More than a year after the onset of the COVID-19 pandemic, the global economy is on a recovery path, albeit not without its side effects, like accelerating inflation in some markets.

The revived international trade is one of the recovery pillar hopefuls in 2021 and beyond, underpinned by the efforts to enhance free trade. A key example of those is the Regional Comprehensive Economic Partnership (RCEP) treaty, which was signed on November 15, 2020, after eight years of negotiations. The UK, on the other hand, is making intense efforts to strike bi- and multilateral trade agreements now that it is no longer a member of the European Union.

Apart from diving deep into key economies' foreign trade data, one can draw broader conclusions about trade based on shipping data. International trade in goods is still largely carried out by container ships, therefore container handling in ports is an important indicator of global trade. Such datasets have been added to the CEIC Database, allowing for reliable estimation of short-term trends in international trade. Due to its comprehensive coverage of over 90 major ports, which handle over 60% of global container traffic, the data provides means of easy comparison between the individual ports' performance.

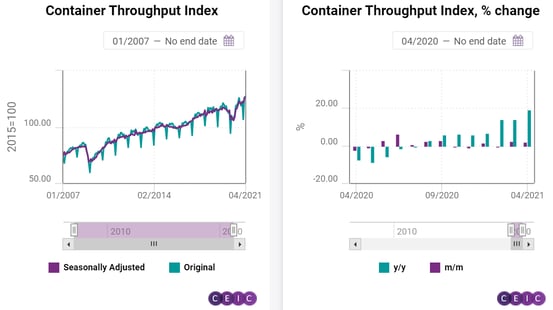

The Institute of Shipping Economics and Logistics (ISL), a leading body for research, advice, and know-how in maritime logistics, publishes its container throughput index in cooperation with the RWI-Leibniz Institute for Economic Research. The indicator is based on the consideration that containers have become the most important means of transporting processed products, which implies that global container throughput and international trade would tend to be highly correlated. The container throughput index is calculated at the end of each month based on the available data reported by the ports.

It excludes any missing values not provided by any ports. The index could contribute to the business cycle analyses, because it is available three to four months in advance of data on world trade published by international organizations, and one month in advance of the first estimates of world trade volumes.

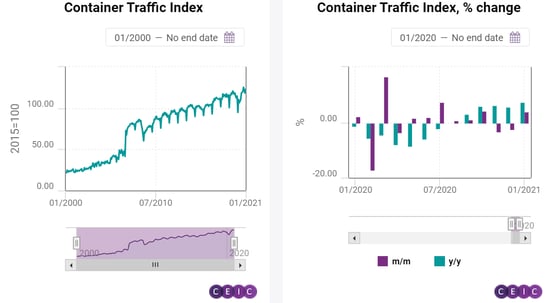

The container traffic index is a similar indicator, however, it includes additional ports, mostly those that report rather late, hence it is a broader indicator, but not as timely as the throughput index.

The ISL dataset further includes container traffic data (monthly and quarterly) in twenty-foot equivalent units (TEU). TEU is based on the size of a standard container with 20 feet length (appr. 6 meters), 8.5 feet height, and 8 feet width.

In November 2020 the UN Conference on Trade and Development (UNCTAD) announced preliminary estimates, according to which the global maritime trade would contract by 4.1% in 2020 due to supply chain disruptions. Although the forward-looking estimates are subject to many assumptions, which can vary depending on the highly uncertain global political environment, the UN body forecasts a 4.8% growth of maritime trade in 2021.

As the shipping industry was forced to rapidly adjust to the pandemic-related restrictions in 2020, it focused on staying profitable rather than maintaining market share. This resulted in relative stability, especially considering the subdued demand in 2020, says the UNCTAD report. Nonetheless, the longer-term outlook for the shipping industry and international trade, in general, should take into account the push towards shorter supply chains and lower dependencies on remote production destinations. In this sense, the UN report points out that as of March 2020, 20% of global trade in manufacturing intermediate products originated in China, compared to 4% in 2002.

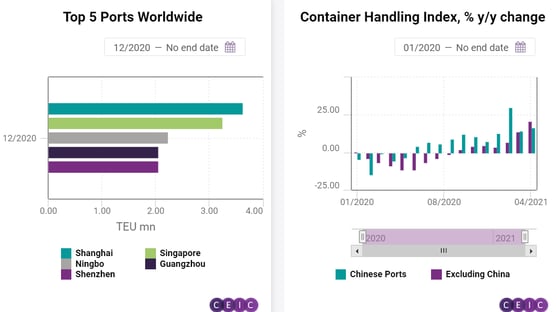

A quick glimpse at the top five busiest ports worldwide again puts China in the spotlight of international trade. Singapore is the only non-Chinese port in the top five. The rest are Shanghai, Shenzhen, Ningbo, and Guangzhou. China started setting the stage for global recovery back in Q2 2020, as its economy registered an expansion on an annual basis. Further, it was the only big global economy that managed to register growth in the full year 2020.

Sign in to access all datasets for this insight piece here. Alternatively, you can learn more about the CEIC China Premium Database - the premier source for everything you need to know about the Chinese economy, housing an unprecedented wealth of information revealing the drivers of this market.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)