Even amidst slowdowns, consumers need a “feel-good” factor. In that regard, India provides some more insights.

During the Great Depression of 1929, when stock markets crashed, unemployment increased substantially, and wiped out wealth from the economy, a strange phenomenon came into being. Amidst such financial crunch, the sale of lipsticks in the US increased. It turned out that women indulged in buying smaller luxury products such as lipsticks instead of fur coats to satiate their spirits. This phenomenon repeated itself once again after the sub-prime mortgage issue turned into a full-blown banking crisis in September 2008. L’Oreal, one of world’s largest cosmetic companies, registered a like-for-like sales growth of 3.1% for the year.

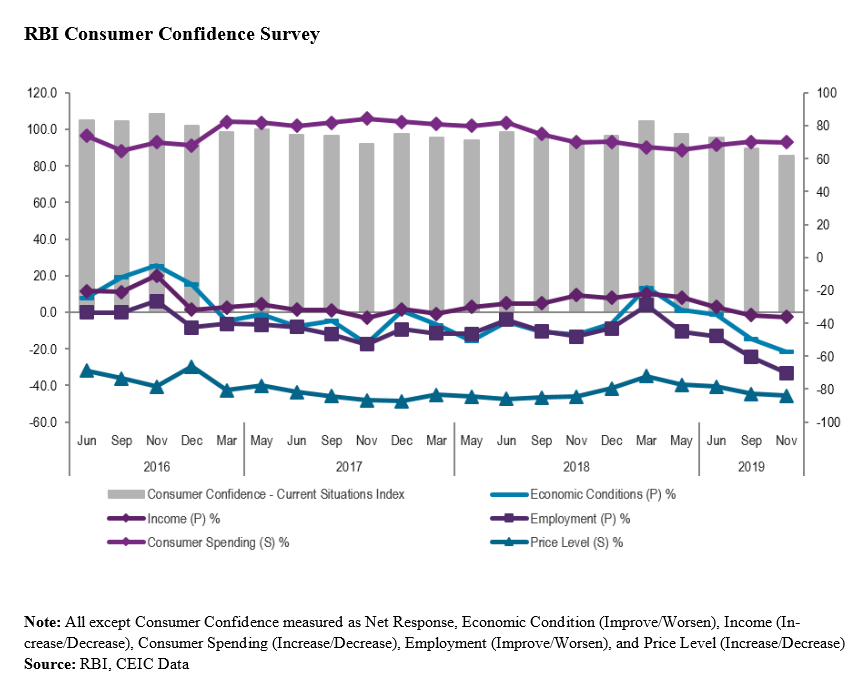

Such is the perplexity surrounding this topic that it has been explored across disciplines, and experts ranging from psychologist to economists have tried to reason its occurrence. From a psychological point of view, it was said that women spend more on beauty products to attract better mates during a downturn, but exploring it from an economist’s perspective reveals a great deal about consumer behaviour, especially the fact that even amidst slowdowns, consumers need a “feel-good” factor. India’s recent slowdown, in this respect, provides some more insights about the lipstick effect.

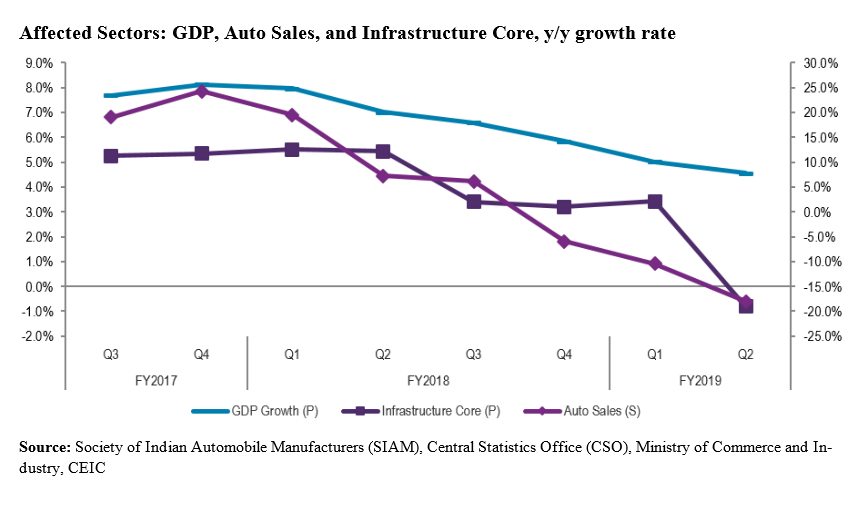

India has been undergoing a GDP slowdown for six quarters straight, starting June 2018. The GDP growth rate for July to September 2019 stood at 4.5%, a decline of about 50 pp from the previous quarter. While the Indian government was under public pressure to take appropriate policy action and counter the slowdown, some ministers came forward to say that there was in fact, no slowdown. In defence against the slowdown argument, the Union Minister of India Ravi Shankar Prasad stated that three films, namely War, Joker, and Sye Raa, grossed over INR 1.2bn on the opening day. While he was forced to retract his statement, he was, unknowingly, referring to the mysterious lipstick effect.

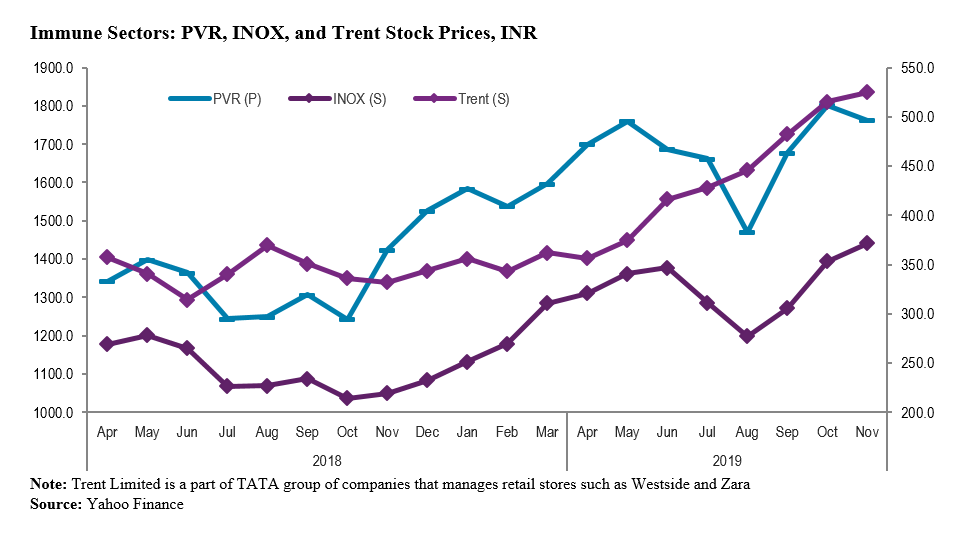

In India, the whole movie-going experience is a small luxury for most people. PVR Cinemas and Inox Leisures, two of India’s largest multiplex chains have performed steadily despite the slowdown. Cosmetics and fast moving consumer goods (FMCG) companies such as Hindustan Unilever (Lakmé), and ITC profited at double digits during the September quarter. In the apparel and accessories segment, companies such as Zara, H&M, and the like, are performing better than high end brands such as Prada, Dior, Gucci or Louis Vuitton. For the latter set, the second-hand market has picked up significantly for purses and belts, even though most payments are being requested in the form of deferred monthly instalments.

Further evidence emerges from looking at sales of e-commerce websites such as Amazon and Flipkart, which offer big discounts, especially during the festive season. In 2019, the Diwali festive sales in October and November surpassed the numbers from a year earlier, not only due to discounts, but also as a result of no-cost or low-cost equated monthly instalments (EMIs), exchange offers, and instant bank discounts. Amazon saw 91% new customers from Tier-2 (population 50,000 - 99,999) and Tier-3 cities (population 20,000 - 49,999), while Flipkart saw the number of transactions from Tier-2 cities double from the previous year. These provide a clear indication of the lipstick effect in action.

However, all the findings also lead to a whole new question on consumer behaviour. The Finance Minister of India, when posed with the question of slowdown in the automobile sector, blamed it on the modus operandi of millennials, who are increasingly opting to travel by taxi or shared transport. The increase in shared transport availability thanks to the advent of ride-hailing firms Uber and Ola, and other taxi services, have led people to buy less cars, and bypass the hassle of driving through traffic.

In addition, car-pooling services have substantially increased. This concept of renting is not limited to just cars. We can now see it in the real estate sector, as more and more people are taking up rental housing instead of buying their own house. Even furniture is available on rent. Hence, it does not seem completely impossible that a change in consumer behaviour and demand is triggering a part of the slowdown. It would be interesting to explore these behavioural aspects that may or may not be related to the overall functioning of the economy.

The CEIC India Premium Database is the go-to resource for analysts, investors, and strategists to assess and run analytical models on the Indian economy. Learn more here

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)

.jpg)