Brazil’s merchandise trade has changed over the past 20 years.

Agricultural and mineral products gradually became the main export commodities, with their share in total exports growing from 10.4% in 2002 to about 30% at the end of 2021. China was the main driver behind this change. The Asian country accounted for more than a third of Brazil’s exports in 2021, compared to just 4.2% in 2002. The US and Argentina are the other two major destinations of Brazilian exports.

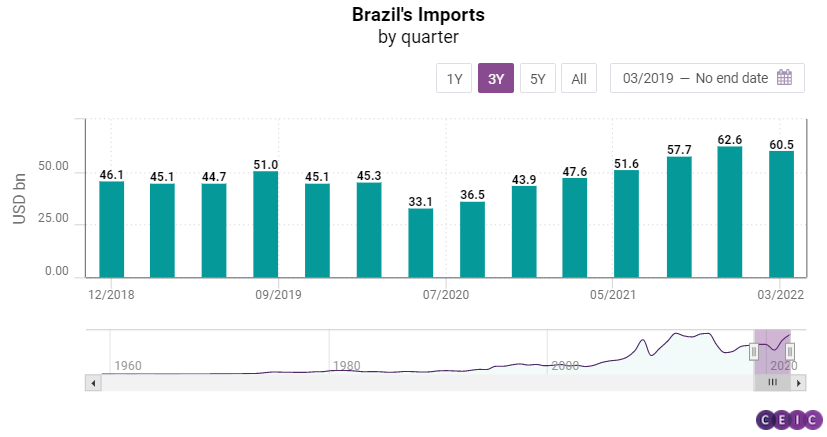

Industrial inputs and fuels are the main items imported by Brazil. Machinery, electrical equipment, and mineral fuels represented 48.3% of Brazil’s imports in 2002, compared to 39.8% in 2021. The share of fertiliser exports reached 6.9% in 2021, following the increasing global competitiveness and the growing output of Brazilian crops in the period. China overtook the US as the main source of imports.

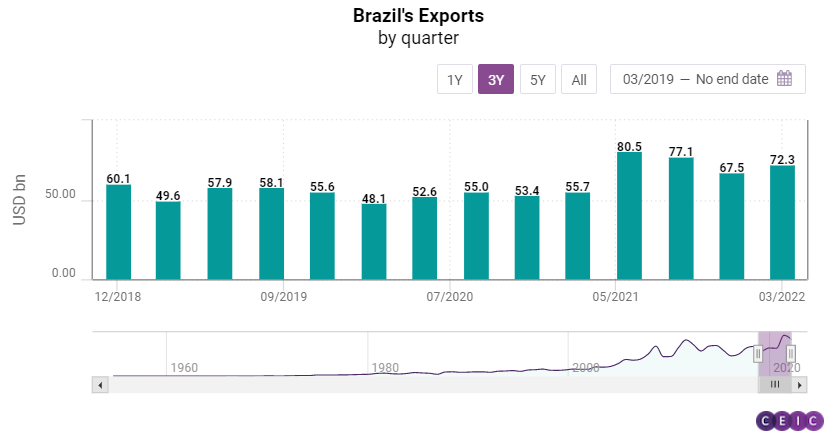

Brazil’s trade balance was USD 11.3bn in Q1 2022, up by 37.6% y/y. Exports totalled USD 72.3bn, a 29.9% y/y growth, while imports were up by 27.1% y/y to USD 60.4bn. Russia’s invasion of Ukraine at the end of February 2022 affected Brazil’s imports, particularly those of fertilisers. Brazil covered 85% of its fertiliser demand via imports in 2021 and Russia was the main source of the commodity, accounting for 23% of total fertiliser imports. Fertiliser imports were up by 106.2% y/y in value terms in Q1 2022, but down by 3.2% y/y in volume. Mineral fuel imports, on the other hand, were up by 82.7% y/y in value terms and by 13.3% y/y in volume terms during the quarter. Agricultural commodities exports benefitted from the rising global prices and soybean export value rose by 77.9% y/y, while that of unroasted coffee grew by 62.8% y/y. Fuel oil export value saw the biggest increase among manufacturing goods, rising by 184.9% y/y during the quarter, followed by beef exports with 76.4% y/y.

Brazil's trade balance is expected to reach USD 111.6bn in 2022, up 81.7% y/y, as exports may grow by 24.2% y/y to USD 348.8bn, while imports are expected to reach USD 237.2bn, up 8.1% y/y. The Russia-Ukraine war may allow Brazil to raise its maize, steel, minerals, and oil exports, as several countries are trying to replace shipments from Russia and Ukraine, following the sanctions on the former and the virtual halt of business activities in the latter. Moreover, export revenues may rise in 2022, on the back of higher commodity prices.

In order to monitor Brazil's foreign trade, we added the Comex Stat dataset of the local ministry of economy – a new addition to the Brazil Premium Database – which contains data on exports and imports broken down by:

- Value (USD mn, FOB) and volume (in kg);

- Economic activity, using the ISIC classification;

- Product and subproduct, using the HS, SITC or NCM classifications;

- Main commodities;

- Origin countries and destination countries;

- Main commercial partners.

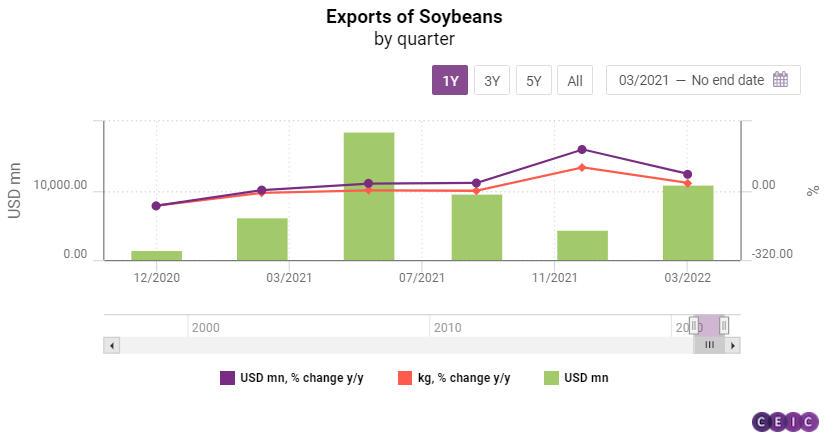

Exports

Agriculture and livestock exports totalled USD 16.4bn in Q1 2022, up by 63.1% y/y. The increase was mainly driven by the shipments of soybeans that posted a 77.9% y/y growth to USD 10.9bn in the period. Export revenues were supported by a 36.3% y/y increase in export volumes, as well as by the higher prices of grain, reflecting stronger demand at the global level. Soybeans accounted for 15% of the total value of Brazil’s exports, followed by unroasted coffee, whose exports increased by 62.8% y/y to USD 2.3bn.

The strong annual growth of soybean exports in Q1 2022 is explained by the early harvest of the grain, which means that in the second half of the year we might see a decline in export growth. Coffee shipments, on the other hand, dropped by 10.1% y/y in volume terms, due to the lower production in the off-season period. The exports of maize remained stable in volume (up 2.9% y/y) but generated revenues of USD 877.7mn, a 24.9% y/y growth. Crude cotton exports, on the other hand, reported a 9% y/y drop to USD 1.1bn in Q1 2022, reflecting the appreciation of the Brazilian real.

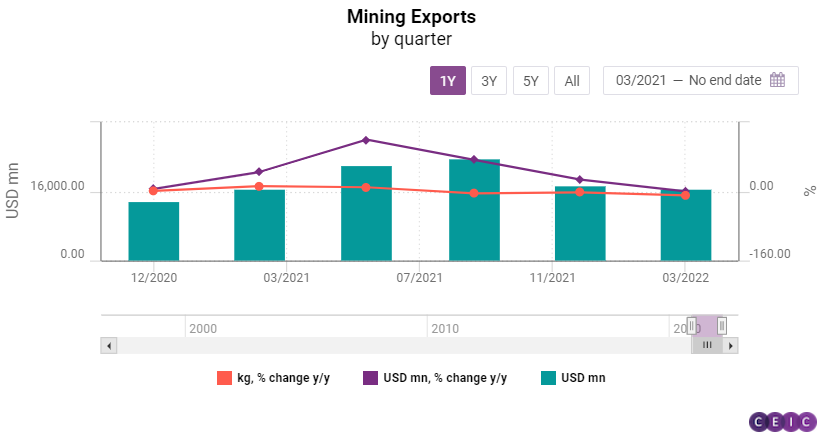

Mining exports posted a 0.2% y/y increase to USD 16.6bn in Q1 2022. Mining companies CSN, Usiminas, Vale SA and Vallourec had to temporarily suspend operations in the state of Minas Gerais because of heavy rains, thus affecting the extraction of iron ores during the period.

Consequently, iron ore exports posted a 31.9% y/y decline to USD 6.4bn and a 10.9% y/y drop in volume. Exports of copper ores totalled USD 637.7mn in the period, down by 10.7% y/y due to the COVID-19 related lockdowns in China which weighed down on demand. Shipments of crude oil jumped by 49.6% y/y to USD 9.2bn in Q1 2022, corresponding to 12.7% of Brazil’s total exports in the quarter, supported by the rising global prices amid the Russia-Ukraine war.

Sign in to access all datasets for this insight piece here. Alternatively, you can learn more about our CEIC Brazil Premium Database -the premier source for everything you need to know about the Brazilian economy, housing an unprecedented wealth of information revealing the drivers of the market.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)