In the period 1976-1989, the US launched 20 investigations against Japan under Section 301 – the same one used by Trump to launch the investigations against China now

In 1975, four years after the collapse of the Bretton Woods system and forty years before Donald J. Trump entered the presidential run targeting trade deficit as a major issue for the domestic economy, the US registered a trade surplus for the last time in its history. Since then, driven by the high global demand for US dol-lars as a reserve currency, the trade balance of the country has run into a chronic deficit.

The turning point of the trade position in the mid 1970s coincided with the beginning of the US’ first modern-time trade war with a major trading partner. In the early 1970s the US imports of electric appliances, office equipment, automobiles and many other Japan-made products surged, which resulted in a substantial increase in trade deficit with Japan. So, in the period 1976-1989, the US launched 20 investigations against Japan under Section 301 – the same one used by Trump to launch the investigations against China now. Also, the US accused Japan of making its exports more competitive by manipulating the yen – an argument that is used against China today.

Indeed, the similarities of the US trade policy against Japan four decades ago and those against China today are not coincidental.

In the early 1990s, the trade gap with Japan amounted to more than half of the total US trade deficit, which is close to the share of the current deficit with China. Things started to change with the acceleration of global growth that boosted demand for US goods. The trade deficit with Japan started to narrow and the total deficit declined substantially and stabilised at around 2% of GDP, which, given the US dollar being used as a reserve currency, looked like a reasonable trade position for the US.

However, since then the US trade gap took a turn for the worse, which continued over the next three decades. The first key event to unleash the rise of the US trade gap was the currency crisis in Latin America and Asia in the mid-1990s that ended the era of fixed exchange rates. Many Latin American and Asian countries allowed their currencies to depreciate and stimulated export-driven growth. The US trade deficit surged from 2.4% of GDP in 1997 to 4.7% of GDP in 2000.

At the same time, the creation of the World Trade Organisation (WTO) and the NAFTA agreement resulted in deep-er trade integration between the US and some of its major trading partners – the EU, Canada and Mexico.

In 2001, China joined the WTO, which lifted all barriers to trade with the rest of the world and resulted in an unprecedented growth of Chinese exports to the US and a sky-rocketing US trade deficit to an all-time high of 6.5% of GDP. Although the US trade gap narrowed after the global financial crisis, it stabilised at an average 4.6% of GDP in the post-crisis period of 2010-2017, far above its historical levels.

The pros and cons of the US’ persistent trade deficit are hard to be quantified and compared on an aggregate level. Trade deficit could be good for the US house-holds that benefit from buying cheaper goods from less developed countries and bad for steel producers that find themselves noncompetitive against lower-price imports from China.

However, fighting against the trade deficit, mainly with China, was one of the key points of President Trump’s rhetoric during the presidential campaign and it’s among the key pillars of his economic agenda. And it was the reason for striking a trade war with China and renegotiating the trade agreements with the other major trading partners. Trump accused China of making its exports more competitive by manipulating the renminbi, stealing intellectual property from US companies, and imposing unfairly high tariffs on US imports. And this was just part, albeit a significant one, of the whole Trump agenda to “put America first” in the trade relations with the rest of the world.

The trade war with China

As president Trump has continuously placed the balancing of trade deficit with China among the key priorities of his ad-ministration, it is not surprising that the trade tensions between the US and China have escalated dramatically in the past year. So far, the tit-for-tat tariffs between the world’s two largest economies have hit investor confidence and rattled financial markets, worsening economic out-looks around the globe.

Then what exactly has the Trump administration been trying to achieve and what is the potential outcome of this confrontation?

In May 2018 the US authorities present-ed a clear list of trade demands, including requirements that China should cut the US-China trade deficit by at least USD 200bn, cut its tariffs on US goods by 2020, stop subsidising tech companies and stealing US intellectual property, and open its economy to more US investment. China, however, is not ready to make such significant concessions, as some of these demands directly interfere with the vision of the Chinese government for the economy and may have a measurable impact on growth. Beijing’s grand plan, called Made in China 2025, aims to transform the country into a hi-tech powerhouse. This state-led industrial policy intends to foster ten core industries, such as IT, robotics, aerospace, future automobiles and biotech, and aims to have 70% of the components sourced locally. It also features preferential policies and offers subsidies to Chinese tech companies, and simultaneously requires multinational corporations operating in China to transfer technology. On the other hand, part of China’s economic reform plan is to become less reliant on exports by achieving higher domestic consumption instead. Therefore, the Chinese government may be willing to cut the huge trade surplus with the US, but the pace of this change would be crucial.

So far China seems to be on the losing side of the dispute, given that exports constitute about 25% of its GDP and its dependence on trade is much heavier than that of the US, whose exports amount to about 8% of GDP. Moreover, a recent study by EconPol Europe suggests that a 25 pp increase in tariffs raises US consumer prices on all affected Chinese products by only 4.5% on average, while the other 20.5% toll falls on Chinese producers. The US government has strategically levied import duties on goods with high avail-ability of substitutes, which transfers a great share of the tariff burden on to Chinese exporters. The Chinese products hit by Trump’s tariffs can mostly be replaced by other goods, forcing exporters to cut selling prices to keep buyers. Thus, China is likely to make some concessions, such as a forced appreciation of the renminbi to balance the trade deficit, if the trade war is resolved with the minimum tariffs imposed by the US. If the trade conflict escalates, however, the US administration may not be able to restrict its selection to such products and more of the tariff burden will fall on US consumers. In such a scenario, the Chinese economy would face significant difficulties, while US consumers would have to pay higher prices for imported goods and US exports would face higher tariffs from China.

As China and the US are on the verge of a deeper fallout over trade, they might be compelled to come to terms with realities neither of them cares to admit. First, as the world’s two largest economies, they are naturally heavily dependent on each other. America needs to vent the sup-pressed domestic demand which would otherwise add to inflationary pressure, while China needs a healthy US economy and buoyant world trade to help it keep its economic engine running. China, however, must admit that the US has a right to be angry about applying unfair trade practices, hurting US producers and labour market. On the other hand, the current US demands could be seen as a critical threat to the future of Chinese economy. If the US administration wants to find the middle ground in the trade disputes, it should certainly reconsider its demands aimed at the Made in China 2025 plan. If neither country can admit these things, at least to itself, the implications for global economy and diplomatic relations could be way worse than anyone is currently expecting. As the world’s two greatest superpowers are in a state of economic trench warfare, there could be no winners from a full-blown war, albeit on the trade front.

Leaning against the wind

The potential for escalating global trade tensions is lurking around the corner. Overall sentiment and business and consumer confidence have remained strong despite the aggravated trade disputes, and headline macro-indicators show signs of continued momentum. Some of the more trade-sensitive data, however, have weakened since the start of 2018.

Purchasing managers’ indices across major economies, such as the US, Japan, China and the euro area, show decelerating growth in export orders. Some sentiment indicators suggest a deteriorating out-look for car makers in developed markets, while production in the industrial sector has been slowing at a faster pace than in the rest of manufacturing, signalling weaker capital spending.

In theory, a rise in tariffs and the resultant increase in import prices should lower import volumes and increase domestic prices and costs. Lower imports should lead to an increase in domestic production (or new trading partners) to compensate for the diminished imports, but these products are likely to come at higher prices. Such inflationary pressures would cause an increase in nominal interest rates, which, combined, will be reflected in declining corporate profits, driving down equity prices. On the other hand, higher inflation should increase input costs and output prices, which would result in reduced export competitiveness, a fall in purchasing power and therefore lower private consumption and investment.

So, if trade tensions continue and escalate into a full-blown global trade war, they might have a negative impact on growth and ripple effects on other economies, especially on emerging markets, which are highly vulnerable to external shocks.

As the world’s two greatest superpowers are in a state of economic trench warfare, there could be no winners from a full-blown war

According to IMF head Christine Lagarde, the intensifying trade war between China and the US could deliver a shock to emerging markets that are already in danger. As a result, the crises in Turkey and Argentina could spread and vulnerabilities in Asian economies in China’s neighbourhood could be triggered, as their supply chains are closely linked to Chinese industry. Collateral damage from the trade war has been limited so far, but rising trade tensions are occurring at a difficult time for most emerging markets, many of which have come under increasing pressure from rising US interest rates and an appreciating US dollar. The main dangers posed by the US-China trade war will be the erosion of confidence and the greater financial market volatility.

When a negative shock hits, a country is likely to fall into crisis or suffer from financial contagion when it has a combination of a twin (current account and fiscal) deficit, a large foreign debt and high inflation triggering a loss of confidence. China has none of these macroeconomic problems, but countries like India, Indonesia and the Philippines are among the most vulnerable due to their twin deficits and moderately high inflation. Their foreign debts, however, are relatively small. Malaysia, on the other hand, has a large foreign debt, but it runs a sizeable current account surplus and has low inflation. Although their asset markets are still susceptible to selling pressures from a rise in risk aversion, the Asia Pacific region’s emerging economies have solid fundamentals. Most of the Asian currencies have fallen against the US dollar since the beginning of 2018, with the three twin-deficit countries falling the most, followed by China. Moreover, the major Asian currencies have been increasingly dependent on the value of the renminbi in recent years, so they may face more depreciation pressure if trade tensions continue.

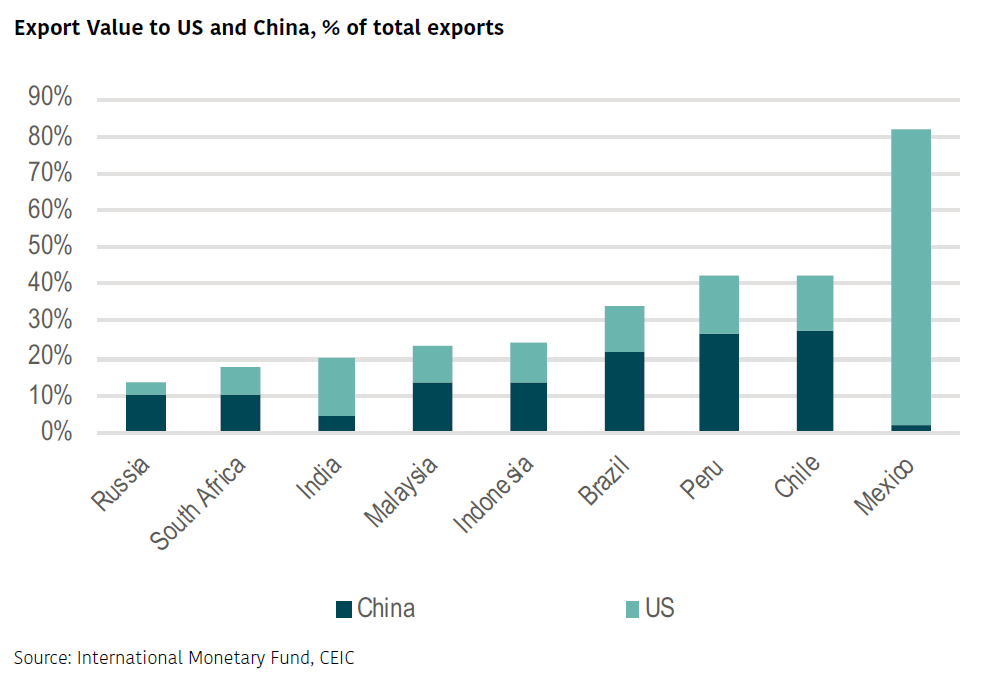

In Latin America, the trade conflict be-tween the US and China could create new opportunities for some countries. Mexico, for example, can benefit from exporting low-technology products to the US and thus competing with China in that segment of the US market. Also, as of 2017, 35.2% of China’s soybean imports was from the US, so the Latin American soybean exporters, like Brazil and Argentina, could benefit from a further deepening of the trade conflict between the world’s two largest economies. However, the risks for the broader Latin American economies far outweigh sector-specific opportunities. The countries in this region remain overly dependent on exports to the US and China, thus a drop in demand from any of the two superpowers as a result of trade tensions may have a devastating effect on them.

Whether the US president will keep his firm course of taking no prisoners, or both sides will find a mutually beneficial compromise, remains to be seen. During the G-20 meeting in Buenos Aires there were some tentative attempts at achieving a consensus. While both leaders demonstrated willingness to resolve the conflict, there was nothing specific on the table and the tension between the world’s two largest economies may escalate at any time. The differences be-tween the two countries remain. The US administration is unlikely to backtrack on its claims to reduce trade deficit with China and China is not ready to make such concessions, at least not on the scale required by the US, which might trigger an-other negotiations deadlock.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)