The Micro Units Development and Refinance Agency, popularly known as MUDRA, is a financial institution set up by the Government of India, under Prime Minister Mudra Yojana (PMMY) for the development and refinancing of micro-unit enterprises. It is targeted to provide financial inclusiveness and support to the marginalized and hitherto socio-economically neglected classes. A total of INR 18.9tn have been sanctioned since the launch of the scheme in 2015, this has acted as a major push for the promotion of the MSME sector and may prove to be a significant tool for economic growth.

However, since its inception, there are concerns regarding the asset quality of MUDRA loans. The MUDRA non-performing assets (NPA) ratio in the outstanding loans has increased to 11.98% as of March 2021 in comparison to 5.38% in March 2018 highlighting the asset quality trouble bubbling in the scheme. This requires banks to focus on repayment capacity at an appraisal stage and monitor loans through their life cycles much more closely.

Established as a flagship refinance and guarantee scheme of the Government of India, the Pradhan Mantri Mudra Yojana (PMMY) was introduced in 2015 and aimed to provide easy access to credit to India’s vast pool of non-corporate and informal enterprises. In addition, the scheme is also aimed to extend credit to the beneficiaries from the aspirational districts identified by NITI Aayog, the policy think-tank under the Government of India, thus enabling the flow of credit to these credit-starved districts, and benefiting new entrepreneurs, especially women. The scheme uses the channel of a non-banking financial institution registered with the Reserve Bank of India (RBI) called the Micro Units Development and Refinance Agency or MUDRA Bank.

The National Sample Survey Office (NSSO) survey shows that there were around 57.7mn small or micro-units in the country in 2013, engaging around 120mn people, mostly individual proprietorships, or own-account enterprises. Among these, over 60% of units were owned by persons belonging to the less privileged sections comprising scheduled caste (SC), scheduled tribe (ST), or other backward classes (OBC). Most of these units are outside the formal banking system and are hence forced to borrow from informal sources or use their limited-owned funds. The MUDRA Loan Scheme is aimed to bridge this gap, as it encourages the younger population to become first-generation entrepreneurs, while also providing financial support to existing businesses in expanding their activities.

The PMMY is directed towards supporting micro-enterprises that propel income generation, particularly in the manufacturing, trading, and services sectors with a loan requirement of up to INR 1mn (USD 12,500). However, it was extended to agriculture and allied activities in 2016. Post its introduction in 2015, the allied activities of agriculture have also been included as eligible under PMMY. Any Indian citizen, who is eligible to avail of a loan and has a business plan for an income-generating activity can avail of a MUDRA loan under PMMY.

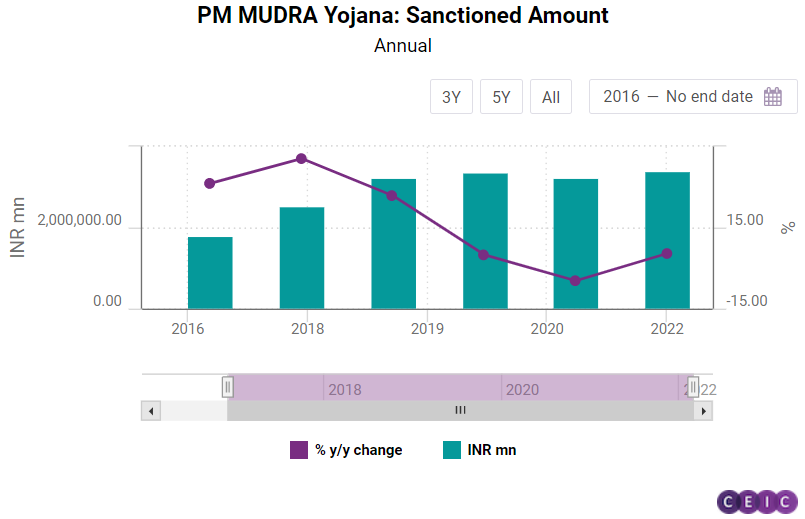

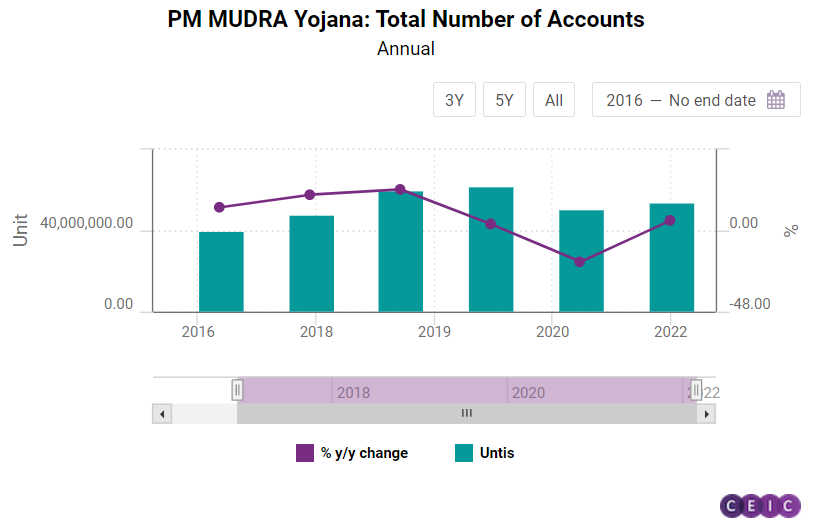

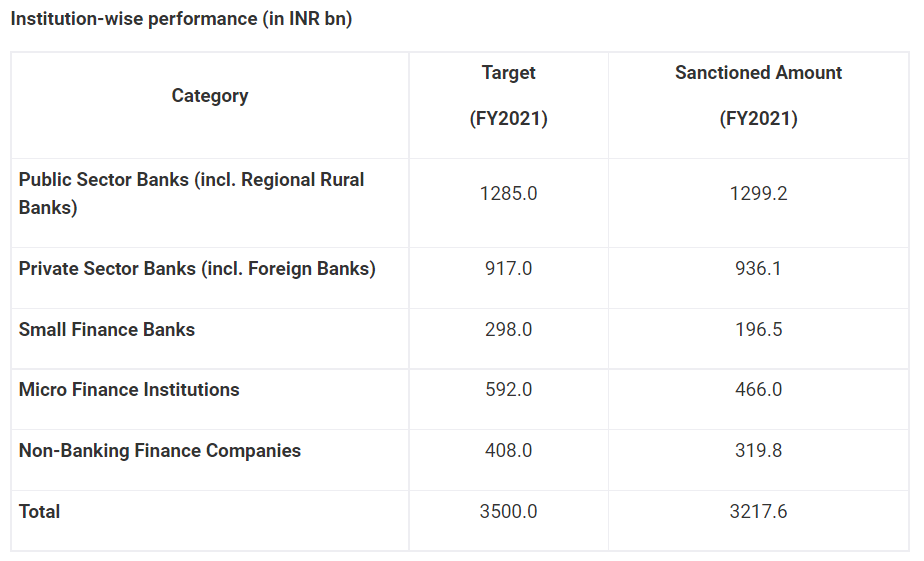

By FY2021, the flagship MUDRA program, with its mandate to fund micro-enterprises and small businesses, extended a cumulative of INR 15.5tn to 295.5mn loan accounts, primarily benefitting the borrowers from the weaker sections of the society (Mudra Annual Report, FY2021). The lending institutions, which include all the Public Sector Banks, Private Sector Banks, Regional Rural Banks, Small Finance Banks, Micro-Finance Institutions (MFIs), and Non-Banking Financial Companies (NBFCs), have exceeded the annual targets set out by the Government of India under PMMY every year. The achievement data indicates a 5% decrease y/y in FY2021 as compared to FY2020 in the overall performance of the program implemented by all the lending institutions. This was mainly due to the low volume of disbursements done in FY2021 by the NBFCs & SFBs pertaining to the COVID-19 situation in the country. However, there is a growth in respect of disbursements of Public Sector Banks and Private Sector Banks.

The Mudra loans are divided into three categories that signify the beneficiaries' growth, development, and funding needs.

The micro-enterprises loans up to INR 1mn are collateral-free, which can also be covered under Credit Guarantee Fund for Micro Units (CGFMU) operated by National Credit Guarantee Trustee Company Limited (NCGTC). Since the objective is to promote entrepreneurship among the new generation of aspiring youth, greater focus is given to Shishu category loans, which literally translate to “baby loans”, followed by Kishore and Tarun categories. Among the three categories, Shishu loans formed the largest share of 79% in terms of the number of accounts and 34% in terms of value for FY2021. Since the inception of the program, Shishu category loans have maintained the highest proportion of the sanctioned amount followed by the Kishore and the Tarun categories.

However, Shishu loan sanctions were reduced by 33% y/y in FY2021 compared to the previous year, as a result of COVID-19. At the same time, the sanctioned amount for the Kishore and the Tarun categories was raised in order to support existing businesses and meet both the term loan and working capital components of financing for income-generating activities. The disbursed amount is in ordinance with the sanctioned amount for most of the months in FY2021.

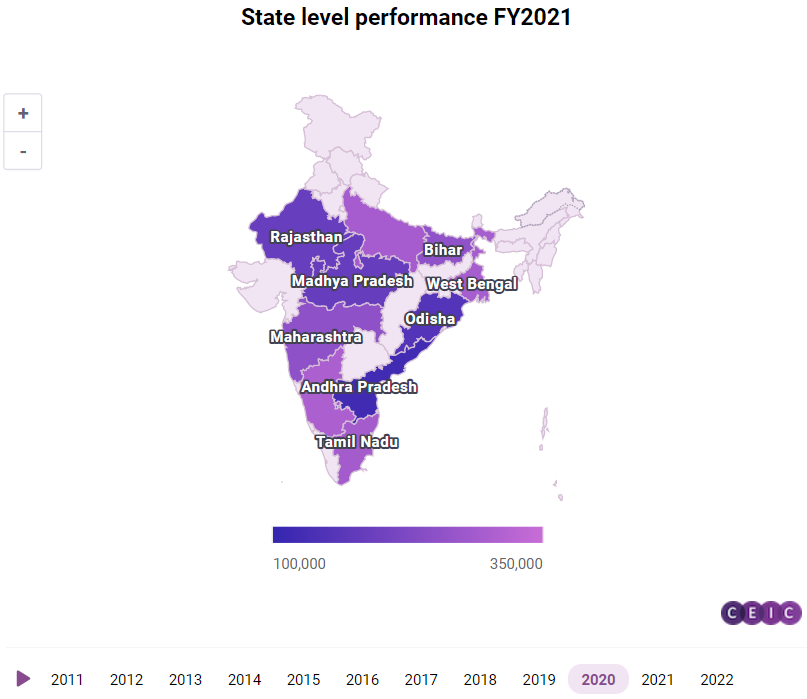

The state-level data for the year FY2021 suggests that Karnataka has topped with the sanction of INR 302bn, followed by West Bengal with INR 293.4bn, and Uttar Pradesh at the third position with INR 292.3bn. Among the districts, the top 10 formed a total of 7.6% share in the total sanctioned loans during FY2021, since these were urban centers with large potential for small business activities as well as the presence of a large number of financial outlets to serve them. Considering the category-wise sanctioned loan amounts in FY2021,

Tamil Nadu held the largest share of disbursements in the Shishu category (15.6%) followed by Maharashtra (14.81%), and Uttar Pradesh (11.89%). Under the Kishore category, the highest amount was disbursed by West Bengal (17.08%) followed by Karnataka (13.9%), and Uttar Pradesh (11.72%). Lastly, under the Tarun category, Uttar Pradesh topped the sanctioned (15.13%) followed by Maharashtra (14.69%), and Karnataka (13.57%).

Sign in to access all datasets for this insight piece here. Learn more about the CEIC India Premium Database - the premier source for everything you need to know about the Indian economy, housing an unprecedented wealth of information revealing the drivers of the market.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)