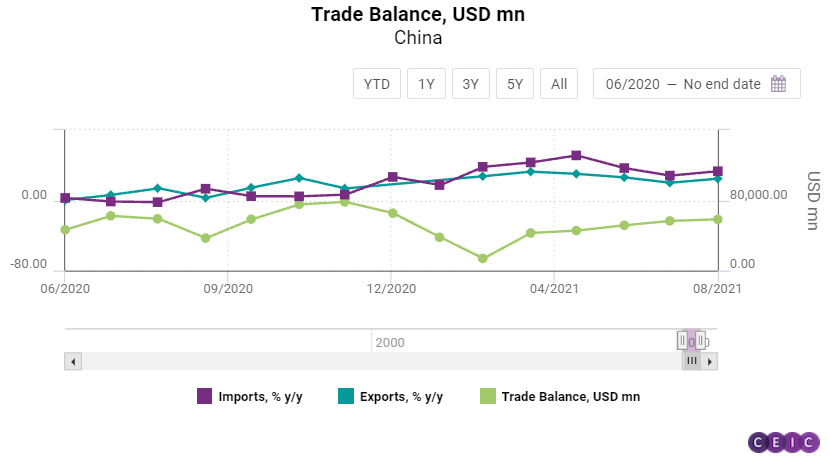

On Wednesday, China's first major release after the national holidays is expected - the foreign trade data for September. China's exports continue to benefit from the global economic recovery with annual growth rates remaining above 20% since the beginning of the year. Despite China's focus on domestic demand, the strong performance of the external sector may be crucial for mitigating the present cooldown of the second largest economy.

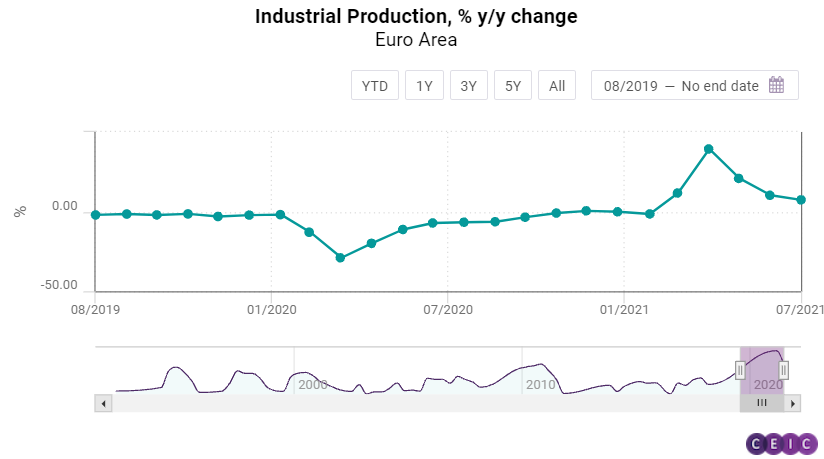

In Europe, the September inflation in Germany is scheduled to be released on Wednesday, followed by the industrial production for the Euro Area. Probably the most expected data release of the week, the US CPI inflation for September, will also be published on that day. Despite the plateau since June and the core inflation decline, the headline inflation in the United States remains high, raising concerns that the Fed's assumptions that inflation will be a transitory problem might have been too optimistic.

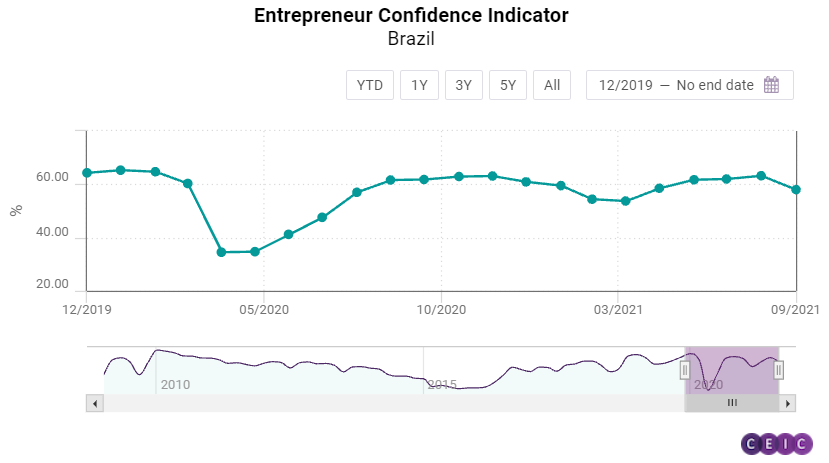

On Thursday, the September inflation data for another major economy, China, is expected to be released, including both producer and consumer price indices. While the consumer price index in China remains low, the global supply shortages have boosted the producer price index to 9.5% in August, the highest rate in 13 years. In the US, the weekly initial jobless claims will be released at 12:30 PM UCT, followed by the entrepreneur confidence survey for Brazil.

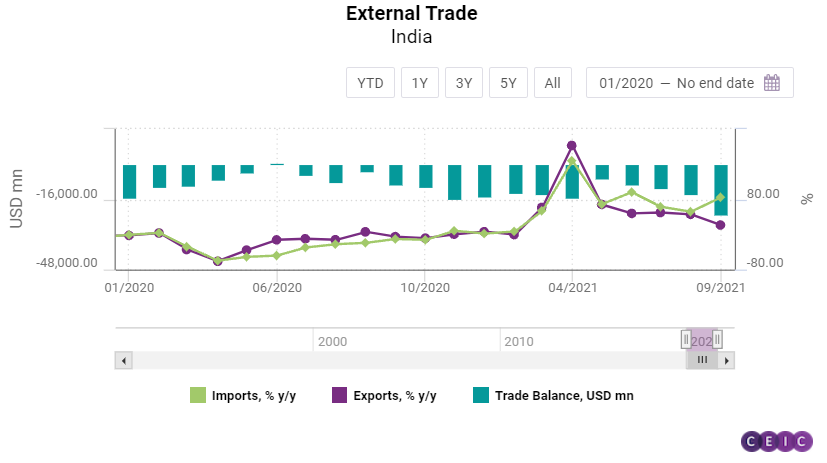

On Friday, the September foreign trade for India and Indonesia will be released together with China's FDI for September and the US retail sales.

Discover the CEIC Global Database and learn how you can gain access to over 7.3 million time-series data, covering over 200 economies, across 18 macroeconomic sectors.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)