The European Union’s public finances are based on three types of legal instruments:

- The financial provisions of the Treaties, adopted through the years (primary law)

- Secondary legislation;

- Provisions adopted by agreement between the institutions.

Article 310 TFEU establishes the principles of unity, universality, equilibrium, annuity, specification and sound financial management. It also incorporates the concept of budgetary discipline into the Treaty as well as the obligation for the Union and the Member States to combat fraud and other illegal activities affecting the financial interests of the Union.

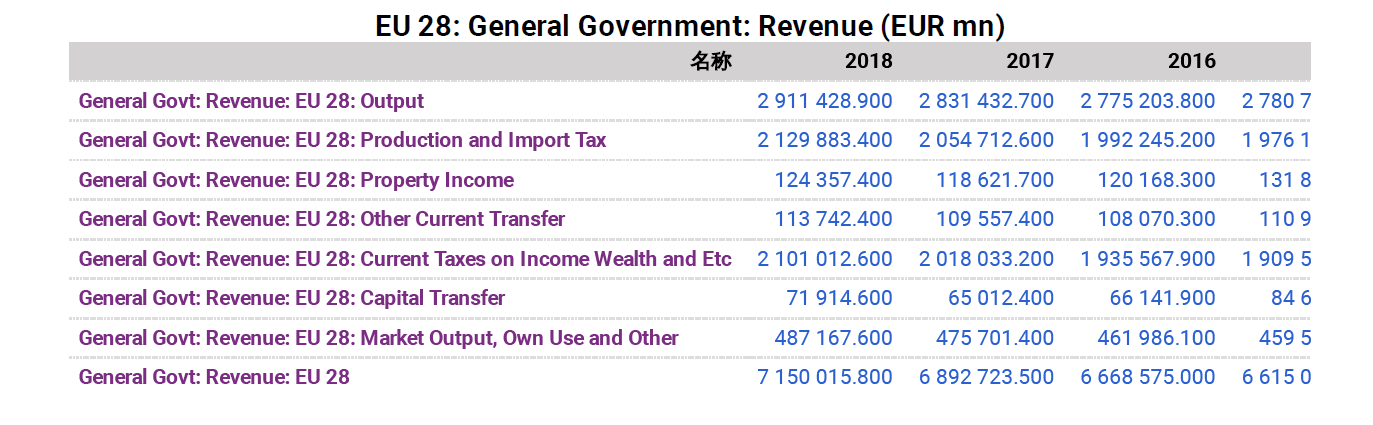

The EU supports the “own resources” system – annual expenditure must be completely covered by annual revenue. The different types of own resources and the method for calculating them are set out in a Council Decision on own resources. It also limits the maximum annual amounts of own resources that the EU may raise during a year to 1.20 %of the EU gross national income (GNI).

(Source: European Union: Public Finance: 5th Edition)

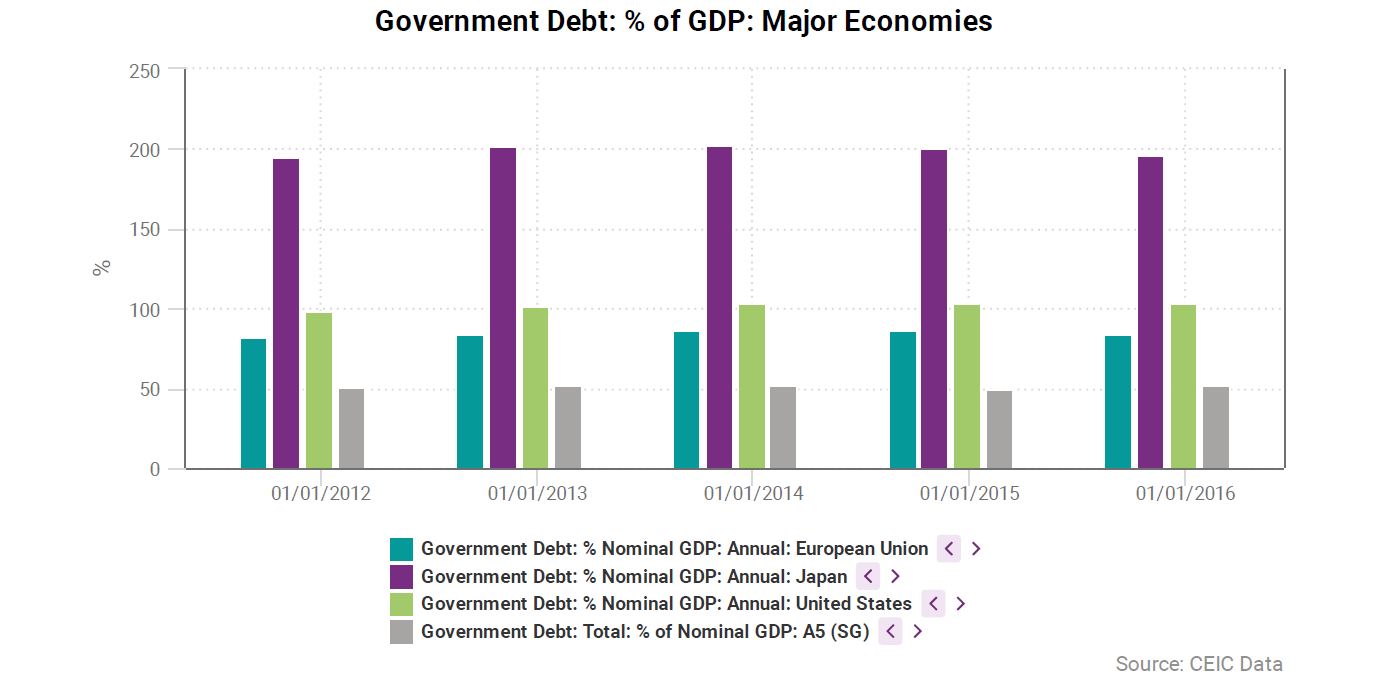

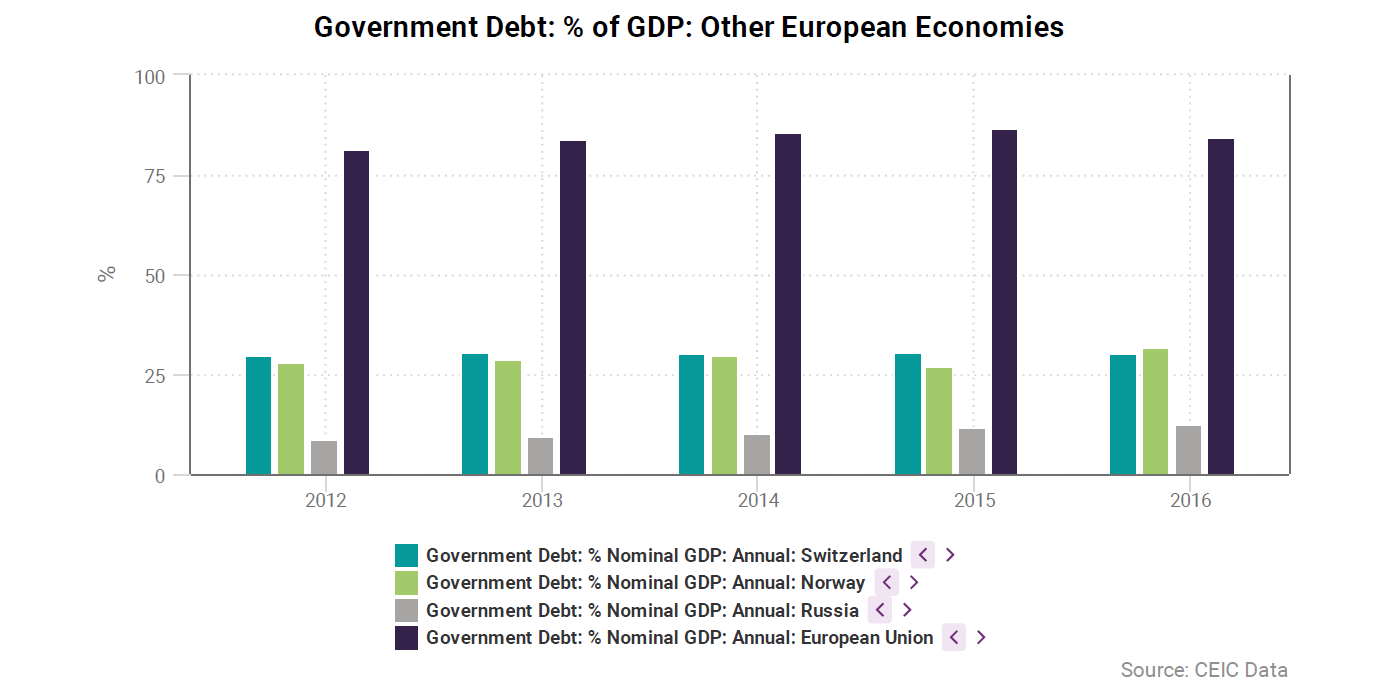

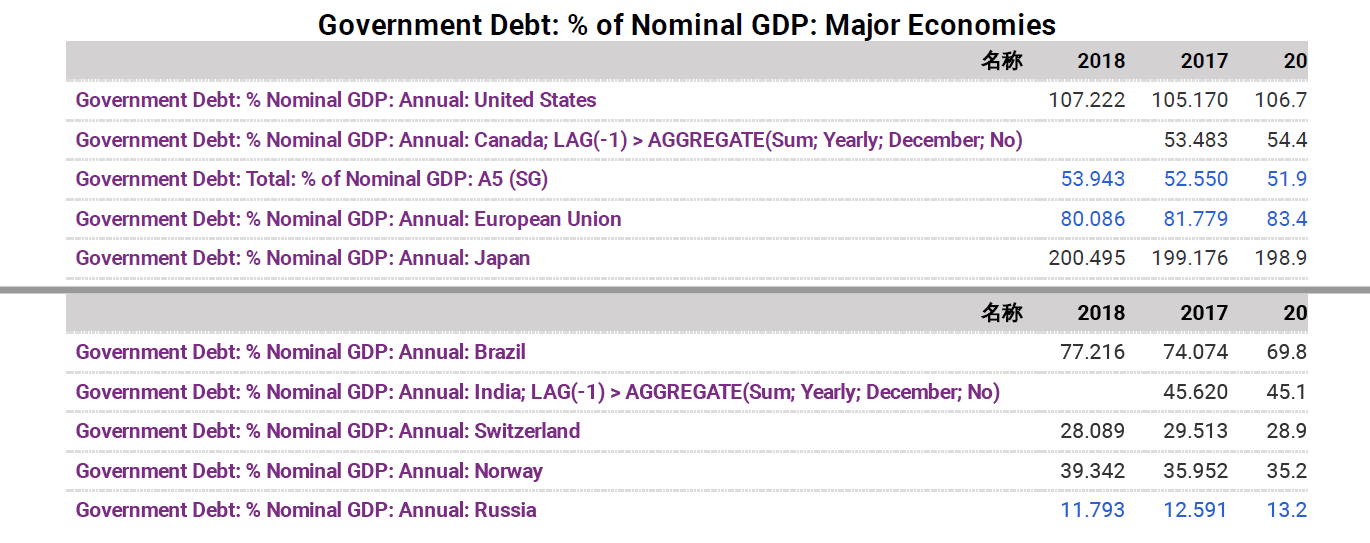

Aggregate government debt ratio is considerably higher in EU compared to other European economies but lower than Japan and USA.

Aggregate government debt ratio is considerably higher in EU compared to other European economies but lower than Japan and USA.

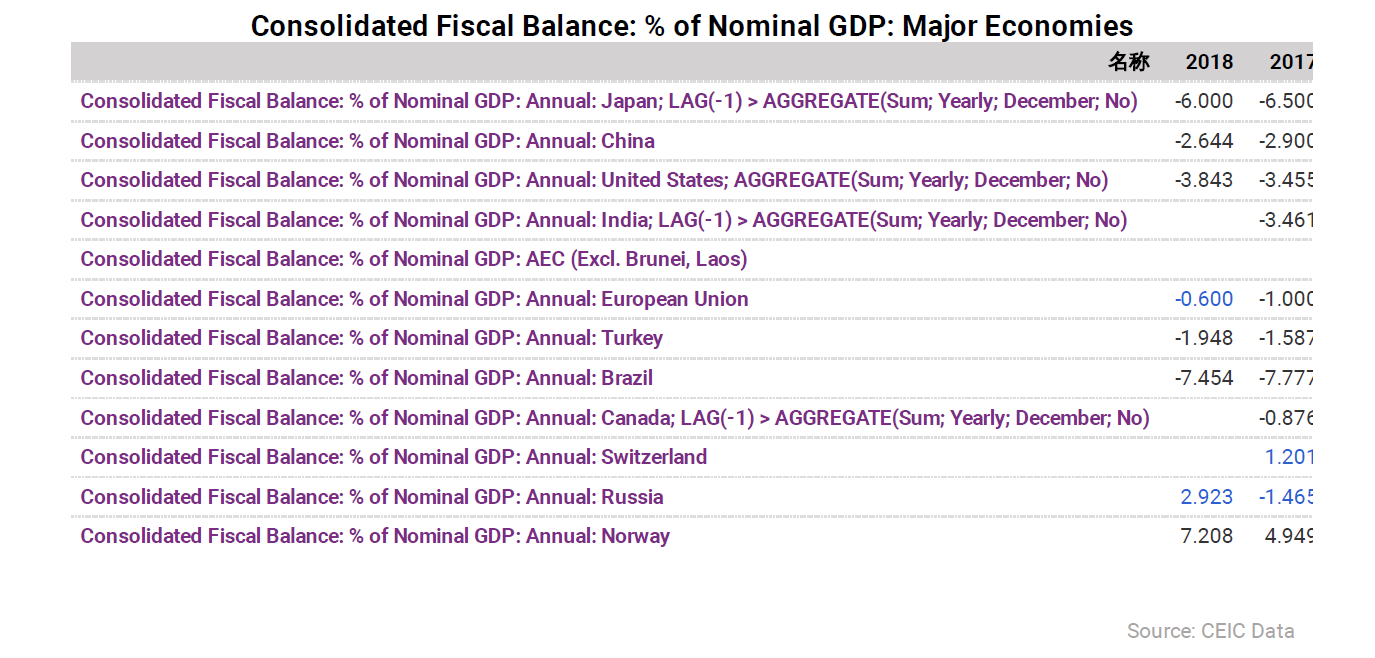

Data for the USA is for the period ending September. Data for Japan, India and Canada is for the period ending March.

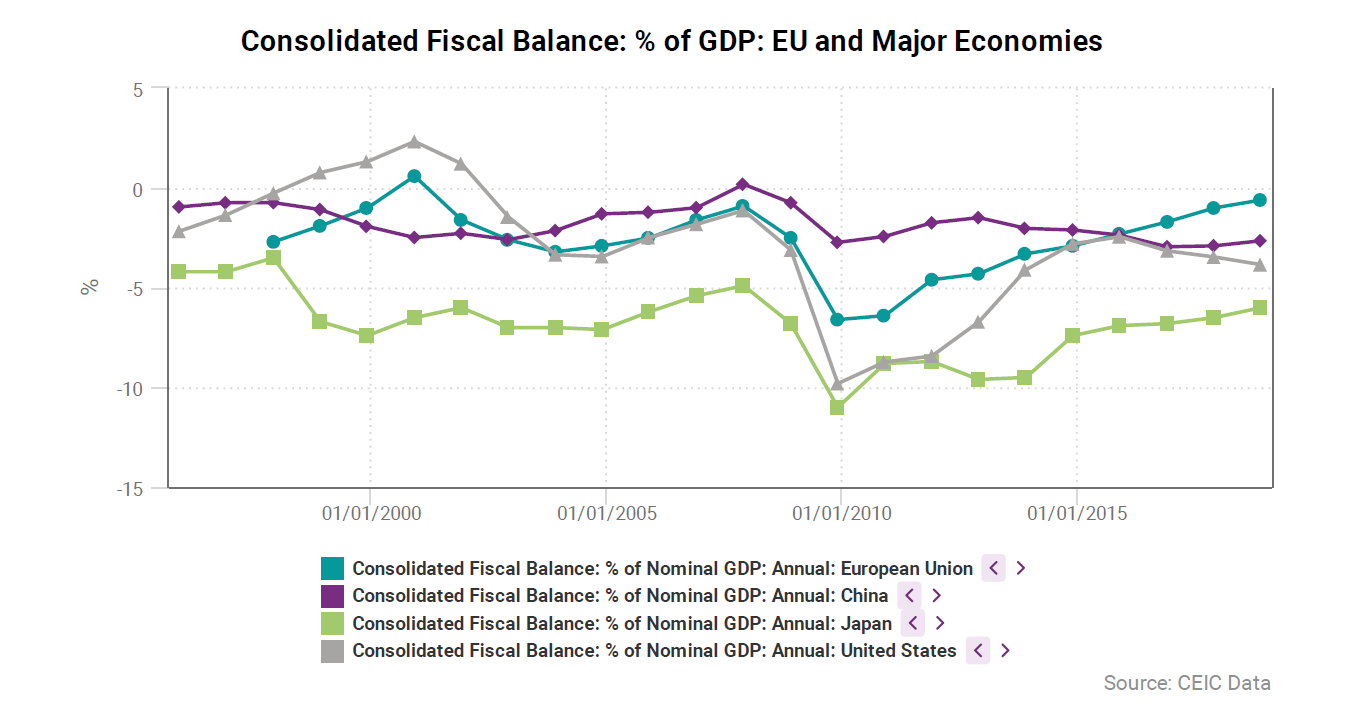

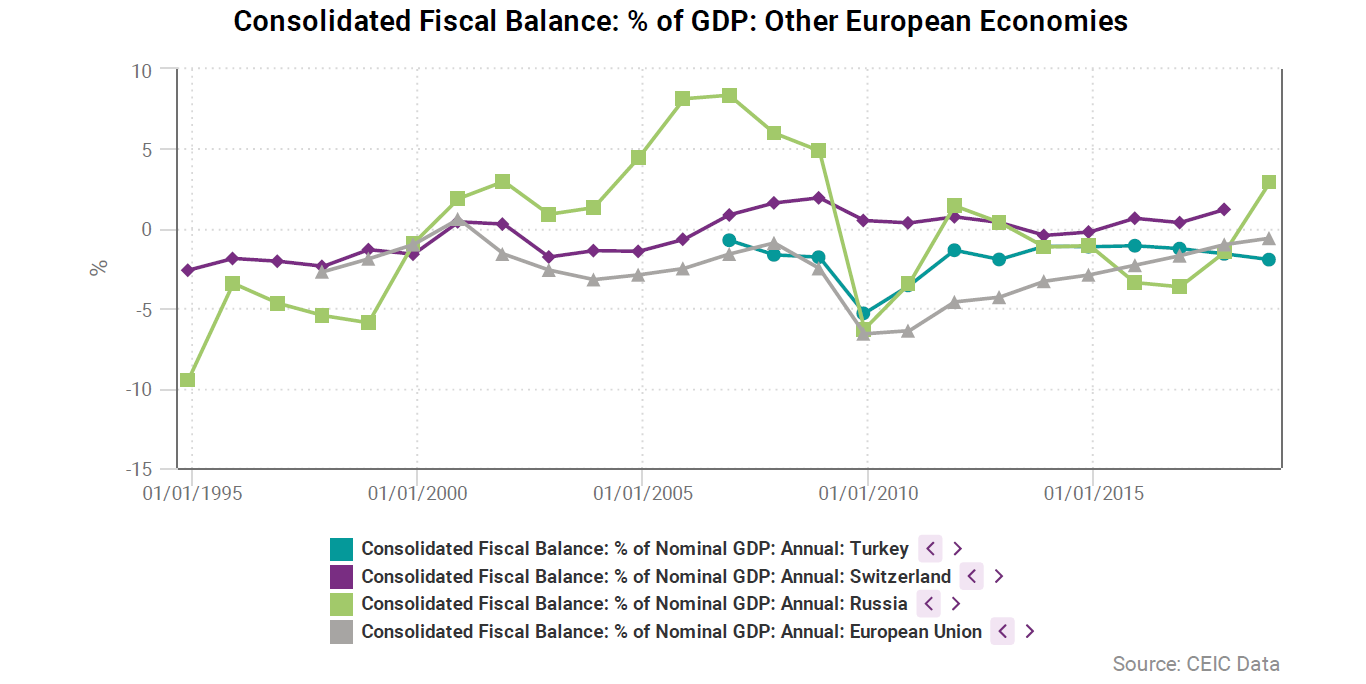

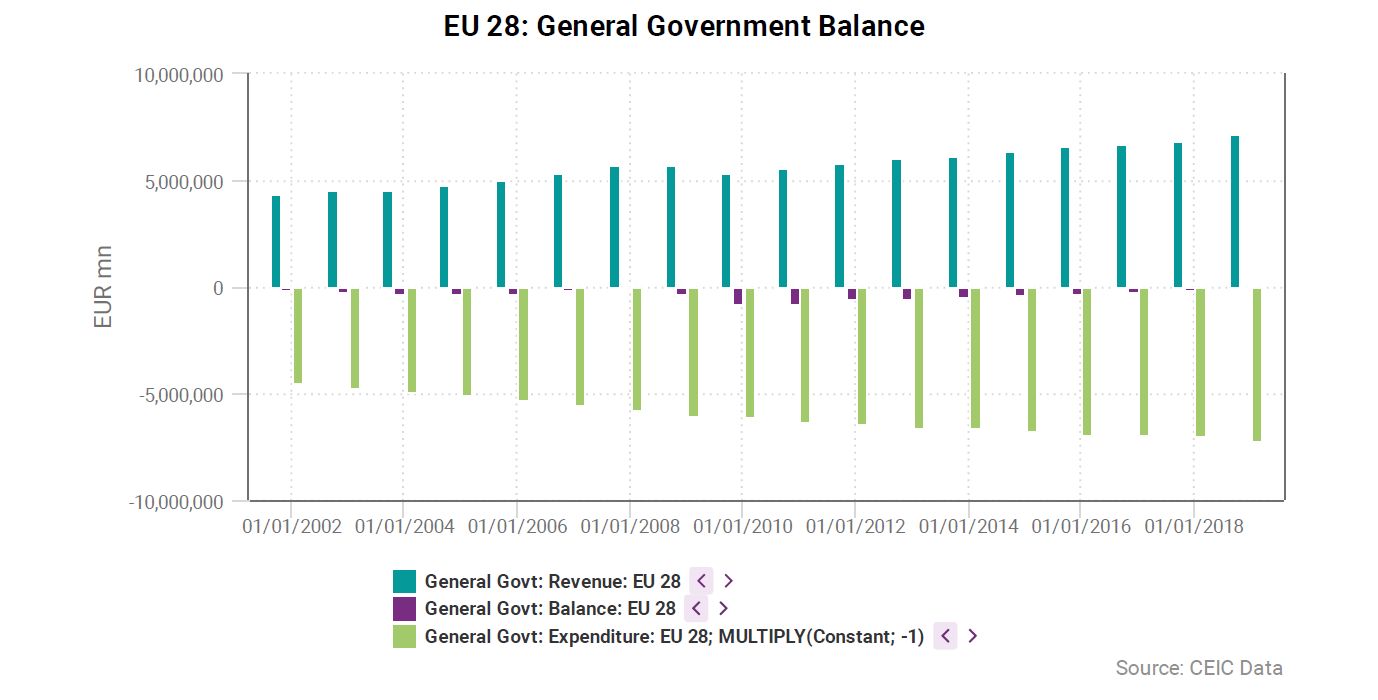

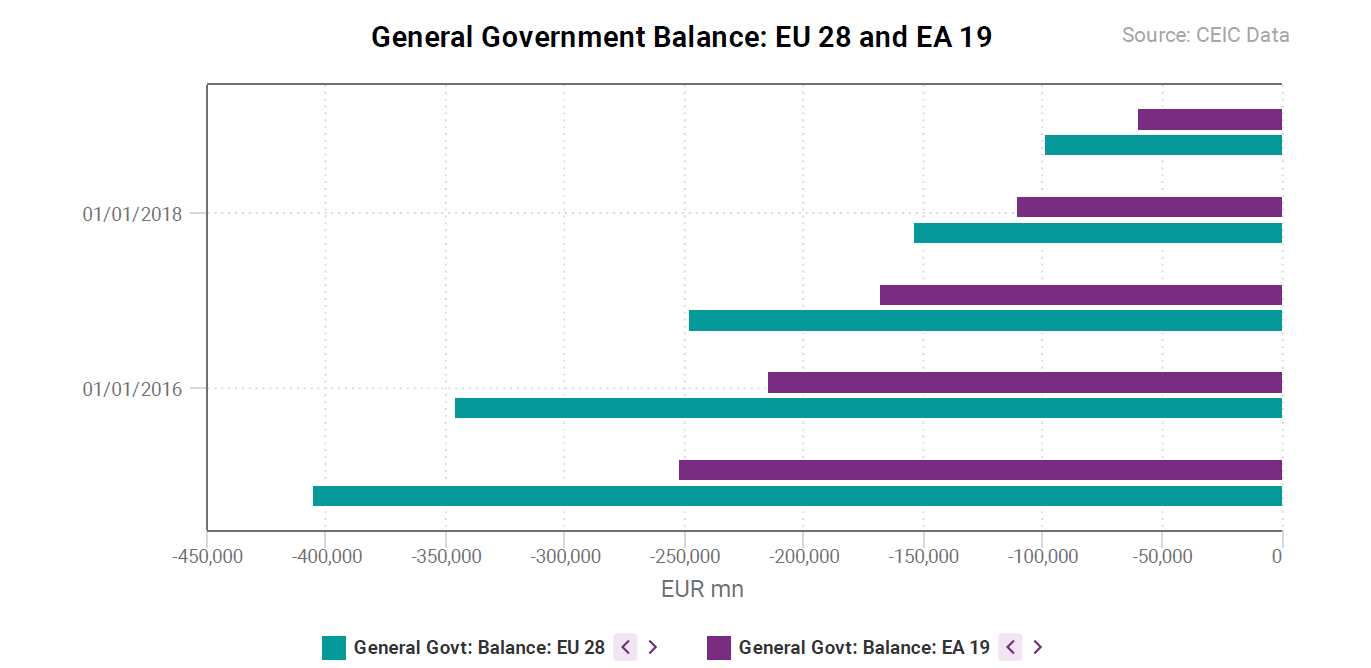

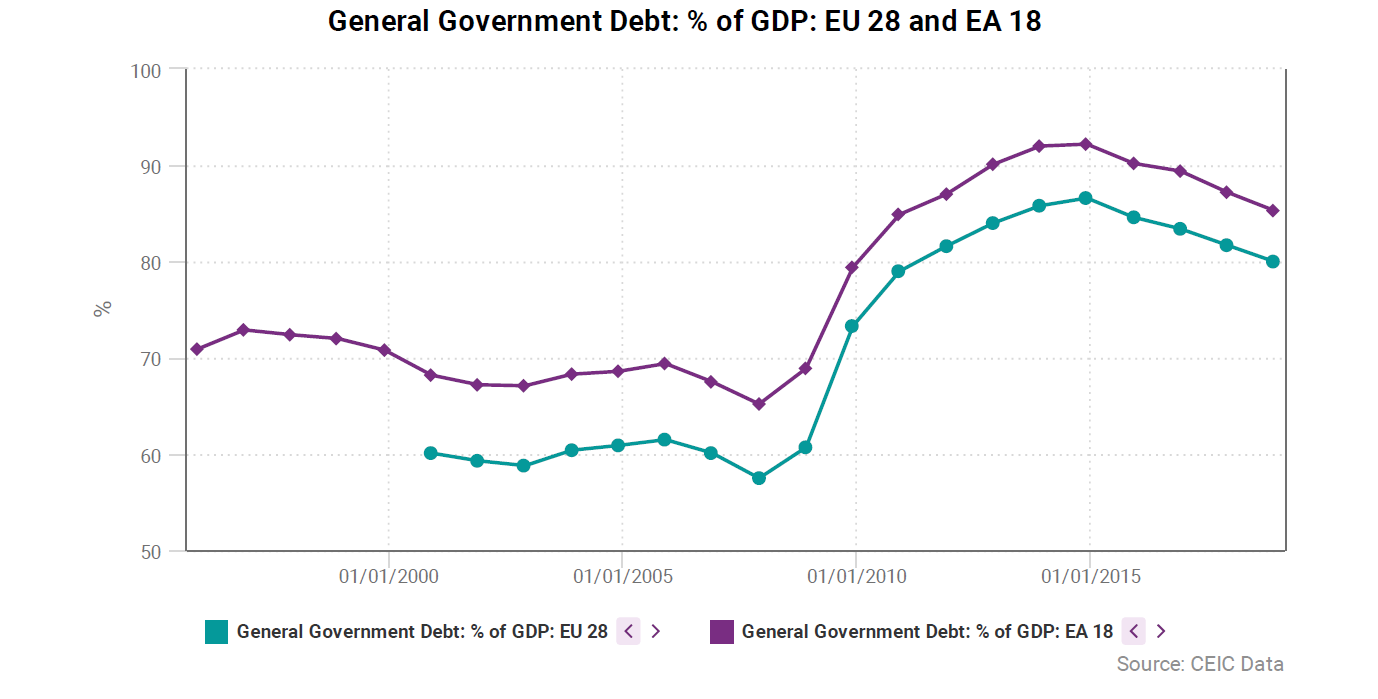

General government deficit has been decreasing since 2010.

General government deficit has been decreasing since 2010.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)