Monetary policy is a key tool of central banks in maneuvering the economy and is of great interest for those monitoring the economy in real-time.

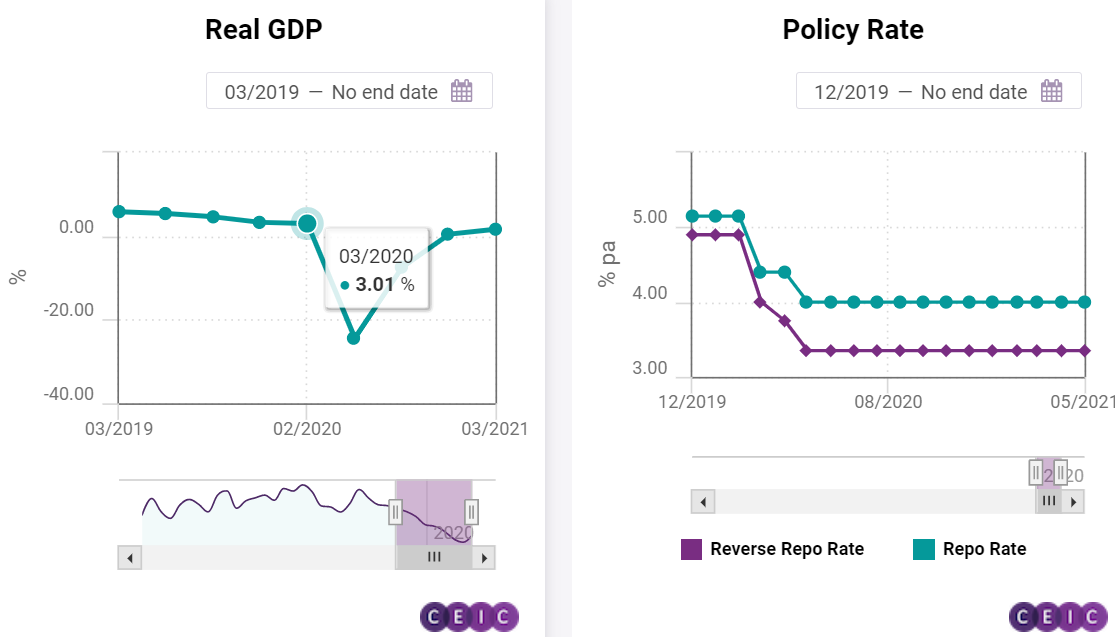

The Reserve Bank of India (RBI) set up a Monetary Policy Committee (MPC) in August 2016 that has three internal and three external members for truly independent policymaking. The MPC meets every two months to deliberate about the policy rate. A decision is reached after assessing multiple indicators of both domestic and global economies, as well as developments, such as monetary policies in advanced economies which have a ripple impact on emerging market economies. At the June 2021 monetary policy announcement, the MPC unanimously voted to keep the policy rate unchanged at 4% while maintaining an accommodative stance to focus on economic growth.

Besides growth and inflation, the MPC members evaluate other high-frequency economic indicators as well as results of survey data that reflect the probable trajectory of the economy, such as indicators of demand, consumption, production, company performance, credit conditions, tax collections, services, and infrastructure. This brings us to the question – what are the experts looking at?

The monetary policy is usually divided into three main segments – the global economy, the domestic economy, and finally, an outlook for the economy. At the international level, the pace of vaccinations and stimulus packages are driving recovery in major advanced economies, however, the pent-up demand in conjunction with elevated input prices have caused inflation in these countries to rise. Emerging markets are also seeing the impact of global food and commodity prices in the form of high inflation.

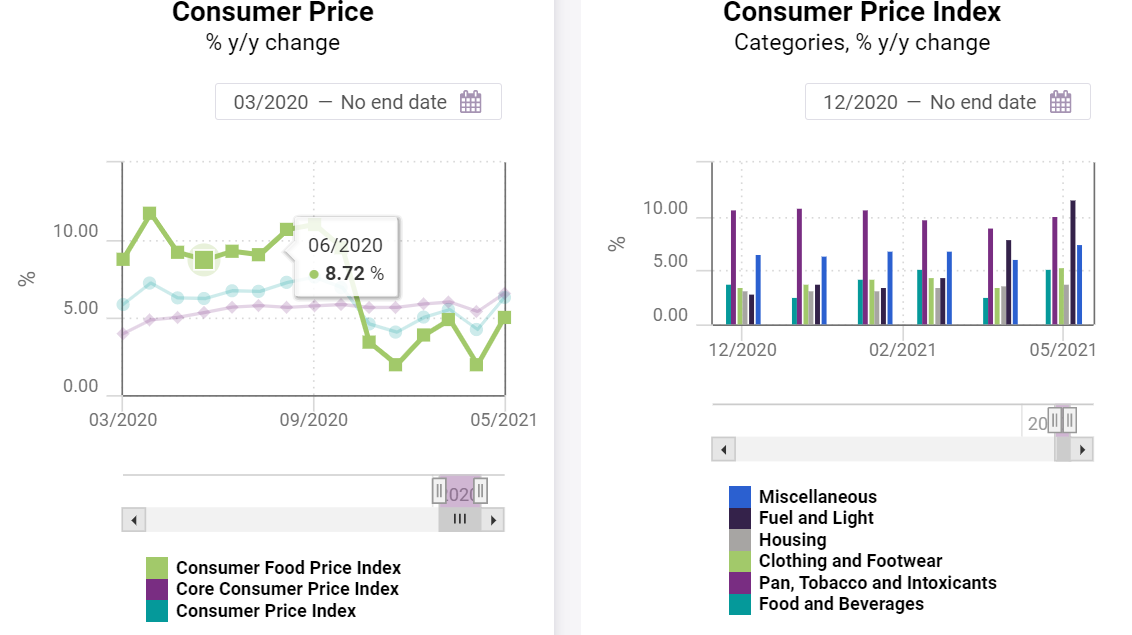

This has resulted in many EMEs increasing their policy rate in recent months, such as Brazil, Russia, and Turkey, which increased policy rates by 75 bps, 50 bps, and 200 bps, respectively. On the domestic front, India is also witnessing a sharp increase in inflation. The headline inflation soared to 6.3% in May 2021, as compared to 4.2% in April. The core inflation has remained above the headline figure since December 2020 and jumped from 5.4% in April to 6.6% in May 2021. At the same time, inflation expectations are also firming up, as per the inflation expectations survey of households. This is particularly concerning as sticky core inflation coupled with high inflation expectations can start an inflationary spiral, putting the MPC in a difficult position, especially now, in light of the second wave of infections, when growth needs to be prioritised.

India had to deal with double-digit inflation in 2013, which was then brought under control using an inflation targeting model, introduced in 2015. Under this inflation targeting regime, the MPC focuses on the growth mandate as long as inflation stays below the target, or rather a target band. At present, this target is set at 4% ± 2%. India saw three consecutive rate cuts between March and May 2020, leading to an effective reduction of 115 bps, from 5.15% to 4%.

Despite eight months of above target inflation, the MPC kept the policy rate unchanged. While core inflation remained sticky, headline inflation came back within the target band in December 2020. However, this time the increase in inflation seems steadier and the upside risks may outweigh the downsides. The wholesale price index has also been undergoing a persistent rise as a result of high fuel and power prices, increasing by 37.6% y/y in May 2021, which is already beginning to ripple onto retail prices.

The recovery in consumption is a very gradual one. Private final consumption expenditure has registered an increase after three consecutive quarters of decline, by 2.7% y/y. The consumer confidence (the current situation index) has declined the second time in a row, to 48.5 in May 2021, a historic low. The future expectations index has declined to 96.4, even below its May 2020 value. However, it is interesting to note that a net 31.4% of the respondents believed consumer spending in the current year is higher as compared to the previous year. This fact is also echoed by the increased production of consumer durables, and greater passenger car sales on the wholesale front. The second wave of infections has brought back the uncertainty that prevailed in the first half of FY2021., and these mixed signals of consumption suggest that consumer demand still remains subdued. At the same time, high input costs are beginning to impact inflation, which as mentioned above, could have a detrimental effect on growth.

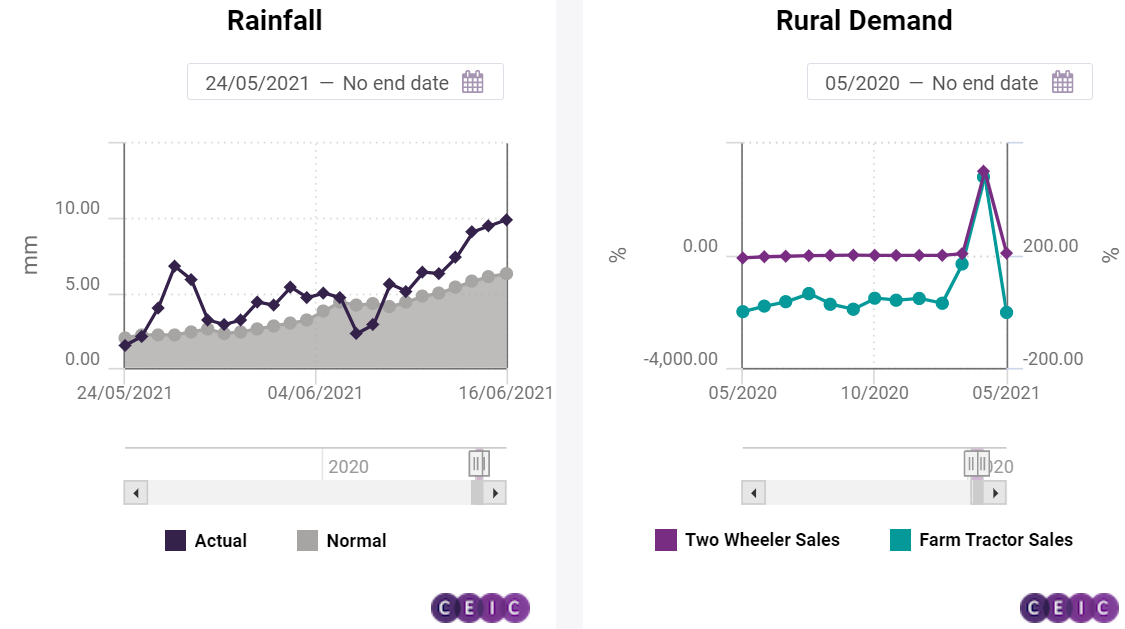

In 2020, when most of the economy was affected by COVID-19 and the lockdown, the rural sector emerged as the unlikely flagbearer of the economic recovery. As early as August 2020, rural indicators had started registering a growth, such as two-wheeler sales, and farm tractor sales. Between March and April 2021, both indicators experienced a surge thanks to the low base.

However, the rise in COVID-19 cases has caused farm tractor sales to decline in May 2021, and two-wheeler sales to slow down. On the bright side, the Indian Meteorological Department has also predicted a normal southwest monsoon for 2021, with rainfall at 101% of the long period average.

Sign in to access all datasets for this insight piece here. Alternatively, you can learn more about the CEIC India Premium Database - the premier source for everything you need to know about the Chinese economy, housing an unprecedented wealth of information revealing the drivers of this market.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)