-png.png?width=747&name=shutterstock_693781024%20(1)-png.png)

Brazil saw a substantial decline in inflation rate between April and August 2020, when many business activities were subdued due to the COVID-19 pandemic.

This allowed the central bank to expand the monetary relief programme that started a year earlier. The central bank cut the key interest rate SELIC gradually to a record low of 2% in August 2020. To avoid a significant decrease in households’ income, caused by a struggling labour market, the federal government put aside its fiscal austerity programme and increased expenditures by more than BRL 524bn (around 7% of GDP) as of December 31, 2020. The bulk of it (56%) was spent on the emergency aid – an income transfer programme to assist unemployed, informal and self-employed workers affected by the pandemic. Initially, the programme envisaged monthly payments of BRL 600 in April, May and June, but the government extended these payments until August and further on from September to December but with the monthly payments reduced to BRL 300.

The emergency aid allowed many low-income families to recover their purchasing power, leading to a significant increase in the country’s domestic demand. The retail sector has been growing by over 5% y/y in each month since July. From January to October 2020, retail sales grew by 0.9% y/y.

On the supply side, many producers have been operating with lower inventories, as factory closures during the lockdown between March and May had a negative impact on manufacturing output. Moreover, the second half of the year was an off-season period for some key segments in agriculture. Costs in the agriculture sector were on the increase and so were exports, supported by a favourable exchange rate. Consequently, Brazil is facing a contraction of supply and an increase in demand.

The Brazilian real depreciated throughout the first half of 2020 and remained quoted above an unprecedented exchange rate level of USD/BRL 4.9 during the second half of the year. Some sectors with inputs quoted in dollars saw a significant increase in costs. Companies on the agriculture and livestock sectors opted to increase exports as a strategy to increase dollar revenues and offset the surge in costs, which further restricted the food supply in the country.

Therefore, the monetary and fiscal measures to mitigate the COVID-crisis that boosted the retail sector, and the supply shock influenced by the exchange rate depreciation, led to an inflationary pressure both on consumer and producer side.

In order to monitor the growing inflationary process we added the dataset of the Getulio Vargas Foundation (FGV) – a new addition to Brazil Premium Database – which contains the following series on inflation:

- The Producer Price Index IPA-M monitors prices of agricultural and industrial products in corporate transactions, that is, at stages preceding households’ consumption.

- The Consumer Price Index IPC-BR-M calculates average price variations of goods and services demanded by families with incomes up to 33 times the national minimum wage in seven major cities in the country.

- The National Construction Cost Index INCC-M monitors house construction costs.

- The General Market Price Index IGP-M is an overall indicator of price movements which considers different stages of the production process. It is a weighted average of the IPA-M, the IPC-BR-M and the INCC-M.

FGV vs the official inflation data

The IGP-M is widely used in the country as a benchmark to readjust prices of rentals and energy, on an annual frequency, according to the inflation of producers and families. Hence, the variations of the IGP-M impact the official consumer inflation in future periods, as rentals and energy have a significant share in the official consumer price index, the IPCA, calculated by the Brazilian Institute of Geography and Statistics (IBGE). Moreover, the breakdown of the FGV indexes allows detailed monitoring of the country's inflation and its impact on the costs of various sectors and products.

In December, the FGV reported substantial inflationary pressures in several stages of economic activity. The producer price index IPA-M rose by 31.6% y/y in the month, reflecting higher agriculture prices and, to a lesser extent, higher manufacturing prices. In parallel, the official consumer price index (IPCA) grew by 4.3% y/y in November, exceeding the inflation target of 4% for 2020. The prospect of price adjustments in the first half of 2021, based on the current inflation indices, may cause inflation to accelerate further and prompt the central bank to raise the SELIC rate throughout 2021.

Supply shock and higher producer prices

The IPA-M producer price index rose by 31.6% y/y in December 2020, compared to 9.1% y/y in December 2019, reflecting higher producer prices for agricultural and livestock products. The combined increase of IPA-M in these two segments in December 2020 was 49.4% y/y, supported by some negative supply shocks. In the first four months of 2020, the Brazilian real depreciated by over 30% against the US dollar, and has remained above BRL 4.9 per USD since April, influenced by a higher uncertainty on international markets, which caused a capital outflow from emerging economies. Hence, agriculture and livestock costs rose on the back of the growing prices of some inputs such as fertilizers, pesticides, and grains in USD.

The currency depreciation also prompted some producers to increase exports and receive higher revenues in BRL. In addition, the production of rice and beans, which are widely consumed in Brazil, fell significantly in the off-season second half of the year. Consequently, the domestic supply of food has shrunk since September 2020, resulting in higher food prices.

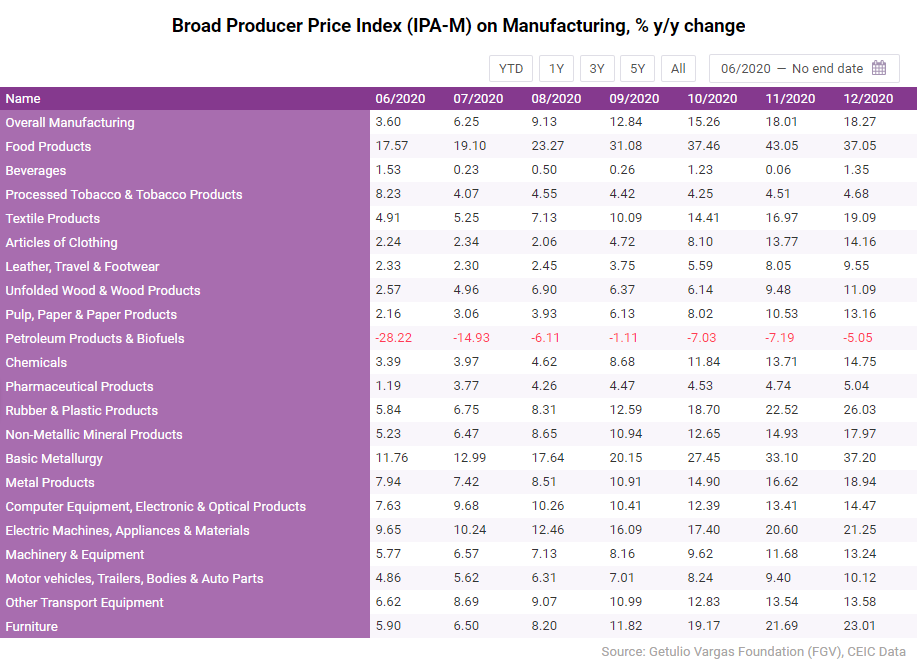

Inflationary pressures also occurred in the manufacturing industry, but to a lesser extent. The local currency depreciation raised costs for many segments in the manufacturing. Moreover, the restricted activity in the factories between March and June caused a shortage of industrial inputs in some supply chains. Hence, many manufacturing segments are operating with lower inventories, which is also pushing producer prices up. The segments which saw the highest increases in the FGV producer price index IPA-M in December 2020 were basic metallurgy with 37.2% y/y, food products with 37.1% y/y, rubber and plastic products with 26% y/y, and furniture with 23% y/y.

You can download the full data analysis for free here. Alternatively, learn more about CEIC Data Brazil Premium as well as the FGV IBRE data here.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)