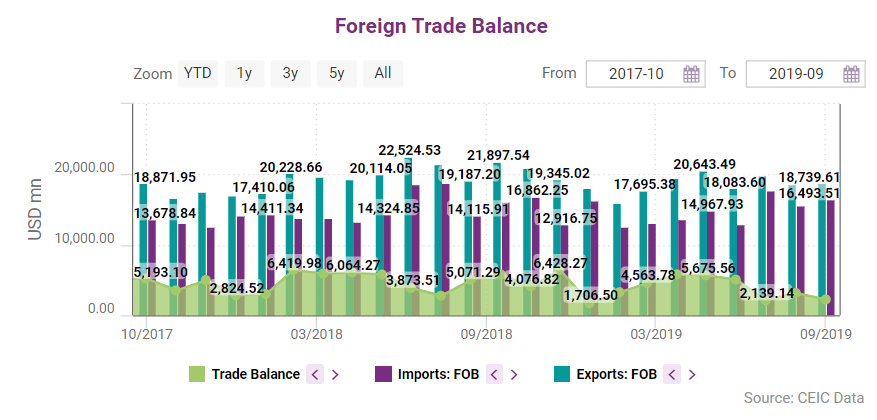

Amid global deceleration in trade volumes, Colombia’s exports grew in Q2 by 5.24% on a yearly basis.

The increase comes as a consequence of an expansion in exports of mineral fuel, oil and its products - the country’s highest grossing fraction of exports. In the same period, imports grew by 8.68% y/y, underpinned by growth in imports of mineral fuel, oil and its products, vehicles and pharmaceutical products by 53.62%, 17.06% and 5.36% y/y, respectively. Colombia has sustained its extremely wide current deficit, standing at USD 939.69mn in June 2019, down by 4.82 y/y but up by 8.22% compared to the previous month.

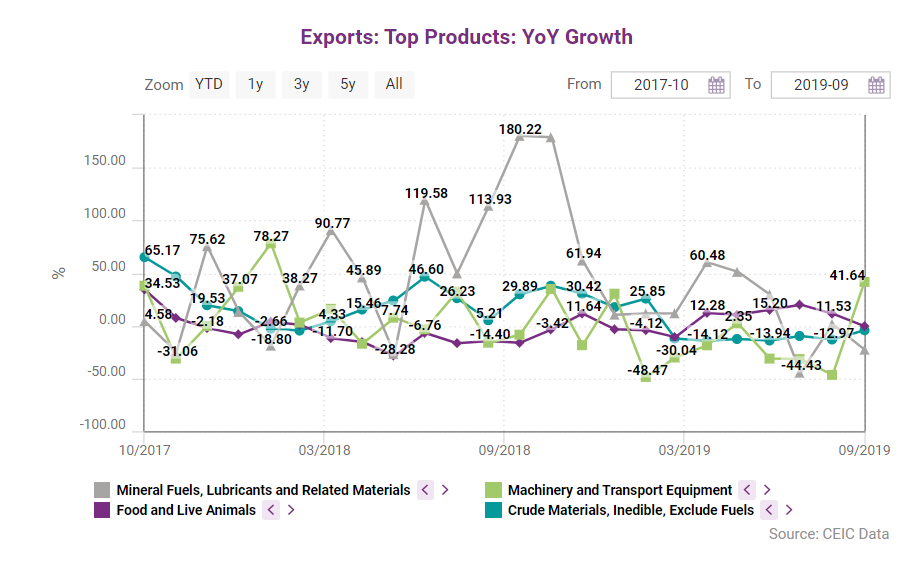

Colombia's exported products

Colombia’s mineral fuel and oil exports, which constituted 58% of total exports as of Q2 2019, expanded slightly by 2.27% on a yearly basis, underpinned by a 2019 high of crude oil prices in mid-May at 74.70 USD per barrel. However, global oil prices have been on a downward trend since then, down to 56.29 USD per barrel on August 8. Given the lack of structural reforms to diversify the economy, this volatility has had a great impact on exports in general, which have dropped steeply to USD 3,043.5mn in June 2019. Coffee exports, another essential exports sector, are stagnating, as they grew by a mere 0.16% on a yearly basis in June.

Amid low oil prices and slowing industrial production growth in the US – Colombia’s major trade partner – Colombian exports to the US contracted by 10.17% y/y in June. Analysts argue that uncertainties coming from the protectionist policies on behalf of the US have begun to affect trade volumes worldwide. In contrast, exports to other major export partners such as Mexico and Ecuador grew by 7.91% and 19.21% on a yearly basis, respectively.

Imports of nuclear reactors, boilers, machinery and parts – the country’s highest grossing fraction of imports – contracted by 4.19% in June, down from a 9.47% y/y increase in May. The second-highest grossing sector – electric machinery – has been on a downward trend for the past quarter: its growth stood at -7.14% y/y in April before plunging to -11.70% in June.

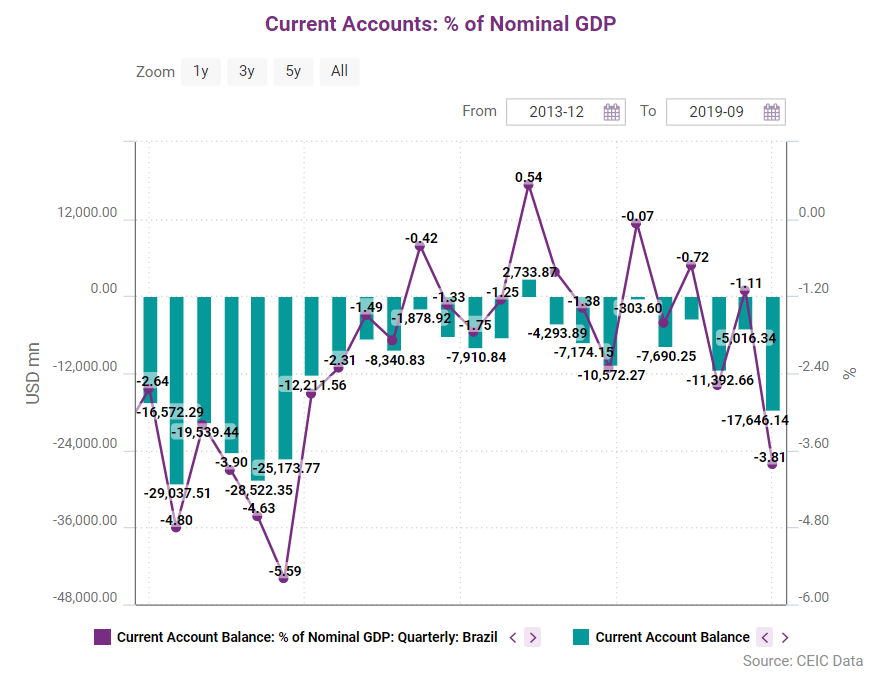

Current accounts and FDI

Given the substantial trade imbalances, Colombia’s current account deficit has been gradually widening for the past year from USD 2.8bn in Q1 2018 to USD 3.61bn in Q1 2019, which accounts for 4.6% of nominal GDP – a figure that is significantly larger than other economies in the region. The current account imbalance is a continuous issue and a hurdle for the Colombian economy, as it reached an all-time high of -7.16% in Q3 2015 due to low oil prices, but was later limited to more sustainable levels of -1.88% at the end of 2017. On a positive note, foreign direct investment has been on the rise, up to USD 3.85bn in Q2 2019 and now represents 4.96% of GDP.

Foreign investment in petroleum dropped in Q2 by 17.29% y/y, but the effect was counterbalanced by a 16.49% y/y expansion in investment in Colombia’s biggest fraction of FDI – financial intermediation activities. Although at record-low levels, foreign portfolio investment has grown on an annual basis, up to USD 666.8mn and 0.85% as a fraction of GDP in Q1 2019, indicating a slight but insufficient increase in investor confidence towards the Colombian market.

The growth is underpinned by an annual increase in the value of foreign investment on the bonds market, while the deficit in equity investments has slightly narrowed down to further strengthen the effect.

Access our Q3 report suite, including the full CEIC Colombia Economy in a Snapshot Q3 2019 Report here.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)

.png)