Russia’s economic deceleration is expected to continue according to the CEIC Leading Indicator, which has sustained its negative trend.

The indicator increased to 108.10 in May 2018 (forecasting the subsequent acceleration of the economy in H2 2018), before sloping downward to reach 100.10 in June 2019, marginally above the threshold of 100. While equity market index and passenger cars production impacted positively overall growth, coal mining and petroleum products production contracted in Q2 2019 to offset this positive effect and contribute to the economic slowdown.

This forecast is in line with the leading analysts’ projections of anaemic economic development in 2019: both Oxford Economics and Fitch Ratings foresee a weak 1.2% GDP growth for the year, while Focus Economics is slightly more optimistic with 1.4% y/y. The loosening of monetary policy is expected to strengthen private consumption, while an expected rouble depreciation is likely to boost exports in the short term.

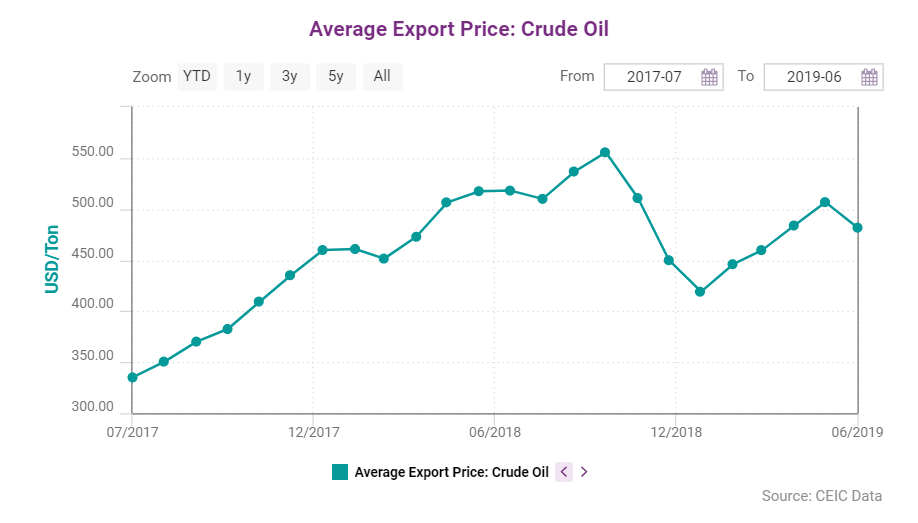

Russian exports, still dependent to a great extent on oil and gas, are forecast to stabilize over the second half of 2019. A decision was made during the sixth OPEC+ meeting in the beginning of July to extend oil supply cuts for an additional nine months. This is expected to maintain stability in international oil prices amid global tensions between the US and Iran, the seizure of an Iranian tanker by the British Royal Marines and the subsequent response from Tehran to name a few.

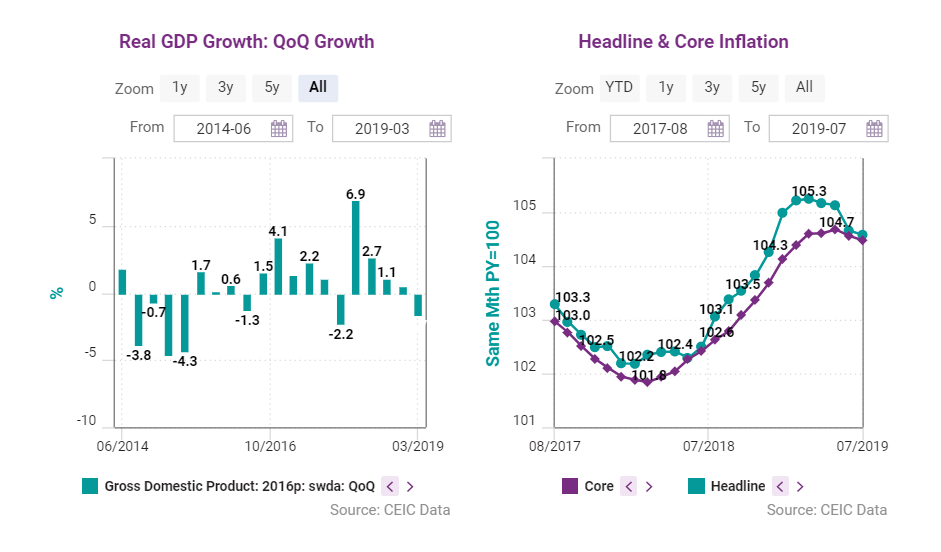

Real growth rate

Real growth rate (seasonally and working-day adjusted) decelerated to 0.63% on an annual basis in Q1 2019 and the Ministry of Economic Development expects it to end 2019 at mere 1.3%. Given the record-low unemployment, the restricted access to foreign capital and the tiny real impact of Putin’s ambitious National Projects infrastructure plan, upward corrections of the GDP growth rate are unlikely in 2019.

Despite the upward effect on inflation of the January VAT hike, indicated by a marginal rise to 5.25% in March, the Consumer Price Index (CPI) has been closing in to the 4% target, down to 4.66% in Q2. It is projected to end 2019 at 4.34%, though forecasts may change, as further policy rate cuts are expected in the months to come.

In the first half of 2019, the rouble gained on all major currencies: 5.88% against the US dollar and 8.15% against the euro, raising concerns regarding Russian exports’ international competitiveness. MOEX – the rouble-denominated stock market index – reached a post-Soviet era high of 2,842.78 on July 4, indicating a decreasing effect of sanctions upon the top players on the market.

Praised by international authorities for its sound fiscal policy in recent years, the Russian federal government has sustained a budget surplus throughout the whole H1 2019, scoring RUB 277.8bn in Q2 2019. The January VAT hike has further strengthened this position, however, additional revenue might be required if the ambitious six-year National Projects programme is to be completed.

This year has not been very favourable to the country’s trade surplus, with a 21.99% plunge on an annual basis in May. From a slump in oil prices at the end of 2018, to the Druzhba oil pipeline contamination in April and the constantly appreciating rouble, the value of Russian exports, which are still very dependent on oil prices and output, contracted by 13.5% y/y in May. Amid geopolitical tensions and weakening domestic consumption, imports dropped by 7.39% on an annual basis, underpinned mainly by a 10% decrease in machines and equipment imports.

You can download the full CEIC Russia Economy in a Snapshot Q2 2019 report here.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)