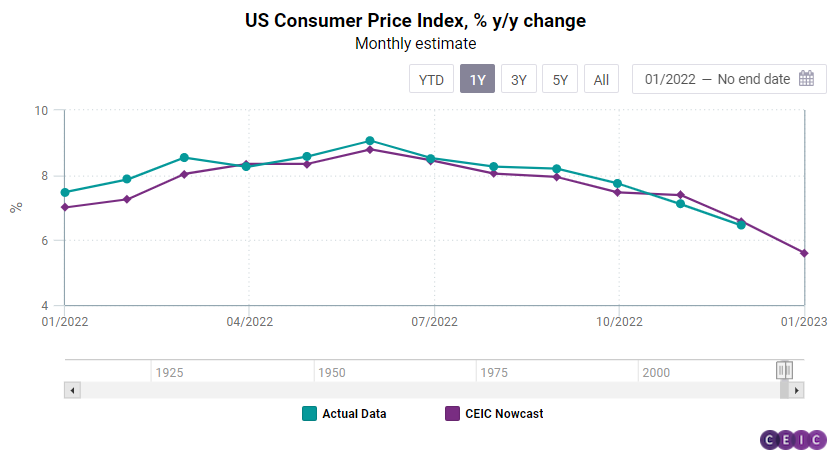

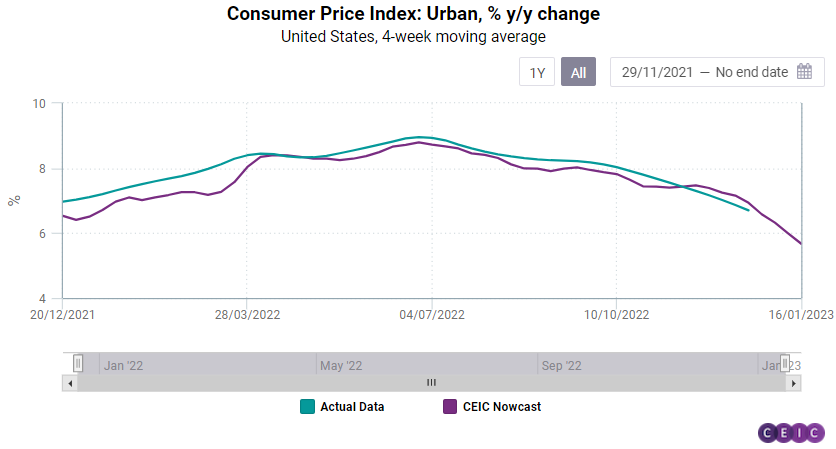

The US headline inflation is headed for a sharper deceleration in January 2023, with the consumer price index growth set to decelerate to 5.6% y/y, according to CEIC’s weekly inflation nowcast. While weekly inflation has climbed broadly downwards since early November, it has recorded two consecutive slowdowns in the two weeks since January 9, 2023. The weekly inflation nowcast shows an increased pace of deceleration in inflation, reinforcing the case for a lesser hawkish stance by the Federal Reserve at the January 31, 2023 meeting.

Official data for US inflation in January will be released on February 14th, a lag of more than ten days after the reference month. However, by leveraging our proprietary machine-learning framework based on alternative data we can estimate US inflation weekly. This cutting-edge approach provides our clients with accurate and up-to-date estimates and insights on US inflation to help anticipate US monetary policy and its implications on emerging markets.

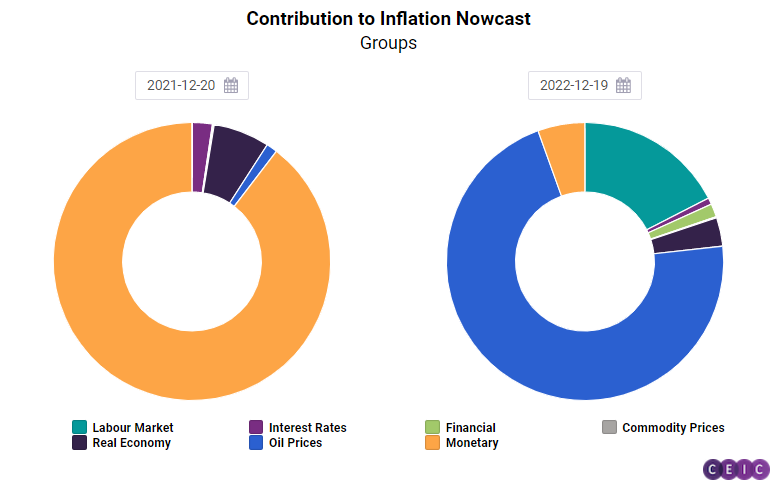

According to the model estimates, oil prices have remained the key driver of the US inflation in January, impacting more than 70% of the total inflation number, followed by labour market (17.5%), and the monetary sector (5.5). Among the high-frequency indicators used in the model, since the beginning of 2022, the retail price of diesel has been the single most significant predictor of US inflation, followed by the Federal Reserve notes and job-market-related indicators like private sector payrolls, weekly jobless claims, and insured unemployment rate. Other predictors of US inflation have been the Johnson Redbook index and the OECD GDP growth tracker, a weekly GDP estimate based on traditional and alternative datasets such as the daily number of seated diners.

The sustained slowdown in inflation for the seventh consecutive month in January shows that the policy rate tightening since the beginning of 2022 has succeeded in reducing inflation. Oil prices have remained a key driver of inflation in January, impacting more than 70% of the total inflation number, followed by labour markets at 17.5%, and monetary sector indicators at 5.5%. The retail price of diesel, the most consistent driver of US inflation, averaged USD 4.55 per gallon in the first three weeks of January, down from the USD 5.25 per gallon average in December.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)