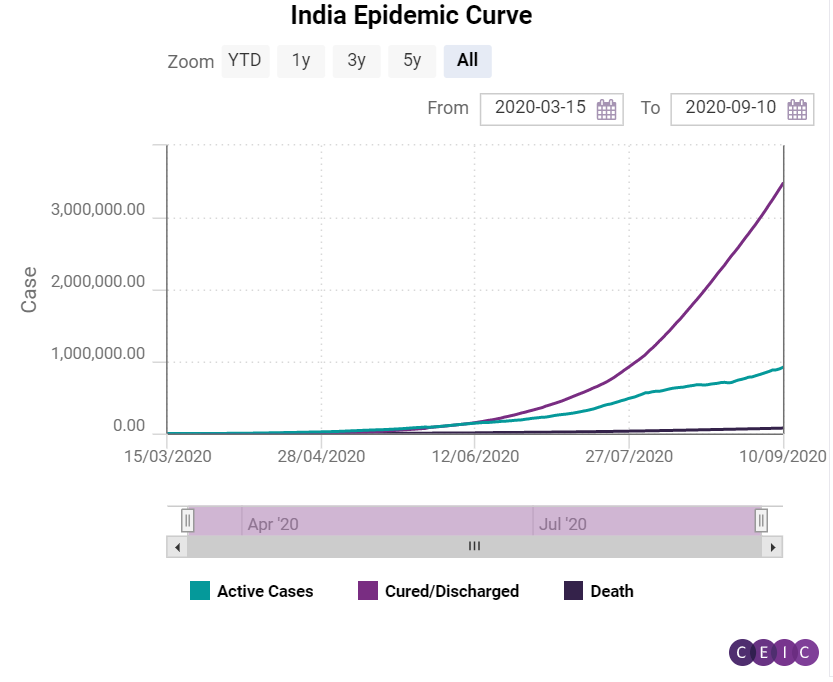

The COVID-19 pandemic has had a devastating effect on economies across the world and India is no exception. The cases in India started escalating at an alarming rate in mid-March, which led the government to instate a pre-emptive 40-day complete lockdown.

Despite these measures, India’s confirmed cases exceeded 2mn in early August. While the lockdown was successful in flattening the COVID-19 curve and in relieving the burden on healthcare system, it effectively paralysed India’s already slowing economy. During the lockdown, only essential activities such as healthcare, pharmacies, and groceries were allowed to operate. The economy suffered both demand and supply shocks and the financial system was hit hard too. During the strict lockdown between March 25 and May 3, the Indian government focused on policy changes to ease the stress on the economy by boosting public expenditure. From May 3 onwards, the state governments were made responsible for handling the disease outbreak, under the guidance of the central government. The lockdown measures were eased step by step, balancing between the spread of the disease and the loss of livelihoods.

Initial Response

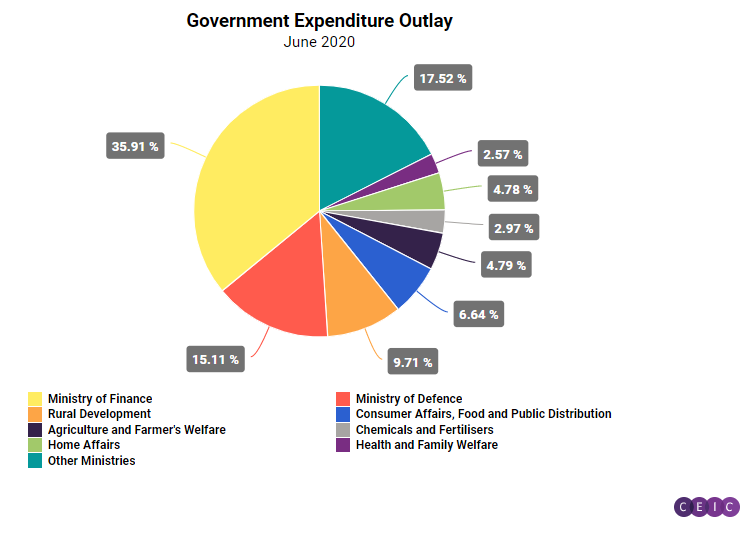

Alongside the announcement of the lockdown on March 24, 2020, Prime Minister Narendra Modi committed INR 150bn as emergency healthcare response to limit the spread of the disease. Over the short run, the package is aimed at developing diagnostics and COVID-19 treatment facilities, providing protective gear to medical professionals, procuring essential medical equipment and drugs for the treatment of infected patients. The scope of the package was widened to strengthen the overall healthcare sector through supporting prevention and preparedness for future disease outbreaks; setting up laboratories and bolstering surveillance activities, bio-security preparedness, and pandemic research; and proactively engaging communities and conducting risk communication activities.

On the same day, another set of short-term measures was announced by the Ministry of Finance. In order to boost demand, the government extended the deadline to file income tax and goods and services tax returns, lowered the tax deducted at source (TDS), introduced a 24x7 customs clearance, and waived the minimum balance maintenance fee in banks. Businesses, especially the micro, small and medium enterprises (MSMEs), were provided with additional relaxations, such as raising the threshold for defaults on liabilities under the Insolvency and Bankruptcy Code 2016 from INR 100,000 to INR 10mn. The revenue loss from this reform is estimated to be INR 78bn. In addition, the loss from lowering TDS and TCS (tax collected at source) rates has been factored in at INR 500bn.

However, the major set of relief measures came through a fiscal stimulus on March 26, 2020, under the INR 1.7tn Pradhan Mantri Garib Kalyan Yojana Scheme. This was largely aimed at addressing the short-term challenges posed by the pandemic, both in terms of demand and protection of lives. The stimulus was a mixture of measures such as insurance cover of INR 5mn per healthcare worker, food supplies for 800mn poor individuals for three months from the date of lockdown, and direct transfer of INR 500 to 200mn women account holders under the Pradhan Mantri Jan-Dhan Yojana, a national mission for financial inclusion. Furthermore, wages were increased under the Mahatma Gandhi National Rural Employment Guarantee Scheme (MNREGS) to INR 202 per day from INR 182.

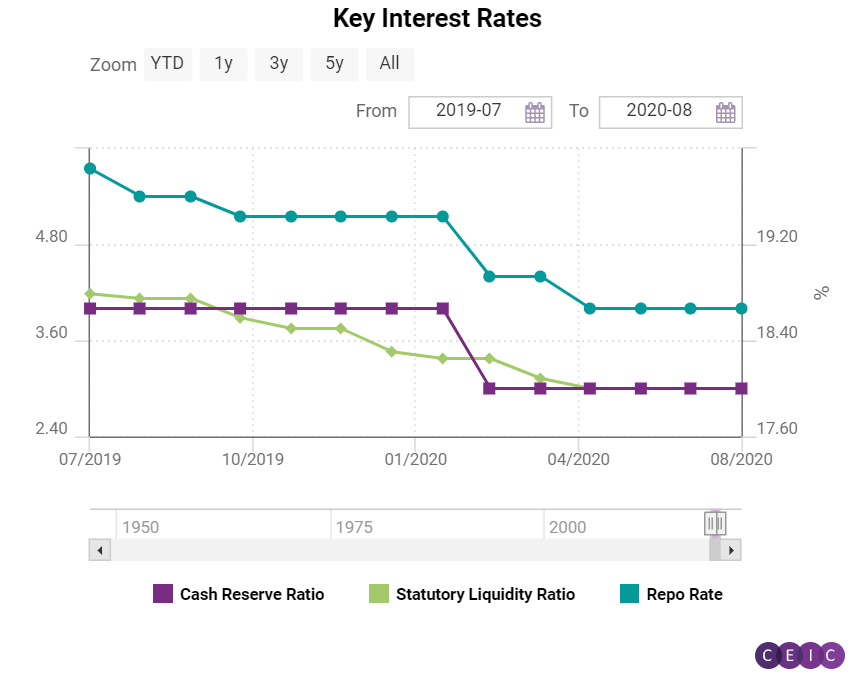

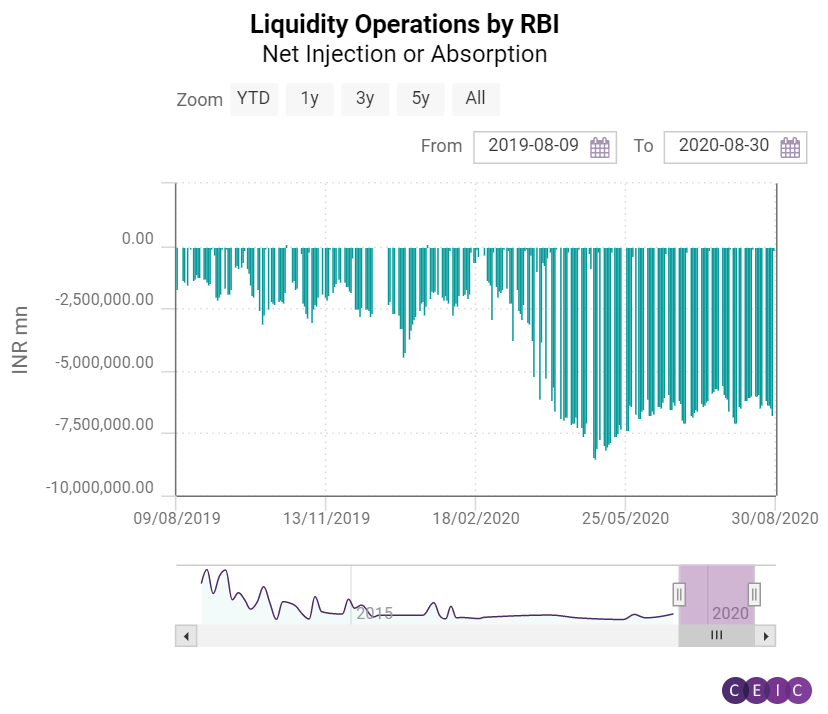

The Reserve Bank of India (RBI) released a separate set of relief measures on March 27, 2020, alongside the monetary policy, primarily for the financial and business sector, including lowering the cash reserve ratio, conducting long-term repo operations, and increasing the marginal standing facility under which banks can borrow overnight. The RBI also allowed a three-month moratorium on term loans along with changes in asset classification norms, which helped businesses retain their creditworthiness while staying out of banks’ non-performing asset lists. Furthermore, RBI’s accommodative stance allowed for a sharp decrease in the policy rate by 115 bps.

Revive and Rebuild

On May 12, India’s Prime Minister Modi announced a fiscal stimulus package worth INR 20tn, roughly around 10% of India’s GDP. This was inclusive of the stimulus from the previous announcement in March, essentially making the second package worth INR 18.3tn. The announcement was accompanied by two major missions - the need for a self-reliant India or Atmanirbhar Bharat, and Vocal for Local, urging the citizens to support local businesses instead of imported products. Out of the total fiscal stimulus, the largest portion was dedicated to RBI’s measures amounting to INR 8tn, or approximately 40%. Liquidity was a great concern for the financial sector, and hence, to supplement the RBI measures the government introduced a special liquidity scheme of INR 300bn to the shadow banking sector comprising of Non-Bank Financial Institutions (NBFIs), Housing Finance Companies (HFCs), Micro Finance Institutions (MFIs), and mutual funds. Furthermore, the sector also stands to benefit from the INR 450bn partial credit guarantee scheme to cover borrowings such as bonds and commercial papers.

In this second round of stimulus, the focus of the government was more on strengthening the supply side, which would in turn help generate employment, and subsequently, demand. Therefore, the goal was to revive businesses, and in particular MSMEs, with a total stimulus of INR 5.94tn. Under this, collateral free automatic loans worth INR 3tn have been made accessible to businesses. In addition, affected MSMEs would also be eligible for subordinate debt, for which INR 200bn has been earmarked. Finally, MSMEs with growth potential and viability that are facing severe shortage of equity would stand to benefit from a separate fund of INR 500bn. A separate liquidity injection of INR 900bn was also made for power distribution companies since they were riddled with unprecedented cash flow problems worsened by demand reduction. The real estate sector has also been adversely impacted as a result of COVID-19, and hence, the projects are at risk of defaulting their Real Estate Regulatory and Development Act (RERA) timelines. To tackle this, the government has provided a substantial extension to all real estate companies.

Sign in to read the full article here. Alternatively, download the COVID-19 Healthcare and Fiscal Response in Emerging Markets Report here.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)