After Jokowi’s re-election in April, the Indonesian government seems set to address the weakening global demand by boosting the economy through investment and exports.

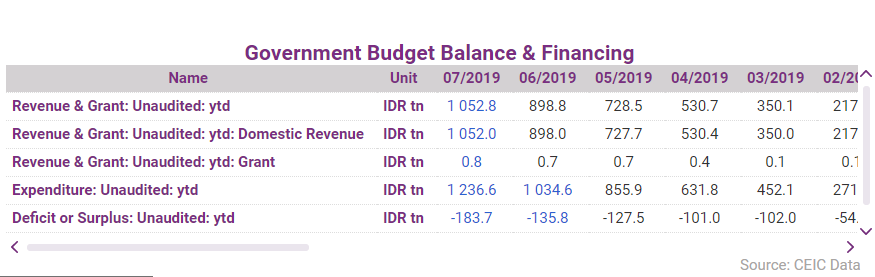

The year 2018 saw a tightening of the fiscal policy and Indonesia recorded the smallest budget deficit in six years standing at 1.8% of nominal GDP. Given the 3% threshold limit set by law, the government theoretically has enough room to pursue a more ambitious spending programme. Nevertheless, with a commitment to a 1.8% fiscal target for 2019 it seems unlikely that huge spending will occur at least until US-China trade relations and the resulting pressure on the rupiah are resolved.

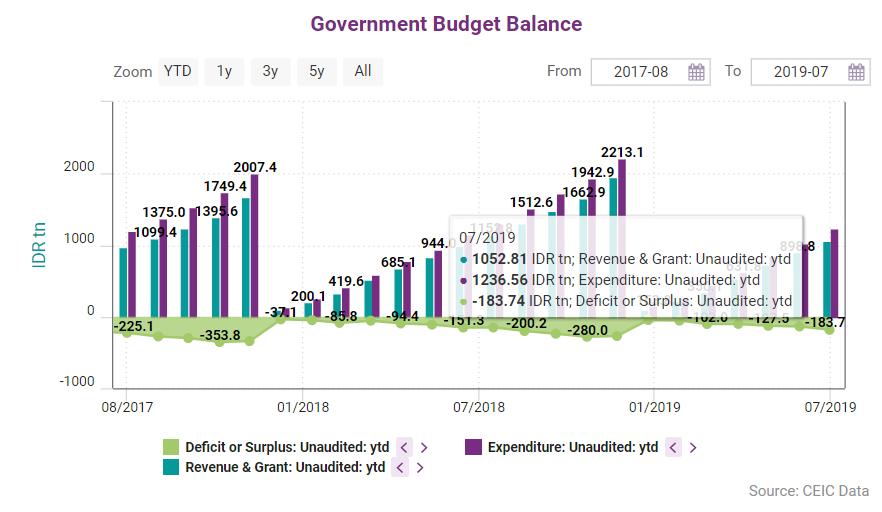

Government budget deficit for the January-April period amounted to IDR 101tn, almost double the amount from the same period of last year, with government expenditure rising to IDR 631.8tn from IDR 452.1tn at the end of March. The development came as a result of an 8.3% annual increase in expenses, while revenue remained almost unchanged – 0.5% growth y/y.

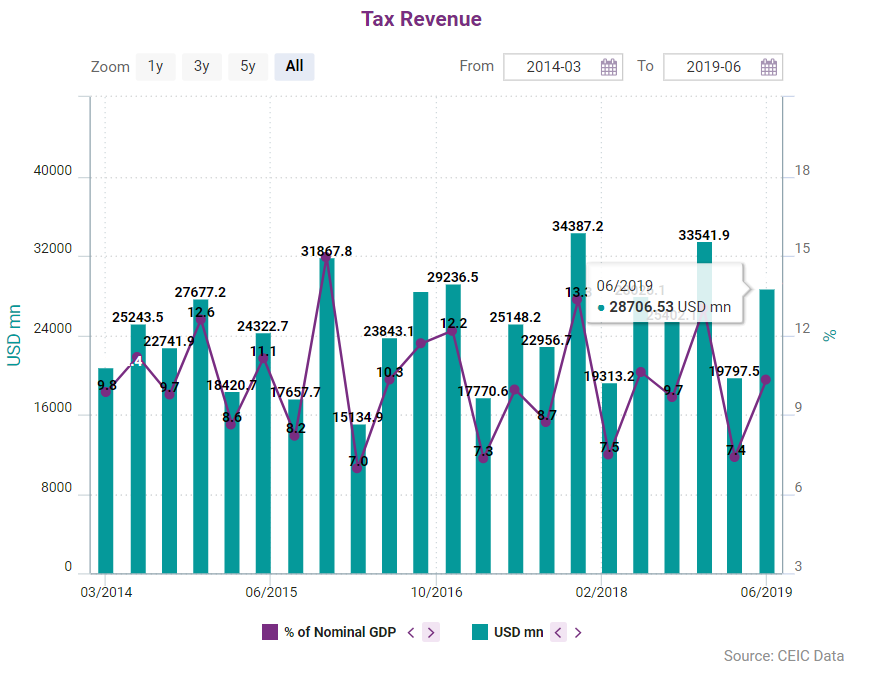

While the government revenue rate came at 102.5% of its target in 2018 as a result of the government’s tax revenue programme, the prognosis for 2019 is more pessimistic, with the Center for Indonesia Taxation Analysis (CITA) projecting an 88.9% return on the INR 1,560tn target this year. The growth of tax revenue decelerated to 7.4% in Q1 against 13.1% in Q4 2018, however, the first quarters of the year are generally the weakest in terms of tax collection. According to CITA, the slow economic growth and the stagnation in foreign trade are hampering tax revenue collection.

The 2019 infrastructure development budget is to be raised by 2.4% y/y to IDR 420tn. Improving national infrastructure is a key pillar of the current government’s development agenda, and there are expectations for continued growth in the years ahead. In the 2019 budget, the allocation for infrastructure spending of almost USD 30bn accounts for around 17% of the total planned spending.

You can download the full CEIC Indonesia Economy in a Snapshot Q2 2019 report here.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)