-png.png)

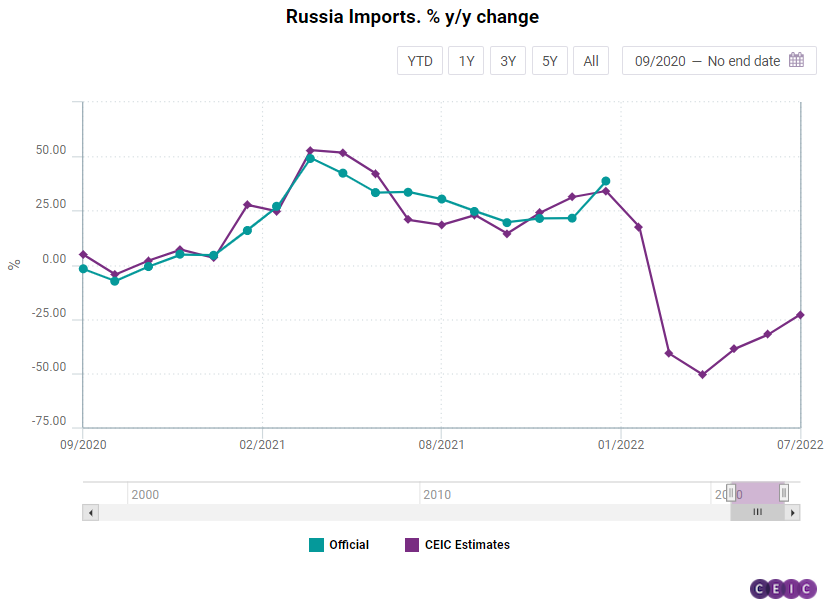

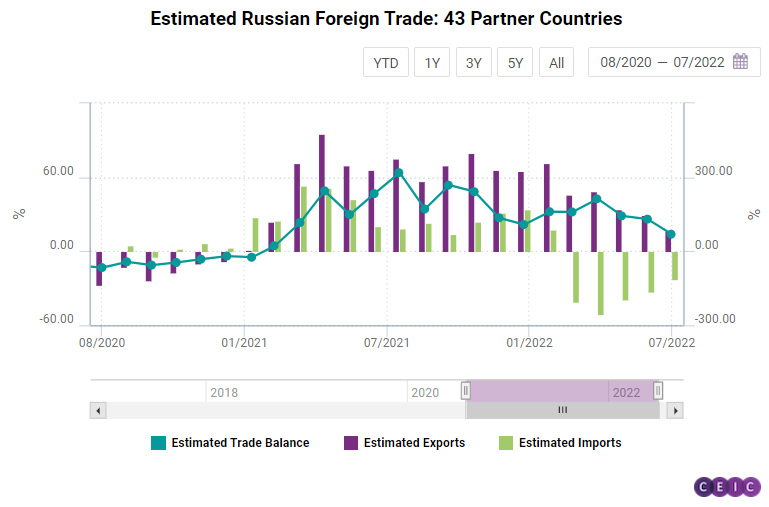

Since Russia’s invasion of Ukraine at the end of February 2022, Russia stopped publishing some key macroeconomic data, including foreign trade statistics. While net exports represented roughly 10% of Russian GDP and therefore timely information is crucial for understanding the current economic situation, the latest available foreign trade data provided by the Federal Customs Service, the official source of Russia's foreign trade data, are until January 2022. In CEIC Insights, we estimated the current Russian exports and imports value based on data from 43 partner countries, which provide timely trade data.

As of 2021, those countries accounted for 64% of Russian exports and for 71% of Russian imports, therefore they can be used as a proxy for the country’s foreign trade relations. The comparison between the actual and the estimated data presented on a year-over-year basis shows that the deviations between the estimated data from the official data are insignificant. The variations are mainly due to the differences between FOB and CIF prices on the one hand and the value of Russia's trade with the remaining partner countries on the other hand.

As of July, the last monthly data available for all 43 trade partners, our estimates show that the value of Russian exports continued its post-pandemic double-digit annual growth rates through the first seven months of 2022. However, the export growth has started to decelerate since the beginning of March, the first full month after the Western sanctions on Russia have been introduced. The strong export growth after the sanctions can be explained by the energy price increase since then as mineral products, including oil and gas, represent more than 50% of Russia's exports.

On top of that, the effects of the sanctions on Russia's exports have been highly heterogeneous. While the exports to European Union countries decreased sharply since March, the ones to Asian countries and Turkey have increased substantially since then.

To illustrate, the exports to Germany, Russia's biggest export destination in Europe before the war, peaked at USD 4.9bn in March and declined to USD 2.7bn in July. On the other hand, Russia's exports to China increased from USD 7.6bn in January 2022 to USD 11.2bn in July.

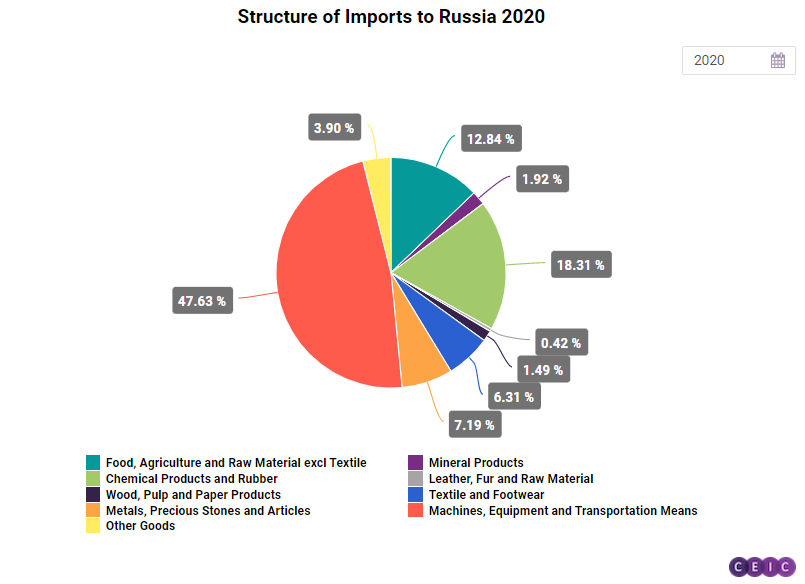

And while the export value continued to increase, imports dropped significantly due to the sanctions imposed by most of the Western countries. Almost half of the value of Russia's pre-war imports constituted machines, equipment and transportation means.

As exports of those goods are heavily sanctioned by US and EU countries, it may explain the significant fraction of a decrease in the value of Russian imports. If this hypothesis is correct, it is very likely that Russian supply chains may become strongly affected in a near future. The import decline and the increase in exports resulted in a stable double-digit growth of Russia's trade surplus.

The CEIC Global Database provides access to a vast database where users can gain insight into the ever-changing dynamics of world economies.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)