The Philippines is a newly industrialised country, which only recently made the transition from an agricultural-based economy towards one based on services and manufacturing.

It has a dynamic economy, highly dependent on international trade developments and capital flows.

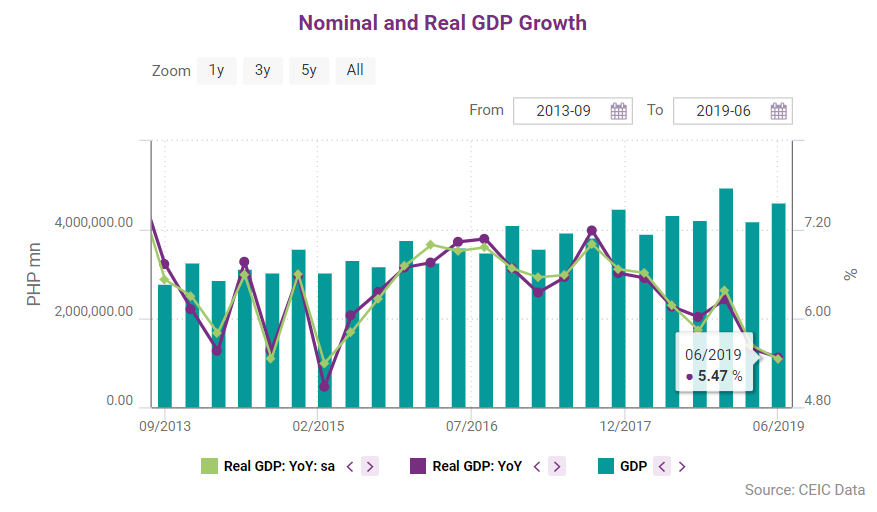

Economic growth reflected by GDP

Nominal GDP per capita stands at slightly above USD 3,100, significantly below the ASEAN Economic Community (AEC)’s average of 11,979.4 at the end of 2017. In the second quarter of 2019, real GDP increased by 5.5% y/y, compared to 5.6% y/y in the previous quarter. Nominal Q2 2019 GDP was PHP 4,627bn (USD 88.9bn). This development reflects upward revisions to household consumption expenditure (PHP 1,646bn up 5.6% y/y), a steady rise in government spending (up 7% to PHP 327.1bn. or USD 6.3bn) coupled with a decline in fixed investment (-4.8% y/y).

Net exports, which have been negative as a trend, were down y/y after a relatively large increase in imports and a smaller move in exports (PHP -126.7bn or USD -2.4bn). PCE contributed to above 75% of total GDP, having increased by 9.5% y/y despite rising international trade pressures. Gross private domestic investment also increased by 15% y/y despite the net negative change in inventories. The strong upward move that has been sustained over the past quarters is a sign that businesses still find investment opportunities and the economy is not substantially cooling. Government expenditure also increased at a steady pace over the past several quarters.

Service and industry sector growth

The services sector GVA made up 47.68% of total GVA in Q2 2019, registering an annual growth of 4.49% y/y. The manufacturing sector, which grew by 4.66% y/y, made up 21.4% of total GVA. The industrial production index (IPI) has been especially volatile in Q2, after falling from January to April. Agriculture, which grew by 3.02% y/y, contributed 12.59% of total GVA with the rest being due to other industries. Following a relatively strong performance in 2017 and 2018, with GDP growth of 6.7% y/y and 6.2% y/y, respectively, and against the backdrop of a looming economic slowdown, growth is likely to moderate to lower long-term average levels in 2019 and the following two years. The 2019 GDP growth projection is 6.4% y/y and 6.5% in 2020 and 2021, underpinned by strong private consumption and continuing government spending.

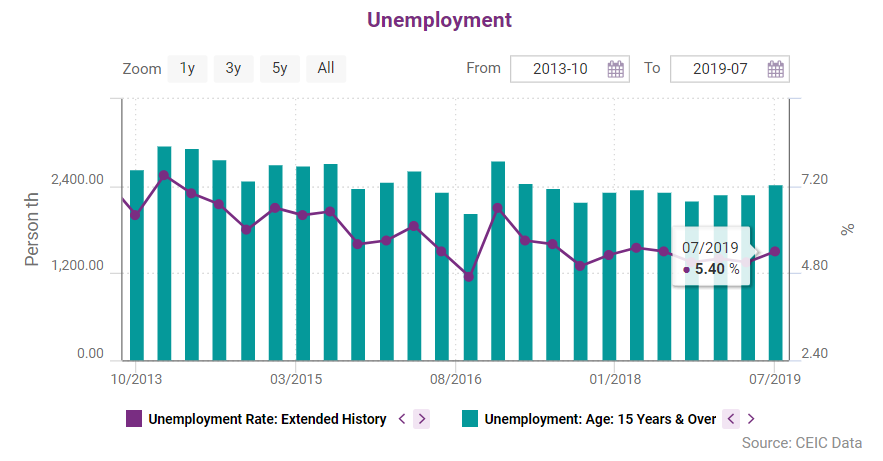

Philippines' labour force

With increasing urbanisation, a growing middle class, and young population, the Philippines boasts strong consumer demand, supported by a vibrant labour market. Having sustained an average annual economic growth of 6.3% in 2010-2017 compared to an average of 4.5% in 2000-2009, the Philippines is poised to make the leap from a lower-middle income country with a gross national income per capita of USD 3,660 in 2017 to an upper-middle income country with per capita income range of USD 3,896–USD 12,055 in the near term. Demographics certainly underpins the vibrant labour market.

Out of a population total of a little above 108mn, about 69.5mn or 64% are in working age, and the share of working people is likely to grow slightly throughout 2019 and 2020. Unemployment has a strong seasonal component, but adjusting for seasonality, it has remained in the 5.9%-6.5% range in the since 2017. The precise reading for Q2 2019 was 6.52% (almost no change y/y), a number that is likely to increase in case of a global slowdown. Average worker earnings in pesos increased by 7.64% y/y, partly due to inflation indexation combined with a 3.14% y/y increase in non-labour productivity. Productivity growth in the manufacturing sector was lower than average which caused unit wage cost also to grow more slowly (4.8% y/y).

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)