By the end of 2017, China’s household disposable income, as a percentage of the GDP, was less than 45%.

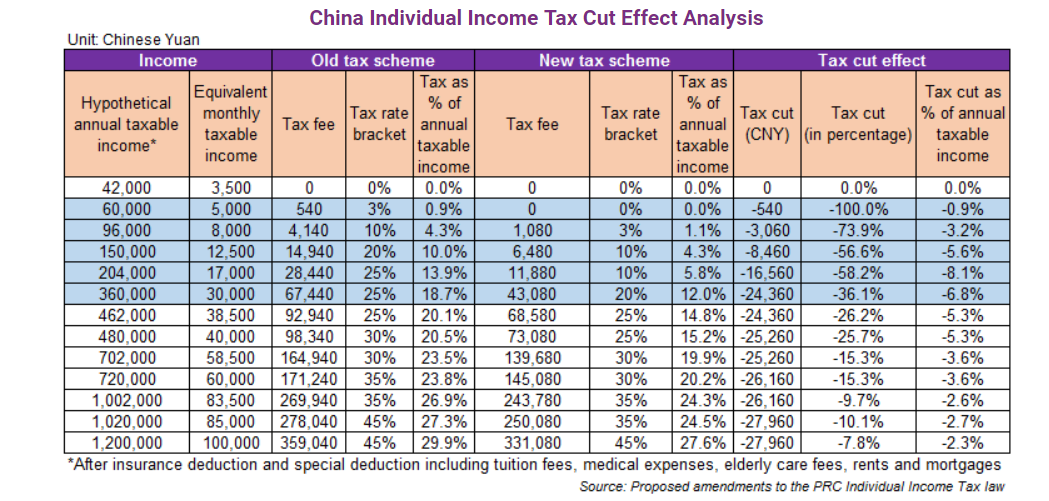

This lead to an extremely low share of household consumption in GDP of below 40%. China had then implemented an aggressive cut in taxes and fees by RMB 1.3tn in 2018, including the most fundamental reform in individual income tax since 2011.

The current effects of the tax-cuts

Based on our calculations, the tax cut effect ranges from 36% to 100% for annual taxable income groups between RMB 60,000 and RMB 360,000. These income groups represent the rising middle class in China. Now that the special deduction also covers tuition fees, medical expenses, mortgage loans and rents, and elderly care expenses, households can enjoy larger tax burden reductions.

Fiscal balance

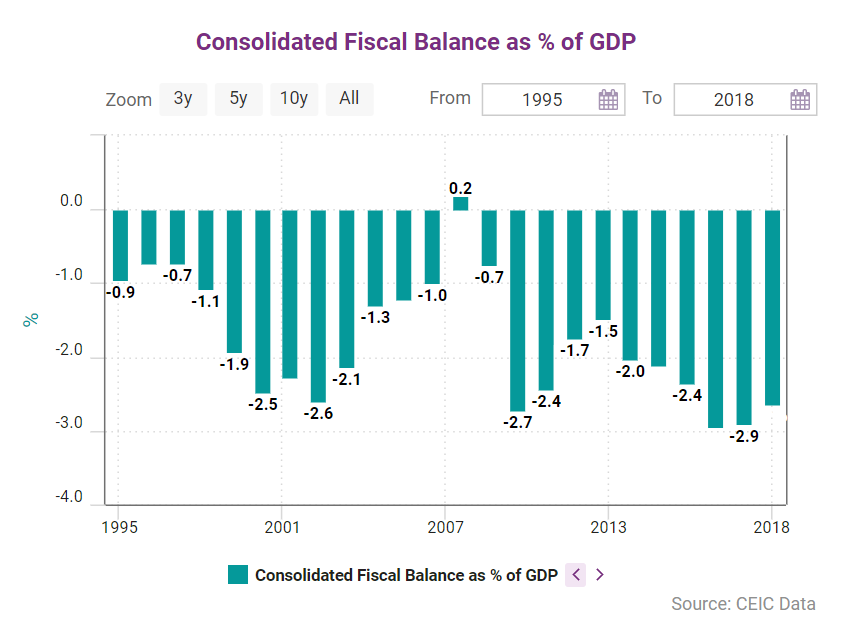

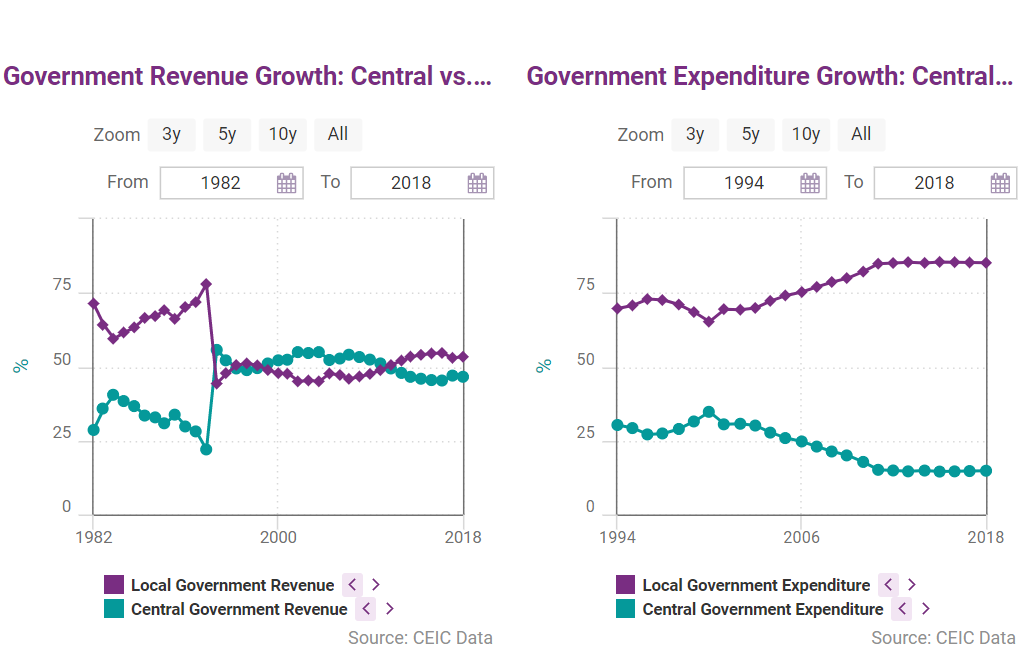

The central government has enough room to increase its debt level, as its debt ratio is below 20% of GDP. China’s large government sector entails massive spending and fiscal transfers for social security. With unprecedented tax cuts, the fiscal deficit will expand, calling for low financing costs for government bonds.

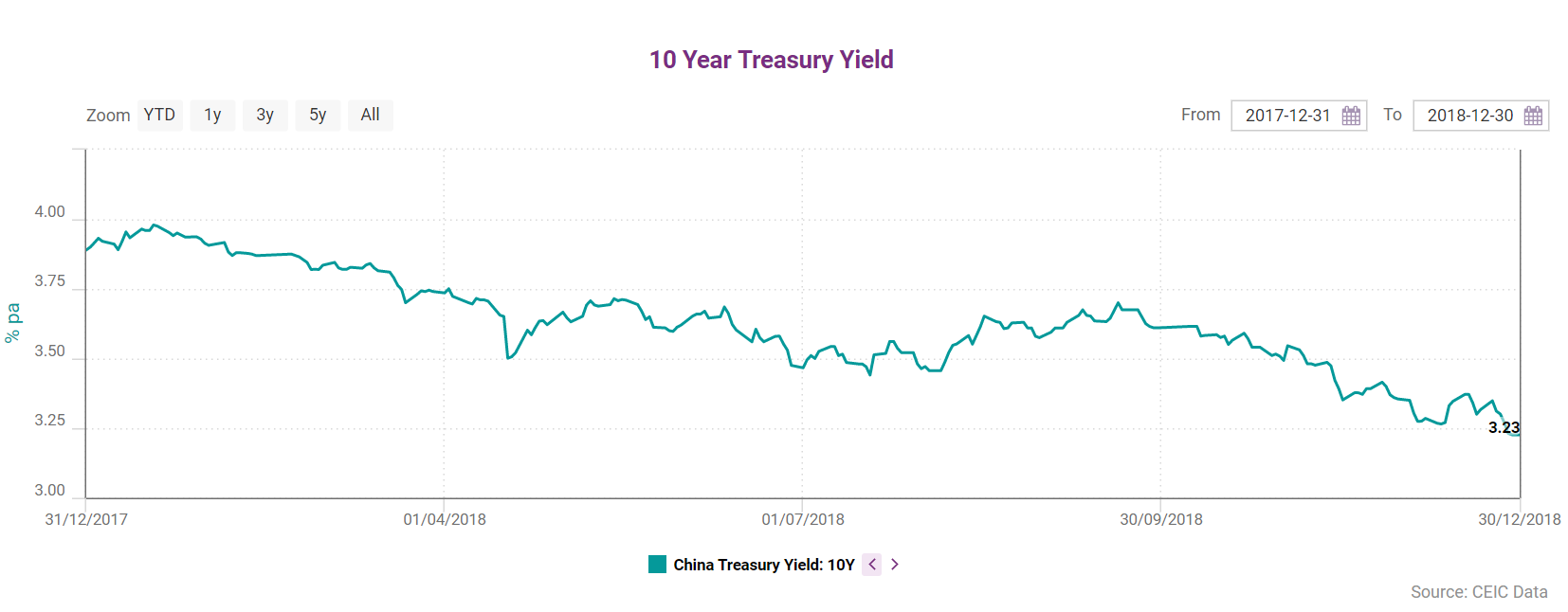

The treasury yield

If China chooses to increase its central government debt, the Treasury securities will play a more important role in China’s monetary policy. In the future we may see the central bank control money supply by trading more Treasury bonds, and the Treasury yield schedule will be affected directly by liquidity injection or withdrawal. The PBoC policy will converge with that of other major central banks in terms of monetary control.

Central bank restraints

To facilitate such an arrangement, China needs to amend its Central Bank Law to allow direct purchase of Treasury securities by the central bank in the primary market. The technical barriers reside in the lack of Treasury bond supply and in the divergence between policy benchmark rates and market interest rates.

You can download the full CEIC China Economy in a Snapshot Q2 2019 report here.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)