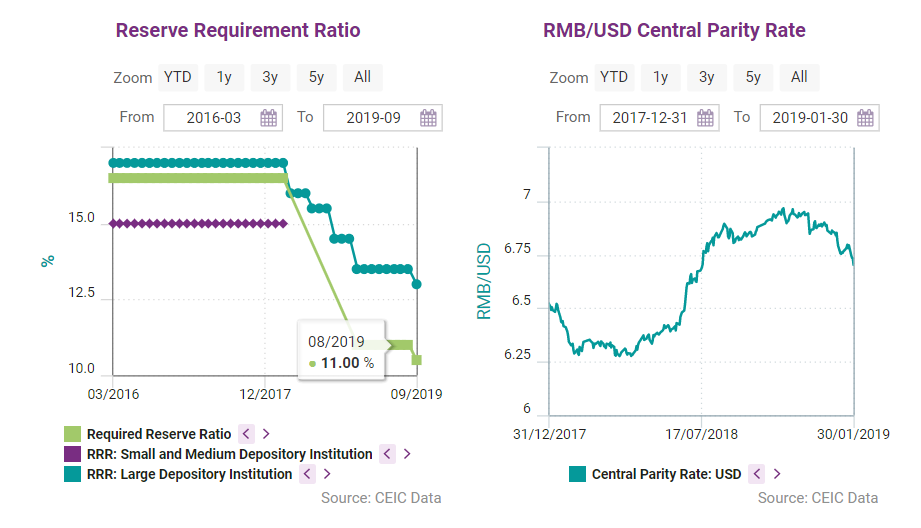

In 2018, the RMB underwent large depreciation pressure, particularly from May onwards.

This was a result of widespread slowdown on the demand side, risk appetites in the stock market declined, and large sell-offs occurred frequently, pushing down onshore indices. Dampened demand also pressed down inflation - consumer and producer price indices headed down in Q4 2018 and PPI even exhibited a deflation risk. The observed disinflation process, however, made more room for monetary policy interventions.

The monetary stance in 2019 will be more proactive, especially in light of softened data and low inflation. However, the central bank will use targeted easing with controllable incremental liquidity to feed financing demand for valuation stability of the RMB. We expect the PBoC to implement RRR cuts, open market operations (OMOs), MLF and Standing Lending Facility (SLF) to hedge against downward pressures and lower real interest rates. A full-fledged interest rate cut, however, is not very likely.

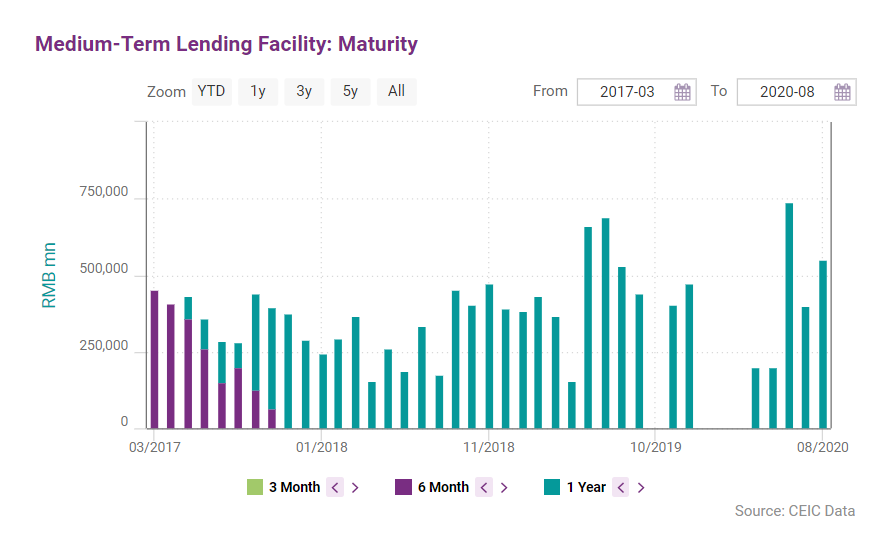

We see lower probability of RRR cuts by the end of Q2 2019, as market sentiments rallied and PBoC retained money supply control. However, RMB 1.35tn of MLF will mature in June and July, so there could be another RRR cut in early Q3 2019.

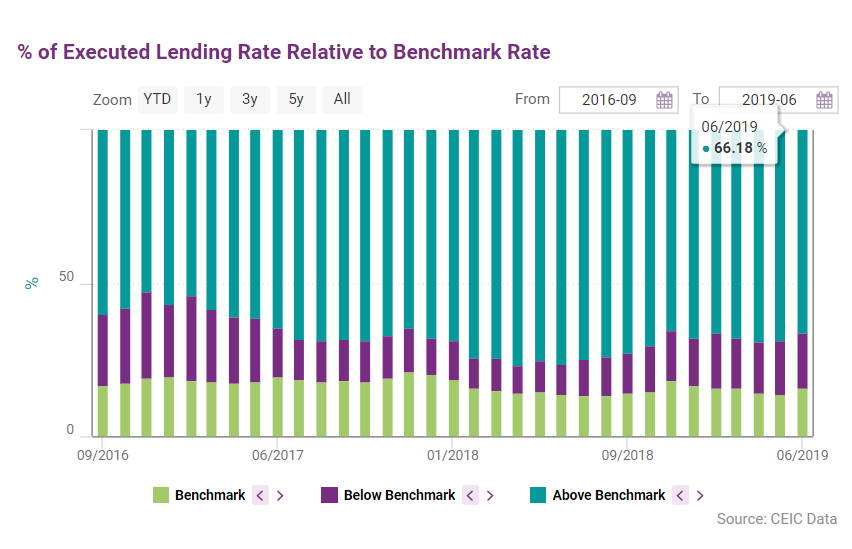

In terms of rate cuts, once the US Federal Reserve stops increasing rates, the pressure on the RMB will be alleviated, and this will be a good time for the PBoC to cut market rates, such as OMO rate, MLF rate, and SLF rate. We do not think cutting benchmark interest rates is essential for two reasons. First, it sends a strong stimulus signal to the market and second, benchmark interest rates are not high, and more than 60% of banks offer lending rates higher than the benchmark rate. Banks can adjust lending rates downwards based on market demand.

Furthermore, difficult access to funding is a common issue for many onshore entities. The financial deleveraging campaign has led to a big gap on off-balance-sheet financing, which depressed growth in infrastructure investment. Therefore, we expect the tight control on shadow banking to be eased in 2019.

You can download the full CEIC China Economy in a Snapshot Q2 2019 report here.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)

.png)