.png?width=750&name=shutterstock_281485025%20(2).png)

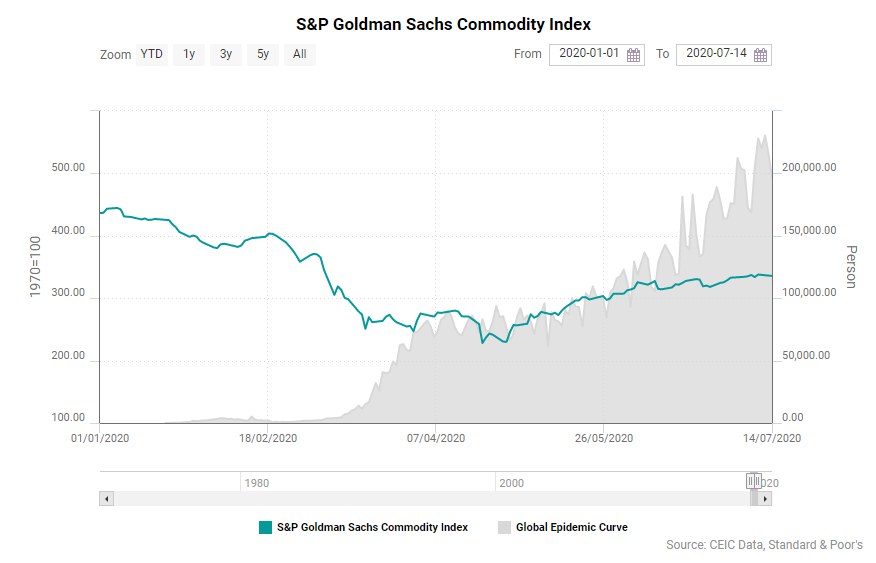

The COVID-19 crisis is projected to result in one of the most severe global economic recessions since the Great Depression of the 1930s and has already had a serious negative impact on global commodity prices.

Most of them have dropped significantly since January 2020 and some continue to go down, according to both the daily commodity prices and futures across the globe, as well as the monthly figures provided by the World Bank.

Oil experienced the most severe monthly price drop, as global demand plummeted and due to the OPEC-Russia price conflict. The monthly average crude oil price went from almost USD 62 per barrel in January 2020 to USD 53 in February, dropping to USD 32 in March and hitting an 18-year low at USD 21 per barrel in April. Most countries have implemented strict measures to contain the spread of the virus including closing borders and imposing travel bans on their citizens. While these measures may have had a positive impact on the number of infected people, they took a heavy toll on the global demand for oil. Most airlines reduced their flights and shipping companies cut down on freight volumes on the back of transport restrictions. According to the International Energy Agency (IEA), the demand for oil will most likely drop by 9.3mn barrels per day y/y in 2020.

Prices of base and precious metals have also gone down as a result of the pandemic but the drop there is significantly less pronounced compared to crude oil. The prices of base metals such as copper, iron ore, zinc, and nickel had been falling slightly since January 2020 but it appears that they hit their annual low for 2020 in April and have slowly been climbing back up since. According to the S&P Global Market Intelligence, base metal prices will gradually rebound during the second half of the year and will recover completely by the end of it. As for the prices of precious metals (gold, platinum, and silver), the trend is similar. Silver and platinum prices abruptly went down in March 2020 but have been steadily recovering since, while gold remained a safe haven asset, apart from a slight price dip between February and March 2020.

Agricultural commodity prices have been the least affected by the crisis – there was only a slight negative change, a far cry from the crash of oil and metal prices. This is mainly due to the relatively sustained demand for the most basic agricultural commodities and to the availability of stockpiles of wheat, rice and soy, which have kept supply and prices stable.

Energy Commodities

The COVID-19 crisis and the imposed measures and restrictions have had a serious impact on most commodities but the most pronounced negative effect was observed in transportation-related ones. As most countries imposed travel restrictions and lockdowns, limiting all activity in an attempt to minimize the spread of the virus, the prices of energy commodities such as oil and gas have plunged since January 2020 and the negative trend went on to reach a historic low, marking a decrease of around 50% in April 2020 compared to January. Another crucial factor was the oil price tensions between Russia and OPEC, who failed to agree on production cuts.

The three primary benchmark oil prices - West Texas Intermediate (WTI), Brent and Dubai/Oman - dropped from USD 57-63 per barrel in January 2020 to a staggering USD 16-23 per barrel in April 2020. In mid-April the futures on WTI with delivery in May made headlines by going into negative territory for the first time in history. Due to the subdued demand, suppliers preferred to pay the clients to get their oil, otherwise they would have ran out of storage capacity.

Most major oil producers are hesitant whether to maintain normal production quantities in the upcoming months as demand for energy commodities has dropped significantly. Recent figures show a slight recovery of crude oil prices in May 2020 but the average price is still expected to stay around USD 35 per barrel in 2020. This severe imbalance between supply and demand will continue to apply downward pressure on prices. The trend is likely to continue until at least the end of 2020 and maybe even carry on to 2021.

While they have still held up better than the prices of crude oil, there is still a negative trend in the months starting January 2020 and continuing until April 2020 which is also expected to continue until at least the end of the year.

Base and Precious Metals

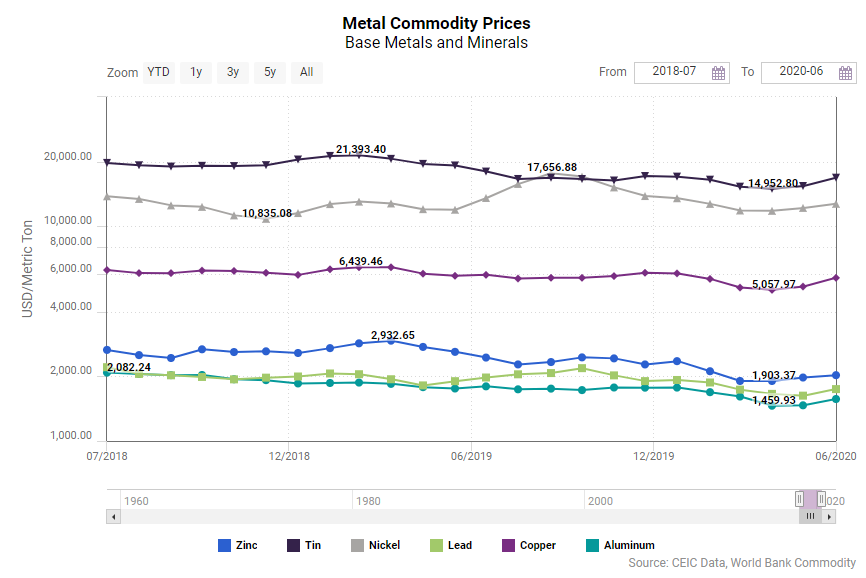

The prices of most base and precious metals were also influenced by the COVID-19 crisis and the accompanying restrictions. The drop, however, especially for precious metals, has been significantly smaller than the one in crude oil prices. In the group of main industrial base metals (aluminium, copper, iron ore, lead, nickel, tin and zinc) the prices of aluminium, copper and zinc saw the most significant decline of between 16% and 19% in April 2020 compared to January.

This decline can be attributed to the worldwide economic activity slowdown and to the supply chain disruptions, as many mines and refineries either reduced their capacity significantly or ceased their production entirely. There is a slight improvement observed in the figures for May 2020 but since production capacity is not expected to be fully restored at least until the end of 2020, the prices will not experience a complete recovery by then.

The fluctuations in the prices of the four primary precious metals (gold, silver, platinum, and palladium) between January and April 2020 were far more subtle. The price of gold, for instance, has even climbed up by 9% in May 2020 compared to January 2020 and the upward trend is expected to continue. This increase is mainly due to the fact that even while some investors opt for cash during a time of crisis, for most people, gold is still the go-to asset during uncertain times.

As for the prices of silver, platinum and palladium, while there was a slight drop between January and March 2020, the April and May 2020 figures show the beginning of a recovery, which is expected to continue in the upcoming months.

Agricultural commodities

The COVID-19 crisis has led to significant losses for rubber manufacturers in March and April following the serious impact of lockdown measures on freight transportation. That, coupled with the temporary closing of numerous tire manufacturers around the world, is expected to have a lasting effect on the rubber industry, as around two-thirds of all rubber demand comes from the tire industry. In contrast, there has been a surge in the demand for rubber for the production of gloves, tubes and other medical products and this trend will persist in the upcoming months.

Due to this increased demand, the price of rubber, and more specifically the TSR-20 rubber widely used by the tire and rubber industry, is expected to recover from its initial drop in March and parts of April 2020 and continue to go up. According to the Network of Rubber Farmers Institute of Thailand, the growing demand for rubber gloves and medical gloves, as well as the upcoming change of seasons should result in an increase in rubber prices in Q3 and Q4 2020.

The demand for cotton has also gone down along with the global slump of clothing retail. Consequently, cotton prices have been declining since January 2020, hitting an 11-year low of USD 1.40 per kg in April 2020. This trend is not expected to continue for long once the lockdowns are lifted. A slow climb in the price of cotton was already observed in May 2020 and a full recovery is likely once all restrictions are phased out.

Sign in to read the full data analysis on Global Commodity Prices here. Alternatively, download our free, comprehensive economic reports for eight regions, from the CEIC Q2 2020 Economic Snapshot Reports.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)