The Thai government has been stimulating economic activity to boost consumer and investor confidence.

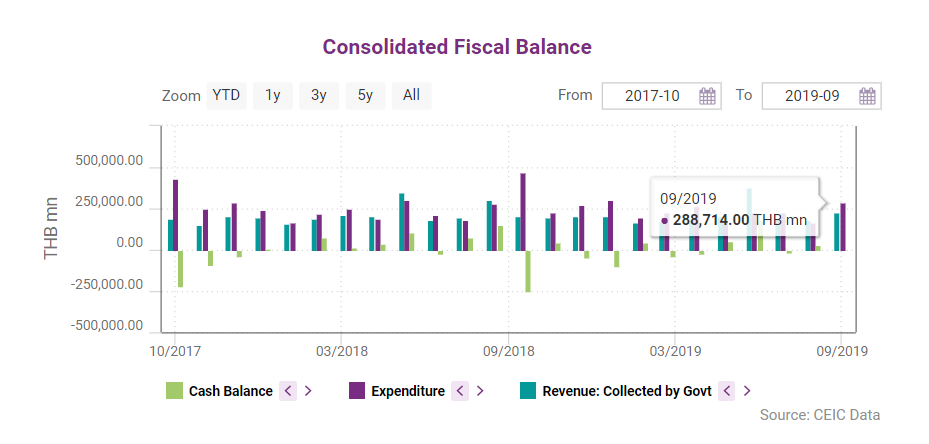

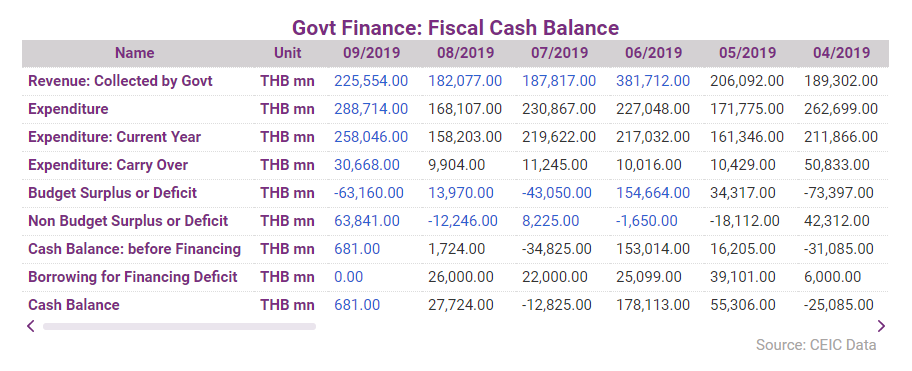

In FY2019, the total approved budget expenditure was THB 3,000bn, down by 1.6% compared to the previous fiscal year. For the first nine months of FY2019 (October 2018-June 2019), the government accumulated revenue and expenditure amounting to THB 1,943bn and THB 2,355bn, respectively. This resulted in a fiscal cash deficit of THB 412bn,

THB 82bn less than during the same period of 2018. The nine-month deficit was also lower than the limit of THB 450bn set by the government. the balance was negative, standing at a deficit of THB 136bn, or equivalent to 1.04% of GDP.

Government finance

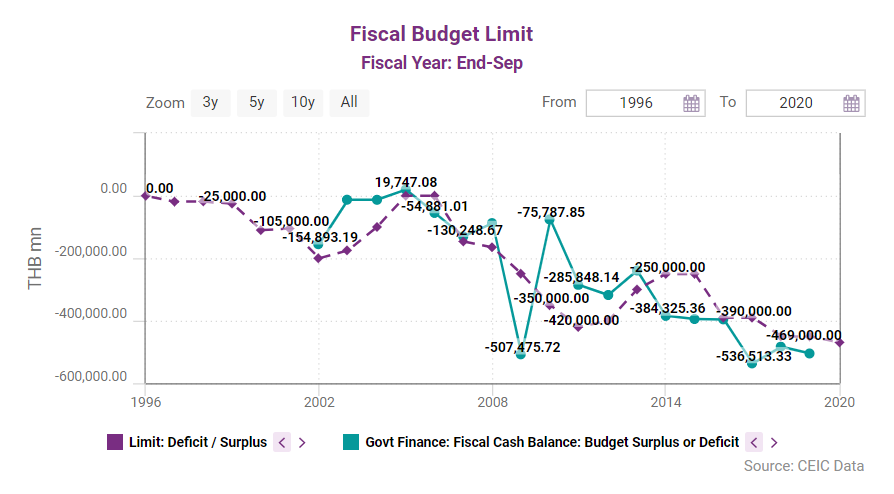

According to the Budget Bureau Director Dechapiwat Na Songkhla, the budget deficit situation is still under control given the fact that the deficit is under the ceiling set by the bureau of THB 710bn or less than 20% of annual expenditure. Recently, the government has set goals to increase tax revenue and reduce infrastructure spending by setting public-private partnerships (PPP) and the Thailand Future Fund (TFFIF), a government infrastructure fund.

The TFFIF is raising funds to the Thai government and is financed through initial public offering (IPO) at the Thai stock market. The Thai government recently approved the stimulus campaign proposed in August 2019.

The new stimulus programme is expected to improve economic growth by at least 0.55% and contribute to a full-year economic growth of 3% or more, finance minister Uttama Savanayana said. The THB 316bn package aims to encourage household spending, including boosting the tourism sector. Besides, the Thai cabinet is also providing support to farmers and small businesses through easing state banks’ lending interest rate and extending loan terms.

Government budget

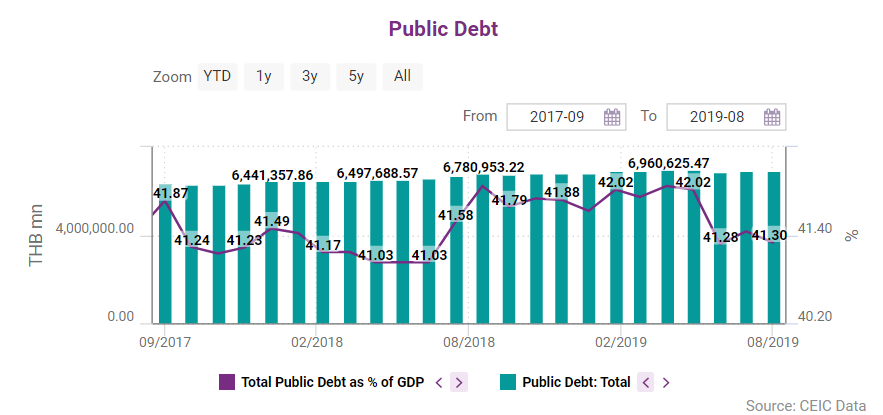

The government continues to claim that the current budget deficit remains within the fiscal framework. Thailand has retained a generally healthy debt position. The external debt remains traditionally low and the percentage of to GDP stood at 34% and 41.3%, respectively, as of June 2019, firmly under the cutoff limit of 60%.

These low debt ratios, which have been stable for years now, speak positively about the Thai government’s ability to maintain fiscal sustainability over time and in different economic and political conditions as well as about its capability to cushion global risks.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)

.png)