Following the ASEAN Economic Community (AEC) blueprint, the capital market enhancement is one of the visions under the pillar of “Highly Integrated and Cohesive Economy” aiming to promote the ASEAN market as an asset class, with the intention of increasing trading liquidity of the member exchanges. This dynamic analysis provide audiences a big picture of financial investment in secondary markets in ASEAN as well as necessary information regarding individual exchanges in the region.

.png?width=745&name=shutterstock_1313301461%20(4).png)

The secondary or stock markets in this case mention mainly to seven exchanges from major six countries: Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam. With the regional unique characteristic, investors are able to access the capital markets gaining diversification benefits from investment opportunities ranging from a frontier market like Vietnam to the sophisticated products in a developed market like Singapore.

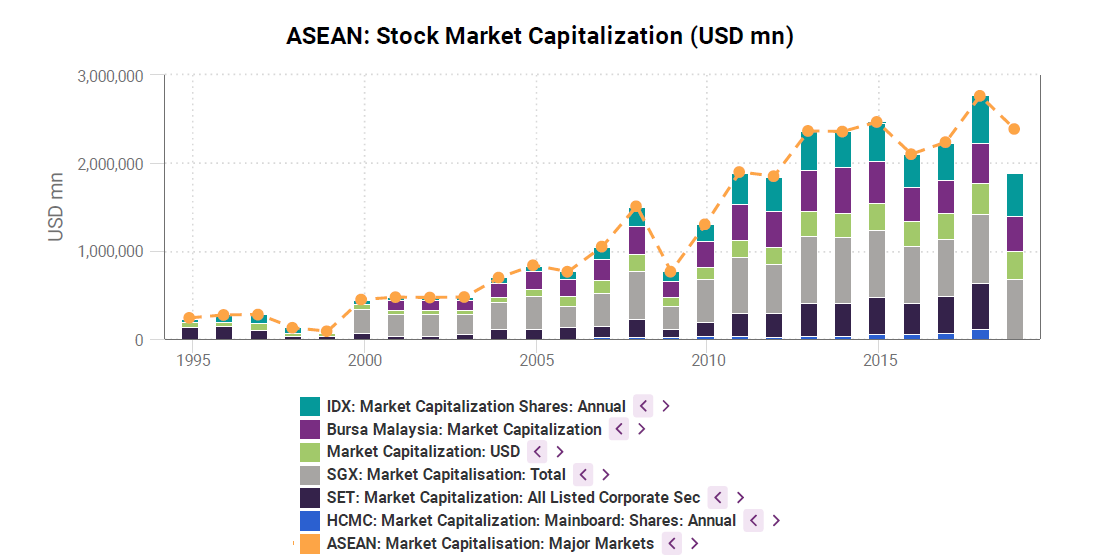

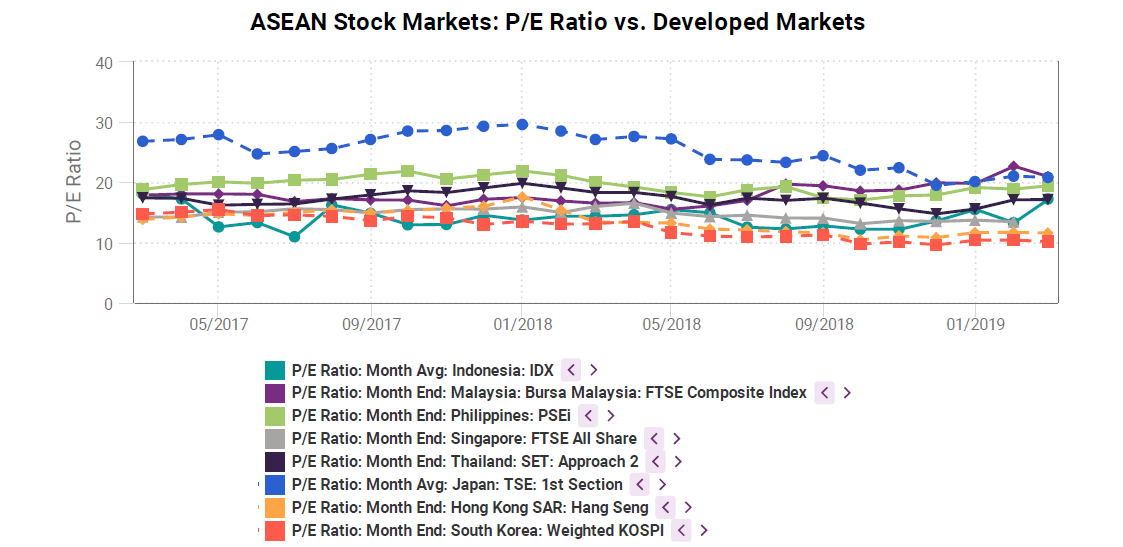

In 2017, the regional exchanges created a combination of over 3,400 listed companies together with USD2.7 trillion market capitalization. The market size advanced satisfactorily by 24% year-over-year from 2016, led by Singapore, Indonesia and Thailand, respectively. In terms of market valuation, the price to earnings ratio indicates that the member exchanges are moderate price measure compared with developed markets in Asian countries.

ff

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)